@Nicole Seaman @jaivipin is referring to Malz Chapter 8 (our page 19) where @Flashback is correct (our formula is missing a square root in the denominator). Thanks!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Errors Found in Study Materials P2.T6. Credit Risk (OLD thread)

- Thread starter Nicole Seaman

- Start date

- Status

- Not open for further replies.

@JulioFRM Yes, MMR should be "modified modified restructuring" (I bet we deleted the extra modified upon spell check). Tagged for revision. Thank you!

@David Harper CFA FRM

Chapter "Credit risk and credit derivatives"

Please check the blue color text. It's contradicting. As in, is credit spread increasing or decreasing for low rated debt as time to maturity increases.

Chapter "Credit risk and credit derivatives"

Please check the blue color text. It's contradicting. As in, is credit spread increasing or decreasing for low rated debt as time to maturity increases.

Last edited:

MiguelVitiello

New Member

broken link

Hi,

I think that the link to ''Credit Risk Measurement & Management Quiz'' in topic 6 Review is wrong because it download the spreadsheet T6.a_2012_XLS_bundle...

Many thanks,

Kind regards,

MV

Hi,

I think that the link to ''Credit Risk Measurement & Management Quiz'' in topic 6 Review is wrong because it download the spreadsheet T6.a_2012_XLS_bundle...

Many thanks,

Kind regards,

MV

MiguelVitiello

New Member

broken link

Hi,

I think that the link to ''Credit Risk Measurement & Management Quiz'' in topic 6 Review is wrong because it download the spreadsheet T6.a_2012_XLS_bundle...

Many thanks,

Kind regards,

MV

sorry, I made a mistake, the link is fine

another typo w.r.t. the definition of R(square): fraction of variance in 'dependent' variable Y that is explained by the 'independent' variable X. Page 15|P1,T2,chapter 4: S&W,linear regression with one regressorHi Nicole and David

i found a small typo in Stock & Watson, Introduction to Econometrics , chapter 4 slide(R14,P1,T2); thought of drawing your attention for next revision. Please ignore if it has been already netted out by someone already.

Thanks!

View attachment 1923

@David Harper CFA FRM

Hi David,

I think the formula for default correlation given in notes is incorrect. "Malz, Chapter 8 (Sections 8.1, 8.2, 8.3 only): Portfolio

Credit Risk"

Hi David,

I think the formula for default correlation given in notes is incorrect. "Malz, Chapter 8 (Sections 8.1, 8.2, 8.3 only): Portfolio

Credit Risk"

Mariana ZF

New Member

@RaDi7 Yes agreed on both, thank you! The source PD is mistaken (doesn't distribute the T) but ours then omits the N(.)Sorry, thank you!

@Nicole Seaman RaDi7 is correct about both of these mistakes. This doesn't require Deeepa, I can correct myself (added to wrike)

Hi David/Nicole,

I see that the error regarding the minus that is missing on the "continuos" ADR formula has already been reported tho i just downloaded this study notes and see that it is still missing, same goes for error on page 21, the missing N(.).

This isn't the first time that i think i might be looking at some old study notes, is there a place where i can see how long ago where the study notes modified? That would help a lot to see if i'm using the up-to-date ones.

Thanks!

Hello @Mariana ZFHi David/Nicole,

I see that the error regarding the minus that is missing on the "continuos" ADR formula has already been reported tho i just downloaded this study notes and see that it is still missing, same goes for error on page 21, the missing N(.).

This isn't the first time that i think i might be looking at some old study notes, is there a place where i can see how long ago where the study notes modified? That would help a lot to see if i'm using the up-to-date ones.

Thanks!

I am currently trying to get through all of the forum threads tagged with "revisepdf" so our study planner PDFs reflect the errors that are pointed out. Whenever I update a PDF in the study planner (or publish a brand new PDF), I will update these threads:

- Part 1: https://forum.bionicturtle.com/threads/2019-part-1-new-and-updated-published-materials.22027/

- Part 2: https://forum.bionicturtle.com/threads/2019-part-2-new-and-updated-published-materials.22028/

These threads are located in the Announcements section of the forum. Here are the previous threads from last year that should be helpful to you, but I promise that I am trying my best to get all of the PDFs updated as soon as possible

