Raj Sachdeva

New Member

@David Harper CFA FRM , can you please share an example of the below case if possible?

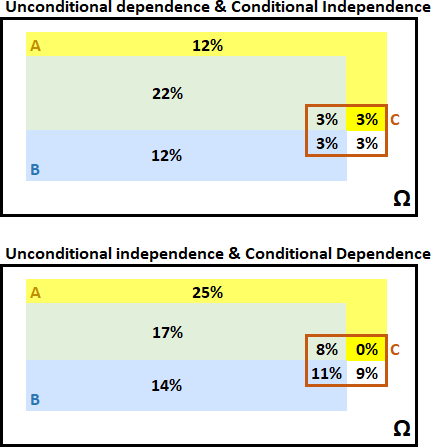

Events can be conditionally independent yet unconditionally dependent. Events can be conditionally dependent, yet independent! [Chapter 1: Fundamentals of Probability, Study Notes, Pg. 5]

It will be easy to remember this with an example.

Thanks,

Raj

Events can be conditionally independent yet unconditionally dependent. Events can be conditionally dependent, yet independent! [Chapter 1: Fundamentals of Probability, Study Notes, Pg. 5]

It will be easy to remember this with an example.

Thanks,

Raj