AIMs: Define and calculate the incremental CVA and the marginal CVA. Describe how collateralization and netting affect the CVA price.

Questions:

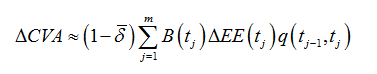

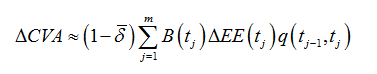

332.1. To price a new trade with the impact of netting, we can calculate the change in CVA, which is called the "incremental CVA" created by the new trade. Incremental CVA is given by the following:

(Source: Jon Gregory, Counterparty Credit Risk: The New Challenge for Global Financial Markets (West Sussex, UK: John Wiley & Sons, 2010))

About Incremental CVA, each of the following is true EXCEPT which is false?

a. Incremental CVAs are not additive: the sum of incremental CVAs is not meaningful

b. Incremental CVA must be less than or equal to Stand-alone CVA

c. Incremental CVA must be greater than or equal to zero; i.e., cannot be negative

d. Incremental CVA is useful for looking at the impact of adding (or removing) a given trade to (from) the netting set of existing trades

332.2. Each of the following is true about Marginal CVA except which is false?

a. By definition, Marginal CVA must be less than or equal to Incremental CVA

b. Unlike Incremental CVA, Marginal CVA is additive: the sum of Marginal CVAs is the total CVA

c. Marginal CVA is more relevant (than Incremental CVA) for apportioning CVA contributions fairly across existing trades or assessing the CVA of more than one new trade

d. Whereas it is difficult to price simultaneous trades with Incremental CVA, Marginal CVA is the appropriate way to calculate the trade-level CVA contributions of several trades at the same time

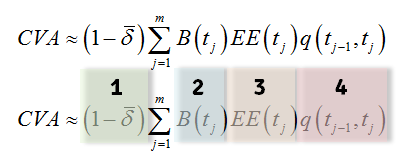

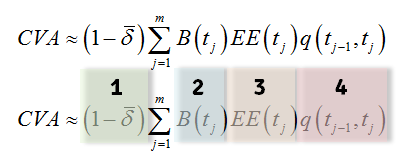

332.3. The following calculation for credit value adjustment (CVA) has four components:

Which of the four components is impacted by collateral?

a. 1 only

b. 3 only

c. 4 only

d. All except for 2

Answers:

Questions:

332.1. To price a new trade with the impact of netting, we can calculate the change in CVA, which is called the "incremental CVA" created by the new trade. Incremental CVA is given by the following:

(Source: Jon Gregory, Counterparty Credit Risk: The New Challenge for Global Financial Markets (West Sussex, UK: John Wiley & Sons, 2010))

About Incremental CVA, each of the following is true EXCEPT which is false?

a. Incremental CVAs are not additive: the sum of incremental CVAs is not meaningful

b. Incremental CVA must be less than or equal to Stand-alone CVA

c. Incremental CVA must be greater than or equal to zero; i.e., cannot be negative

d. Incremental CVA is useful for looking at the impact of adding (or removing) a given trade to (from) the netting set of existing trades

332.2. Each of the following is true about Marginal CVA except which is false?

a. By definition, Marginal CVA must be less than or equal to Incremental CVA

b. Unlike Incremental CVA, Marginal CVA is additive: the sum of Marginal CVAs is the total CVA

c. Marginal CVA is more relevant (than Incremental CVA) for apportioning CVA contributions fairly across existing trades or assessing the CVA of more than one new trade

d. Whereas it is difficult to price simultaneous trades with Incremental CVA, Marginal CVA is the appropriate way to calculate the trade-level CVA contributions of several trades at the same time

332.3. The following calculation for credit value adjustment (CVA) has four components:

Which of the four components is impacted by collateral?

a. 1 only

b. 3 only

c. 4 only

d. All except for 2

Answers: