Learning objectives: Define risk budgeting. Describe the impact of horizon, turnover, and leverage on the risk management process in the investment management industry. Describe the investment process of large investors such as pension funds. Describe the risk management challenges associated with investments in hedge funds.

Questions:

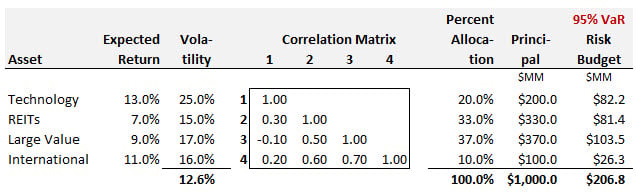

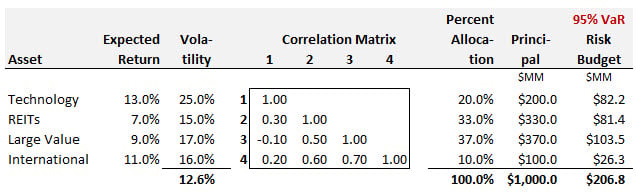

21.7.1. The State Public Employee Retirement Fund (SPERF) needs to allocate $1.0 billion to four asset classes: Technology, REITs, Large Value, and International. In deciding the allocation, the ONLY criteria is to minimize portfolio volatility. The following allocation minimizes portfolio volatility and provides a risk budget based on a 95.0% value at risk (VaR) assuming multivariate normal distributions.

The $200.0 million principal in the Technology asset class will be divided equally between two active managers who both run portfolios with a volatility of 35.0% (by coincidence) and their correlation with each other is zero. In regard to this risk budget, which of the following statements is TRUE?

a. The undiversified VaR is $206.8 but the fund's actual VaR budget is $293.4 million

b. The perfect 1.0s in the diagonal of the correlation matrix are suspicious and should be checked for errors

c. SPERF can allocate a risk budget of approximately $58.0 million to each of the two Technology fund managers

d. The weakness of this approach is that, although expected returns influenced the result, the benefits of diversification are not included

21.7.2. Jane is evaluating job opportunities in the buy side and the sell side. She considers a buy side firm where the investment style (or characteristics) include a long-term time horizon, slow turnover, and low leverage. Unsurprisingly, this buy side firm also emphasizes diversification as a risk control. Additionally, each of the following is a valid risk management technique, tactic, or approach EXCEPT which of the following is she LEAST LIKELY to observe at this buy-side firm?

a. The buy side firm benchmarks against the S&P 500 and similar established equity indices.

b. The firm minimizes tracking error risk (aka, tracking error volatility) by increasing its cash allocation to at least 50%

c. The buy side firm recently centralizes with a global custodian and reduced the number of disparate risk systems

d. The buy side firm determines a risk appetite and allocate a risk budget to its major asset classes that cascades to each of its active managers

21.7.3. Four colleagues who work at the State Public Employee Retirement Fund (SPERF) are having a friendly debate about the investment process (and its metrics) at their pension fund. Their fund is a large fund that delegates to managers across various traditional and alternative asset classes, including private equity funds and a successful hedge fund. The hedge fund's outperformance is due to skillful investing in mispriced, illiquid assets. You overhear them making the following points:

a. Albert

b. Betty

c. Charles

d. Derek

Answers here:

Questions:

21.7.1. The State Public Employee Retirement Fund (SPERF) needs to allocate $1.0 billion to four asset classes: Technology, REITs, Large Value, and International. In deciding the allocation, the ONLY criteria is to minimize portfolio volatility. The following allocation minimizes portfolio volatility and provides a risk budget based on a 95.0% value at risk (VaR) assuming multivariate normal distributions.

The $200.0 million principal in the Technology asset class will be divided equally between two active managers who both run portfolios with a volatility of 35.0% (by coincidence) and their correlation with each other is zero. In regard to this risk budget, which of the following statements is TRUE?

a. The undiversified VaR is $206.8 but the fund's actual VaR budget is $293.4 million

b. The perfect 1.0s in the diagonal of the correlation matrix are suspicious and should be checked for errors

c. SPERF can allocate a risk budget of approximately $58.0 million to each of the two Technology fund managers

d. The weakness of this approach is that, although expected returns influenced the result, the benefits of diversification are not included

21.7.2. Jane is evaluating job opportunities in the buy side and the sell side. She considers a buy side firm where the investment style (or characteristics) include a long-term time horizon, slow turnover, and low leverage. Unsurprisingly, this buy side firm also emphasizes diversification as a risk control. Additionally, each of the following is a valid risk management technique, tactic, or approach EXCEPT which of the following is she LEAST LIKELY to observe at this buy-side firm?

a. The buy side firm benchmarks against the S&P 500 and similar established equity indices.

b. The firm minimizes tracking error risk (aka, tracking error volatility) by increasing its cash allocation to at least 50%

c. The buy side firm recently centralizes with a global custodian and reduced the number of disparate risk systems

d. The buy side firm determines a risk appetite and allocate a risk budget to its major asset classes that cascades to each of its active managers

21.7.3. Four colleagues who work at the State Public Employee Retirement Fund (SPERF) are having a friendly debate about the investment process (and its metrics) at their pension fund. Their fund is a large fund that delegates to managers across various traditional and alternative asset classes, including private equity funds and a successful hedge fund. The hedge fund's outperformance is due to skillful investing in mispriced, illiquid assets. You overhear them making the following points:

- Albert says that funding risk should be a top priority

- Betty says the hedge fund VaR budget should be adjusted for artificially low correlations and volatility

- Charles says that most of the firm's downside risk is due to policy mix while only a small portion is due to active-management risk

- Derek says that the weakness of VaR is that it cannot accurately inform top-down risk budgets based on forward-looking risk, nor can VaR contribute to useful insights into risk drivers

a. Albert

b. Betty

c. Charles

d. Derek

Answers here:

Last edited by a moderator: