Hi,

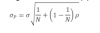

Regarding the formula for portfolio risk wiht many assets (p. 6 of Jorion/VaR study notes), the text says the following:

"It is evident from the formula above, that the portfolio risk, sigma_ p, tends to zero as N increases".

Shouldn't rhe risk converge to the product of sigma and the square root of the correlation?

Thanks

Regarding the formula for portfolio risk wiht many assets (p. 6 of Jorion/VaR study notes), the text says the following:

"It is evident from the formula above, that the portfolio risk, sigma_ p, tends to zero as N increases".

Shouldn't rhe risk converge to the product of sigma and the square root of the correlation?

Thanks

Apologies. It should read exactly as you show, we will get this fixed. Thank you! (cc

Apologies. It should read exactly as you show, we will get this fixed. Thank you! (cc