kylian.mbappe

Member

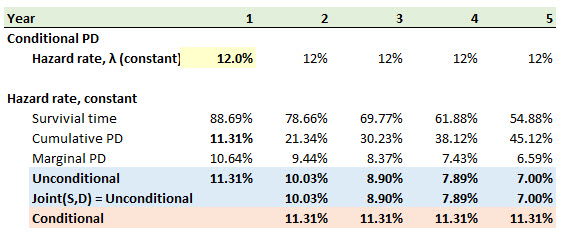

The question was : what is the probability of default in the second year given survival in first yearHi @AHoekstra @AnnaM @amit.m.sharma @a_ishrat1973 The hazard rate is an instantaneous conditional PD. If the question gave the hazard rate, λ = 0.12 and if it is constant (see below), then:

- Each year's conditional PD is 11.31% which is also the Year 1 PD = 1 - exp(-0.12*1) = 11.31%; when the hazard is constant, it will always be a little less than the hazard. They are both conditional, but hazard is the instantaneous version.

- The joint (aka, unconditional) PD is year 2 is 10.03% (see blue below). This would be the answer

my xls is here https://www.dropbox.com/s/vfyw2xs0n8dblhm/052019-hazard.xlsx?dl=0

In that case, as above, constant λ = 0.12 --> conditional PD of 11.31% regardless of the year, but I sure hope there wasn't confusion with joint or unconditional ...

In that case, as above, constant λ = 0.12 --> conditional PD of 11.31% regardless of the year, but I sure hope there wasn't confusion with joint or unconditional ...

.. Pretty lame i know hahaha

.. Pretty lame i know hahaha