AIMs: Describe and assess the major weakness attributable to single-factor approaches when hedging portfolios or implementing asset liability techniques. Describe key-rate shift analysis. Define, calculate, and interpret key rate ‘01 and key rate duration.

Questions

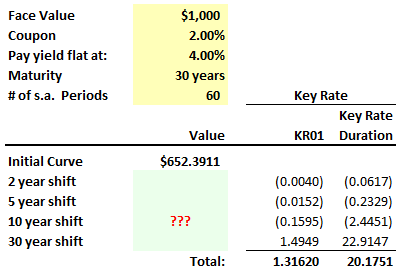

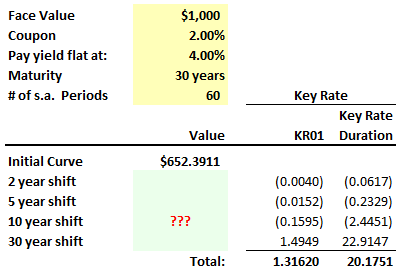

318.1. The exhibit below shows the results of a key-rate shift calculation for 30-year bond with face value of $1,000 that pays a semi-annual coupon with coupon rate of 2.0%. If the current par yield curve is flat at 4.0%, the initial price of the bond is approximately $652.39. The exhibit omits the four bond values that result from re-pricing the bond under a key rate shift but does show the resulting key-rate '01 (KR01s) and key-rate durations:

How does the 10-year shift value (red "???") compare to the initial value of $652.39?

a. Less by $0.1595

b. Less by $2.4451

c. Greater $0.1595

d. Greater by $2.4451

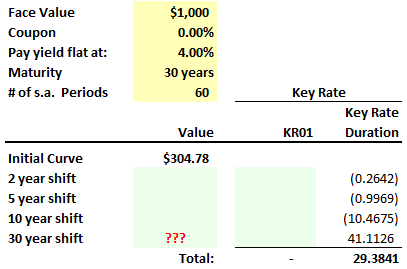

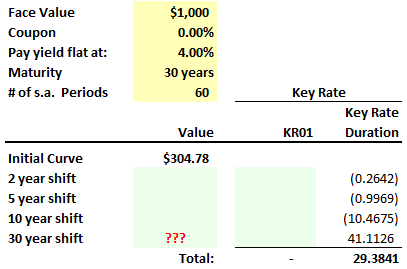

318.2. The following exhibit displays key rate durations (final column) for a par $1,000 zero-coupon bond with 30 years to maturity. The bond has an initial value of $304.78 because the current par yield curve is flat at 4.0%:

Which is nearest the the value of the bond under a 30-year shift (red "???")?

a. $303.53

b. $304.29

c. $306.03

d. $307.42

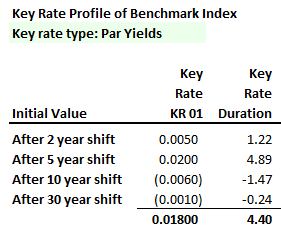

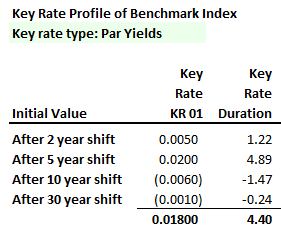

318.3. Sally manages a bond portfolio that is benchmarked against an index with the following key rate profile:

Sally's single-factor portfolio duration exactly matches the index's duration. However, compared to the benchmark which is concentrated in shorter maturities, Sally's portfolio has a higher concentration in bonds with higher maturities; i.e., 10 and 30 year maturities. Which of the following statements is true?

a. If rates steepen (i.e., a non-parallel shift), Sally's portfolio is likely to underperform the benchmark

b. If rates steepen (i.e., a non-parallel shift), Sally's portfolio is likely to overperform the benchmark

c. Key rate shifts is still a single-factor technique because convexity is not included, such that Sally's portfolio is likely to match the benchmark's portfolio even under a non-parallel shift

d. Sally should expect that the benchmark index's yield-based DV01 is equal to exactly 0.01800 because that is the sum of the KR01

Answers:

Questions

318.1. The exhibit below shows the results of a key-rate shift calculation for 30-year bond with face value of $1,000 that pays a semi-annual coupon with coupon rate of 2.0%. If the current par yield curve is flat at 4.0%, the initial price of the bond is approximately $652.39. The exhibit omits the four bond values that result from re-pricing the bond under a key rate shift but does show the resulting key-rate '01 (KR01s) and key-rate durations:

How does the 10-year shift value (red "???") compare to the initial value of $652.39?

a. Less by $0.1595

b. Less by $2.4451

c. Greater $0.1595

d. Greater by $2.4451

318.2. The following exhibit displays key rate durations (final column) for a par $1,000 zero-coupon bond with 30 years to maturity. The bond has an initial value of $304.78 because the current par yield curve is flat at 4.0%:

Which is nearest the the value of the bond under a 30-year shift (red "???")?

a. $303.53

b. $304.29

c. $306.03

d. $307.42

318.3. Sally manages a bond portfolio that is benchmarked against an index with the following key rate profile:

Sally's single-factor portfolio duration exactly matches the index's duration. However, compared to the benchmark which is concentrated in shorter maturities, Sally's portfolio has a higher concentration in bonds with higher maturities; i.e., 10 and 30 year maturities. Which of the following statements is true?

a. If rates steepen (i.e., a non-parallel shift), Sally's portfolio is likely to underperform the benchmark

b. If rates steepen (i.e., a non-parallel shift), Sally's portfolio is likely to overperform the benchmark

c. Key rate shifts is still a single-factor technique because convexity is not included, such that Sally's portfolio is likely to match the benchmark's portfolio even under a non-parallel shift

d. Sally should expect that the benchmark index's yield-based DV01 is equal to exactly 0.01800 because that is the sum of the KR01

Answers: