gargi.adhikari

Active Member

Hi,

In reference to R16.P1.T2.HULL_CH11:Topic: VARIANCE_COVARIANCE_MATRIX_+VE_SEMI_DEFINITE

Can anyone explain what is meant by the "Variance-Covariance Matrix" In order to be "Internally Consistent" has to satisfy the condition of w * C * wT =>+Ve Semi Definite" ...? What is "w" here...?

I understand the meaning of the "Variance-Covariance Matrix" ..but am lost of the meaning a matrix being "Internally Consistent" and what it means to satisfy the condition of being +Ve Semi Definite"..if some one could illustrate a matrix with numbers, I would be very grateful...

In reference to R16.P1.T2.HULL_CH11:Topic: VARIANCE_COVARIANCE_MATRIX_+VE_SEMI_DEFINITE

Can anyone explain what is meant by the "Variance-Covariance Matrix" In order to be "Internally Consistent" has to satisfy the condition of w * C * wT =>+Ve Semi Definite" ...? What is "w" here...?

I understand the meaning of the "Variance-Covariance Matrix" ..but am lost of the meaning a matrix being "Internally Consistent" and what it means to satisfy the condition of being +Ve Semi Definite"..if some one could illustrate a matrix with numbers, I would be very grateful...

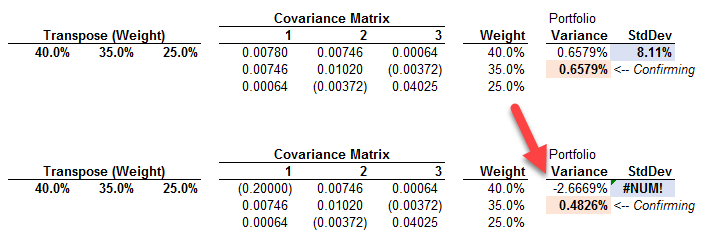

To illustrate, I just retrieved an example of portfolio variance (based on matrix multiplication), XLS is here

To illustrate, I just retrieved an example of portfolio variance (based on matrix multiplication), XLS is here