Hello @Apara,Hello,

Can someone please help me with this MBS question.

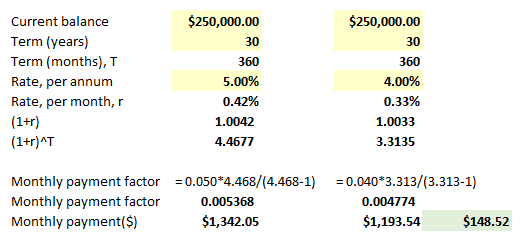

A homeowner has a 30 year 5% fixed rate mortgage, with a current balance of USD 250,000. Mortgage rates have been decreasing. If the existing mortgage is refinanced into a new 30 year 4% fixed rate mortgae, how much will the homeowner save monthly.

I know the formula i.e. r (1+r)^n / (1+r) but I am not getting the answer. I do not have access to your forum, hence couldn't check if anyone else has asked this question.

Thank you for posting your question in the forum. Even without a subscription, you will always have full access to the free sections, which includes the search function so you can easily find out if someone asked the same question. I've moved your question here to this thread, where there has been a great deal of discussion already, so you may find your answer in the comments above. I hope this helps!

Nicole