Suzanne Evans

Well-Known Member

Questions:

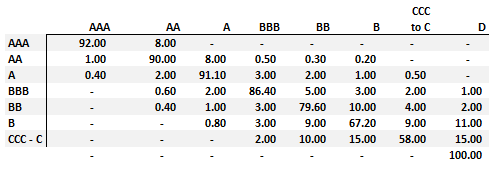

206.1. The following migration matrix gives the credit ratings transition probabilities of corporate bonds over a one-year period:

Given the one-year transition matrix above, which of the following statements is TRUE:

a. After two years, the cumulative probability that an AAA-rated bond will be AAA-rated is 84.60%

b. Within two years, and assuming Markovian independence, the cumulative probability that a CCC-rated bond will default is 25.57%

c. After one year, a B-rated bond has a 76.20% probability of at least maintaining its rating; i.e. B-rated or better

d. Within two years, an AA-rated bond cannot default

206.2. In regard to credit events, each of the following is true EXCEPT for which is false?

a. As a random variable, a credit event can be characterized by a Bernoulli because it is a discrete event that either happens or does not

b. In regard to credit derivatives, a "default" is a credit event but the converse is not necessarily true

c. ISDA definitions of "credit events" are designed, at least in part, to minimize legal risk

d. While a downgrade may impact the mark-to-market value of a bond (market risk), a downgrade is never a credit event

206.3. In regard to credit ratings, which of the following is TRUE?

a. S&P BB+ is an investment grade rating

b. Moody's Baa3 is a speculative (non investment grade) rating

c. Companies with higher ratings tend to have higher leverage ratios and lower cash flow coverage multipliers

d. S&P ratings are a measure of PD while Moody's ratings are a measure of the joint effect of PD and LGD

Answers: