You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Taylor series approximation - why does it overstate a long call/put option VaR?

- Thread starter Mezzala95

- Start date

-

- Tags

- taylor-series

Lu Shu Kai FRM

Well-Known Member

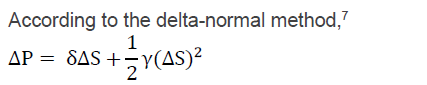

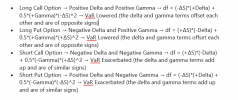

Hi @Mezzala95 ,

David's post i.e. https://www.bionicturtle.com/a-note-about-delta-gamma-value-at-risk-var-as-taylor-series/ explains it really well. If I recall, it is actually the opposite? Long call/put lowers VaR vice versa for the short option position.

David's post i.e. https://www.bionicturtle.com/a-note-about-delta-gamma-value-at-risk-var-as-taylor-series/ explains it really well. If I recall, it is actually the opposite? Long call/put lowers VaR vice versa for the short option position.

@lushukai thank you for helping me to recall this!Hi @Mezzala95 ,

David's post i.e. https://www.bionicturtle.com/a-note-about-delta-gamma-value-at-risk-var-as-taylor-series/ explains it really well. If I recall, it is actually the opposite? Long call/put lowers VaR vice versa for the short option position.

After reading your comment and link, I remembered that I had actually saved (to a word doc) an old post of yours on this exact concept!

You provided the below bullet points and I had used that to learn the first time around. Absolutely kicking myself for forgetting these concepts, thanks again!

Similar threads

- Replies

- 1

- Views

- 2K

- Replies

- 0

- Views

- 3K

- Replies

- 5

- Views

- 7K

- Replies

- 8

- Views

- 3K

- Replies

- 2

- Views

- 3K