2018 Part 1: https://forum.bionicturtle.com/threads/2018-part-1-new-and-updated-published-materials.13310/

2018 Part 2: https://forum.bionicturtle.com/threads/2018-part-2-new-and-updated-published-materials.13309/

Thank you,

Nicole

JeffSchmitz

New Member

Hi David,

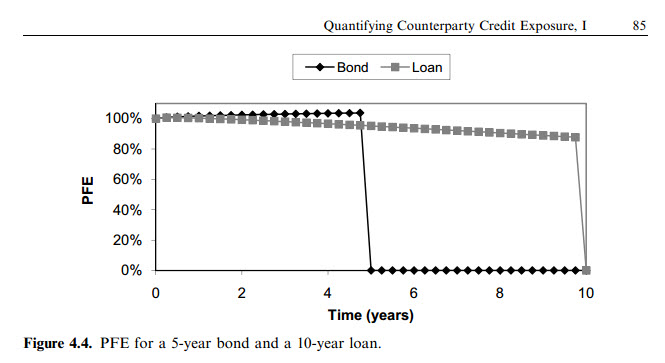

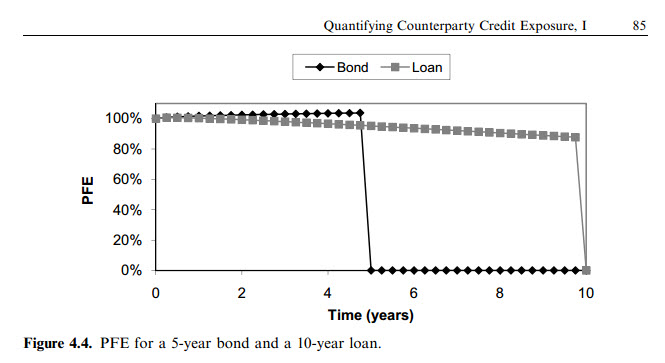

I am currently reviewing your great new videos for Part 2, and became a little bit confused while watching the video on Gregory, Chapter 7: Credit Exposure and Funding. At minute 33:50 you are showing the figure 7.8 "Illustration of a square root of time exposure profile" while saying that this is the expected exposure at different time steps for Loans and Bonds. But shouldn't the expected exposure of a loan or bond be going back to 0 as it is pulled to par for bonds or repayed for loans?

The study notes are saying that this graph represents the exposure profiles for FX forwards, which also sounds more logical to me.

Thank you,

Best regards,

Jeff

I am currently reviewing your great new videos for Part 2, and became a little bit confused while watching the video on Gregory, Chapter 7: Credit Exposure and Funding. At minute 33:50 you are showing the figure 7.8 "Illustration of a square root of time exposure profile" while saying that this is the expected exposure at different time steps for Loans and Bonds. But shouldn't the expected exposure of a loan or bond be going back to 0 as it is pulled to par for bonds or repayed for loans?

The study notes are saying that this graph represents the exposure profiles for FX forwards, which also sounds more logical to me.

Thank you,

Best regards,

Jeff

Hi @JeffSchmitz Yes, right, it's my mistake. As you suggest, the graph is labelled "Illustration of a square root of time exposure profile" and therefore reflects a generic diffusion concept which is applicable, as Gregory mentions, to FRA/forward contracts but even to the early years in a swap before amortization overwhelms. The reason i made the mistake is that the graph appears immediately after 7.3.1. Loans and Bonds, but it is meant to refer to 7.3.2. Future uncertainty, and I just didn't catch it while recording

If we go all the way back to Gregory's 1st edition (because I think he does not repeat this in the 2nd or 3rd versions, but I could be wrong ...), then we find his PFE curve for a loan/bond. This is much nearer to your expectation and characterization, although it's interesting that he does not show a pull-to-par, but rather he has 100% of notional immediately (hmmm ... I think we've talked about this in the forum before but I'm not sure I agree with this aspect. For example, if you buy a 30-year zero-coupon bond, what is the PFE + 1 day from purchase? Isn't it far less than the notional? ...)

If we go all the way back to Gregory's 1st edition (because I think he does not repeat this in the 2nd or 3rd versions, but I could be wrong ...), then we find his PFE curve for a loan/bond. This is much nearer to your expectation and characterization, although it's interesting that he does not show a pull-to-par, but rather he has 100% of notional immediately (hmmm ... I think we've talked about this in the forum before but I'm not sure I agree with this aspect. For example, if you buy a 30-year zero-coupon bond, what is the PFE + 1 day from purchase? Isn't it far less than the notional? ...)

evelyn.peng

Active Member

Hi there,

for Choudhry, in 2020, the last LO "Explain the decline in demand in the new-issue securitized finance products market following the 2007 financial crisis" appear to be removed out of the curriculum.

In the most up to date Study Note published on 06/12, that LO is still included.

I understand it is not a mistake, and I appreciate the extra study note for that LO. Just wanted to point out that the LO appears to be removed from the 2020 curriculum based on the handy spreadsheet comparison Nicole provided.

