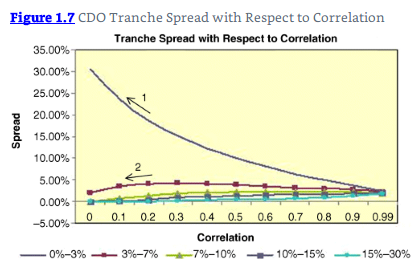

Hi David, I am struggling to understand this concept of loss occurring (i.e Spread change in Equity Tranche and Mezzanine Tranche).

1) Why does Equity Tranche spread increases if the correlation decreases as shown in the graph below. (eg. If correlation is high in the equity tranche - the full tranche will get wiped out and hence the spread should be high --> This is why i am getting confused with the material and graph arrow 1). Even if Ford and GM were rated as Junk bonds, how did it impact the CDO tranche to reduce the correlation..

2) " Spread decreases when the correlation decreases". But atleast that is in line with the concept that the entire tranche will not get wiped out and hence asking for lower spread as the correlation decreases.

But the fundamental question is why GM, Ford categorization of Junk bonds decreased the correlation.

1) Why does Equity Tranche spread increases if the correlation decreases as shown in the graph below. (eg. If correlation is high in the equity tranche - the full tranche will get wiped out and hence the spread should be high --> This is why i am getting confused with the material and graph arrow 1). Even if Ford and GM were rated as Junk bonds, how did it impact the CDO tranche to reduce the correlation..

2) " Spread decreases when the correlation decreases". But atleast that is in line with the concept that the entire tranche will not get wiped out and hence asking for lower spread as the correlation decreases.

But the fundamental question is why GM, Ford categorization of Junk bonds decreased the correlation.

) the hedge fund did not own/short the CDO equity tranche, it has sold credit protection on the tranche (aka, short CDS that referenced the tranche) so its "short" position is a short CDS which is synthetically long the underlying bonds. They lost on this written protection when the underlying bonds downgrade, in the same way they would experience a M2M loss on a short CDS that referenced the bonds directly (without the intermediation of a CDO, so to speak)

) the hedge fund did not own/short the CDO equity tranche, it has sold credit protection on the tranche (aka, short CDS that referenced the tranche) so its "short" position is a short CDS which is synthetically long the underlying bonds. They lost on this written protection when the underlying bonds downgrade, in the same way they would experience a M2M loss on a short CDS that referenced the bonds directly (without the intermediation of a CDO, so to speak) .

.