You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Exam Feedback May 2019 Part 2 Exam Feedback

- Thread starter Nicole Seaman

- Start date

-

- Tags

- exam-feedback

- Status

- Not open for further replies.

amit.m.sharma

Member

The GARP website has June 28 as the date for sending out the emails for the resultsAnyone received the GARP email with the result estimated date?

amit.m.sharma

Member

You can get two 4s and 3 1s and still passIf we get 4 in credit and rmim and rest all 2 will we pass

Really? So there is no section-wise cutoff? As in, if you absolutely bomb one/two sections but get to score high in other areas, you are still good?You can get two 4s and 3 1s and still pass

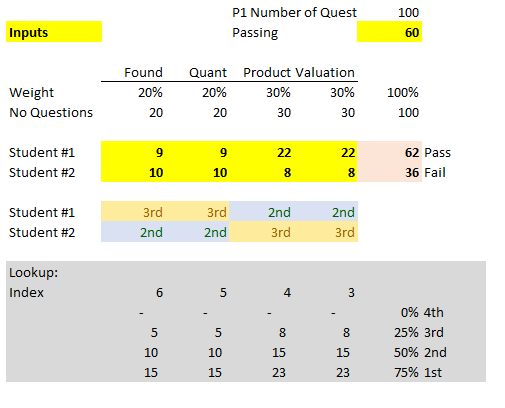

@AK88 Yes, correct: topic-wise performance is merely informational as only the total score produces a pass/fail outcome. Therefore, you could bomb one topic and make up elsewhere. See, for example, here my previous illustration of a counter-intuitive outcome where hypothetical Student #1 earns 3/3/2/2 and passes while Student #2 earns 2/2/3/3 but fails https://forum.bionicturtle.com/threads/quartiles-and-weights-exam-results.9883/post-45570 i.e.,

@hellohi

Okay I built this small spreadsheet (because trying to talk about this soon becomes a word soupimo), please see https://www.dropbox.com/s/ikhbkm0571fdchh/1019-garp-frm-scoring-exam.xlsx?dl=0

... and below is a snapshot. This is just for P1 and you only input (change) the yellow cells, the rest is calculated.

Notice how I input an extreme version of the one you referenced in your email; i.e., Student #1 earns 3/3/2/2 and passes while Student #2 earns 2/2/3/3 but fails. I was deliberately provocative: notice how the seemingly subtle difference can lead to a difference between a final score of 62 and 36 (wow!). Caveat: I'm not sure my quantiles are exactly calibrated, but they can't be too far off. I hope that clarifies!

amit.m.sharma

Member

Amarnadh D

Member

This is absolutely correct. I choose the same answer.This is how I calculated -

A. PD in Year 1 = 1-e^(-0.12) = 11.30%

B. Cumulative PD in Year 2 = 1-e^(-2x0.12) = 21.33%

Hence, PD in Year 2 = A - B = 21.33 - 11.30 = 10.03%

Now, Conditional PD = 10.03/.887 = 11.3%

This is the answer for all years.

amit.m.sharma

Member

The question on the after tax risk adjusted return on capital, we were given expected loss, unexpected loss and economic capital. I had not seen unexpected loss in any RAROC problem earlier so this one threw me off. Given that we are told the unexpected loss value, are we obliged to use it in the RAROC calculation?

From other threads in the forum, I could find a discussion between unexpected loss and economic capital with economic capital = alpha * unexpected loss. Who exactly decides this alpha?

worst case loss = expected loss + unexpected loss

why don't we use worst case loss instead of expected loss in the RAROC calculation?

From other threads in the forum, I could find a discussion between unexpected loss and economic capital with economic capital = alpha * unexpected loss. Who exactly decides this alpha?

worst case loss = expected loss + unexpected loss

why don't we use worst case loss instead of expected loss in the RAROC calculation?

The question on the after tax risk adjusted return on capital, we were given expected loss, unexpected loss and economic capital. I had not seen unexpected loss in any RAROC problem earlier so this one threw me off. Given that we are told the unexpected loss value, are we obliged to use it in the RAROC calculation?

From other threads in the forum, I could find a discussion between unexpected loss and economic capital with economic capital = alpha * unexpected loss. Who exactly decides this alpha?

worst case loss = expected loss + unexpected loss

why don't we use worst case loss instead of expected loss in the RAROC calculation?

My understanding is that the unexpected loss is superfluous information in computing the after-tax RAROC. Just ignore it and compute after-tax RAROC as you normally would, as all pertinent information is already given.

tigeryellow

New Member

Hey, guys. I have a grammar question. Do you still remember the BCVA question?

"For the perspective of company A, its exposure to company B is 1M, while for the perspective of company B, its exposure to company A is 2M"

if I would like to calculate the credit risk for Company A. Which EAD should I use? 1M or 2M. From my current understanding, it should be 1M, because credit exposure to sb means if sb default the amount will be in credit risk. I remember I used 2M in the exam, because I thought company B's exposure to company A means the amount company A have the position in B. So which one should be the correct one?

"For the perspective of company A, its exposure to company B is 1M, while for the perspective of company B, its exposure to company A is 2M"

if I would like to calculate the credit risk for Company A. Which EAD should I use? 1M or 2M. From my current understanding, it should be 1M, because credit exposure to sb means if sb default the amount will be in credit risk. I remember I used 2M in the exam, because I thought company B's exposure to company A means the amount company A have the position in B. So which one should be the correct one?

Sairam2366

New Member

Fingers crossedAny "tells" so far? Results out in 10 days!

flyawayaloe

New Member

getting nervous for sure... felt pretty good after the exam but now start to worry if the result turns out completely opposite to initial feel.

christylee

New Member

anybody received the arpm bootcamp email from garp? it says you can register for it and will give you 40 cpd credits

flyawayaloe

New Member

Yes. Believe it's ju advertisementanybody received the arpm bootcamp email from garp? it says you can register for it and will give you 40 cpd credits

christylee

New Member

Oh have you receive it?Yes. Believe it's ju advertisement

flyawayaloe

New Member

yes I have received it.Oh have you receive it?

- Status

- Not open for further replies.

Similar threads

- Replies

- 2

- Views

- 1K

- Replies

- 9

- Views

- 2K

- Replies

- 2

- Views

- 1K

- Replies

- 9

- Views

- 3K

- Replies

- 5

- Views

- 2K