Thanks so much for adding with more stuff!

Some comments:

For Vasicek, what formula did you apply? Wasn’t the formula already provided?

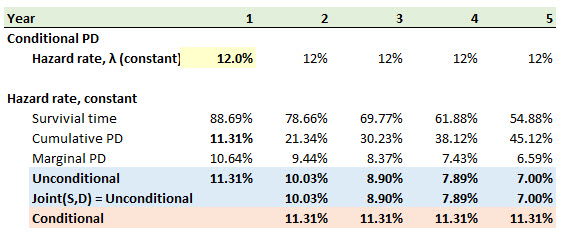

On the hazard rate, yeah if it was conditional pd then I got it wrong.

Yes I marked the option which said spreading ops risk loss into 4 quarters.

For risk budgeting, my answer was 14mil.

Same answer as you for the fin tech question.

I used r*e (^-kT)+Theta (1-e (^-kT). My answer matched.

Damnit, I maked 16.6. I think i spend 10-15mins on this question. After 5 tries or so I found 16.6m. Probably still an error somewhere, cant believe I couldnt get this question right more easily.

Good to hear regarding the ops risk in 4 quarters.