SyroneDavid

New Member

Hi everyone, @David Harper CFA FRM ,

Is there a spreadsheet for this? doesnt seem to be included in the course material (only for the example for risk budgeting across asset class)

Having a hard time deriving the numbers myself, also cause i am not sure which numbers are given as an assumption and which ones are calculated

Thanks!

Is there a spreadsheet for this? doesnt seem to be included in the course material (only for the example for risk budgeting across asset class)

Having a hard time deriving the numbers myself, also cause i am not sure which numbers are given as an assumption and which ones are calculated

Thanks!

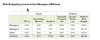

You hopefully realize this is my XLS recreation of Jorion's Table 17-4. As you've already noted, the Portfolio's Relative Risk Budget value is given by $525.0 (in total to allocate) * 4.0% TEV * 2.326 (i.e., 99% confident normal deviate) = $48.85. Then Manager 1's Budget = $291 Allocated Principal * 6.0% TEV * 2.326 where $291 = 55% * $525 and where 55% = IR(Mgr_1)/IR(Port) * [TEV(Port)/TEV(Mgr_1)] = 0.60/0.72 * (4.0%/6.0%). Thanks,

You hopefully realize this is my XLS recreation of Jorion's Table 17-4. As you've already noted, the Portfolio's Relative Risk Budget value is given by $525.0 (in total to allocate) * 4.0% TEV * 2.326 (i.e., 99% confident normal deviate) = $48.85. Then Manager 1's Budget = $291 Allocated Principal * 6.0% TEV * 2.326 where $291 = 55% * $525 and where 55% = IR(Mgr_1)/IR(Port) * [TEV(Port)/TEV(Mgr_1)] = 0.60/0.72 * (4.0%/6.0%). Thanks,