Thanks,

Evelyn

for Choudhry, in 2020, the last LO "Explain the decline in demand in the new-issue securitized finance products market following the 2007 financial crisis" appear to be removed out of the curriculum.

In the most up to date Study Note published on 06/12, that LO is still included.

I understand it is not a mistake, and I appreciate the extra study note for that LO. Just wanted to point out that the LO appears to be removed from the 2020 curriculum based on the handy spreadsheet comparison Nicole provided.

Thanks,

Evelyn

T6-R12-P2 page 11. The last example is using "year" in the last 2 lines on the page instead of \lambda (i.e. 3). Looks like a typo in the Excel used for the example.

T6-R12-P2 pg 14. The second heading of the table for the example should be "Cumulative Default Prob" not "Cumulative Default Time". The same errata is present on the next page.

T6-R12-P2 pg 19, last sentence of question 306.1: "both the spot andswap are risk-free curves". The word swap is missing.

T6-R12-P2 pg 26, The values in the text before the table are inconsistent with the table and the text afterwards. ($1.0MM portfolio, $1000MM portfolio, 500 positions, 50 positions, 2MM each or 20MM each).

T6-R12-P2 pg 14. The second heading of the table for the example should be "Cumulative Default Prob" not "Cumulative Default Time". The same errata is present on the next page.

T6-R12-P2 pg 19, last sentence of question 306.1: "both the spot and

T6-R12-P2 pg 26, The values in the text before the table are inconsistent with the table and the text afterwards. ($1.0MM portfolio, $1000MM portfolio, 500 positions, 50 positions, 2MM each or 20MM each).

Last edited:

T6-R13-P2 pg 8. MTM section, paragraph 2, sentence 2: MTM may be negative or positive. "be" is missing.

T6-R13-P2 pg 21. Top of the page, Without Netting example. This uses values of 10.0 during the explanation which should actually be 11.0

T6-R13-P2 pg 30. Q4 and Q5 assess AIMs for Gregory Chater 6 and not 5. They appear a little early in the study notes. This may be an error.

T6-R13-P2 pg 36, the two bullets at the bottom. The equations should read (100 - 7)% = 93% and (100 - 15)% = 85%. The 00's are missing.

T6-R13-P2 pg 54, the bottom of the page, before the table. "where the implied netting factor is21/13 = 92.3%" this should be 12/13 i.e. (with netting / without netting) = netting factor

T6-R13-P2 pg 75, There is an extra "hello" in the heading at the top of the page.

T6-R13-P2 pg 21. Top of the page, Without Netting example. This uses values of 10.0 during the explanation which should actually be 11.0

T6-R13-P2 pg 30. Q4 and Q5 assess AIMs for Gregory Chater 6 and not 5. They appear a little early in the study notes. This may be an error.

T6-R13-P2 pg 36, the two bullets at the bottom. The equations should read (100 - 7)% = 93% and (100 - 15)% = 85%. The 00's are missing.

T6-R13-P2 pg 54, the bottom of the page, before the table. "where the implied netting factor is

T6-R13-P2 pg 75, There is an extra "hello" in the heading at the top of the page.

Last edited:

T7-R29-P2 pg16. In the figure, X is allocated Marginal EC of $40 but it is $30 in the text. The text is correct here, if we have Y already we need $30 more EC if we want to include business X too. The same is true for Y, it should be $40 in the figure.

T7-R36-P2 pg12, Credit conversion Factors Table. 0% is applied to "Loan commitments with original maturity less than one year" not "Loan commitments with an original maturity greater than or equal to one year"

T7-R36-P2 pg13 in the tables the remaining maturity should be ">5" not "<5" in the last row. "M" is not defined for the second table.

T7-R36-P2 pg12, Credit conversion Factors Table. 0% is applied to "Loan commitments with original maturity less than one year" not "Loan commitments with an original maturity greater than or equal to one year"

T7-R36-P2 pg13 in the tables the remaining maturity should be ">5" not "<5" in the last row. "M" is not defined for the second table.

Last edited:

A new thread has been created here for 2021: https://forum.bionicturtle.com/threads/errors-found-in-2021-study-materials-p2-t6-credit-risk.23686/

- Status

- Not open for further replies.

Similar threads

- Sticky

- Replies

- 1

- Views

- 142

- Locked

- Replies

- 4

- Views

- 1K

- Sticky

- Replies

- 0

- Views

- 143

- Sticky

- Replies

- 0

- Views

- 711

- Sticky

- Replies

- 0

- Views

- 2K