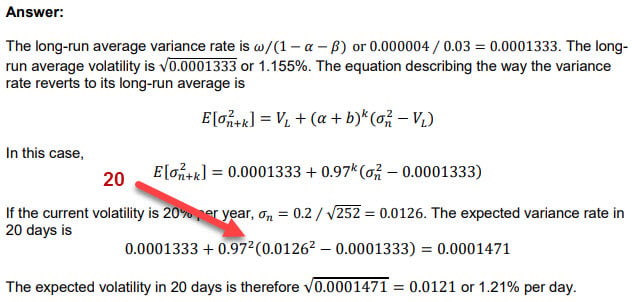

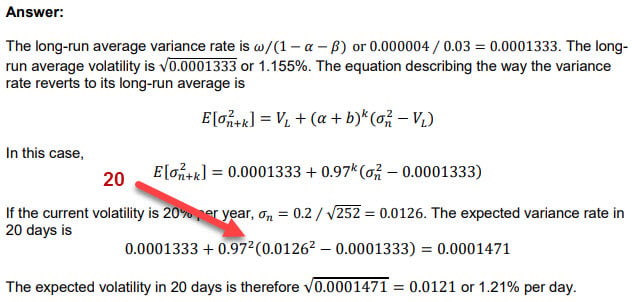

Hi @David Harper CFA FRM I reckon there's a typo in pg 24 (Study notes, Hull, Risk Management, Chapters 10 & 11 (ewma, garch & copulas)) in the answer of question 10.14, as it says t=2 but I think I should be t=20 as we want to find volatility in 20 days. I think answer is ok.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Errors Found in Study Materials P1.T2. Quantitative Methods (OLD thread)

- Thread starter Nicole Seaman

- Start date

- Status

- Not open for further replies.

Hello @JulioFRM,Hi @David Harper CFA FRM I reckon there's a typo in pg 24 (Study notes, Hull, Risk Management, Chapters 10 & 11 (ewma, garch & copulas)) in the answer of question 10.14, as it says t=2 but I think I should be t=20 as we want to find volatility in 20 days. I think answer is ok.

Please note that I moved your question here to this thread that is specifically for errors found in any of the Topic 2 the study notes. There is a thread like this in the forum for each topic. The question that you pointed out is one of the EOC Q&A in Hull's book. It was copied directly from the book, but I will let @David Harper CFA FRM answer your question as to whether the book contains a typo or not.

Thank you,

Nicole

Hi @JulioFRM Yes, you are correct of course, thank you! @Nicole Seaman The typo does not impact the answer (see below, it should be 0.97^20 rather than 0.97^2); I tasked in wrike as a minor revision. Thanks!

ziminli1228

Member

Under P1T2, there were supposed to be two formulas calculating volatility which in the pdf refers to equation 10.2 and 10.4 but I didn't find it in the notes nor the practice questions. Could you please point me to the right direction?

Thank you

Thank you

yadav.anil

New Member

hi @David Harper CFA FRM

P52 - sol 307.1.

first line - 3rd central moment = (1-0.05)^3*5% + (0-0.05)^3*95%

shouldn't 0.05 be 0.95? or am i missing something?

P52 - sol 307.1.

first line - 3rd central moment = (1-0.05)^3*5% + (0-0.05)^3*95%

shouldn't 0.05 be 0.95? or am i missing something?

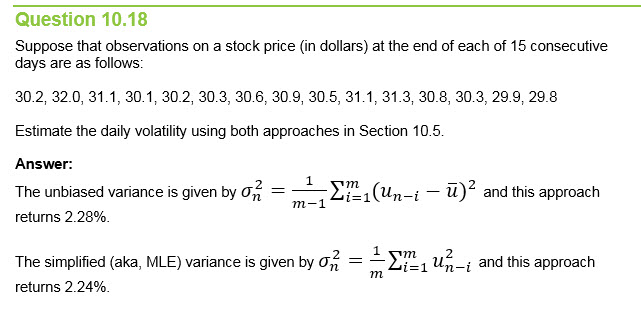

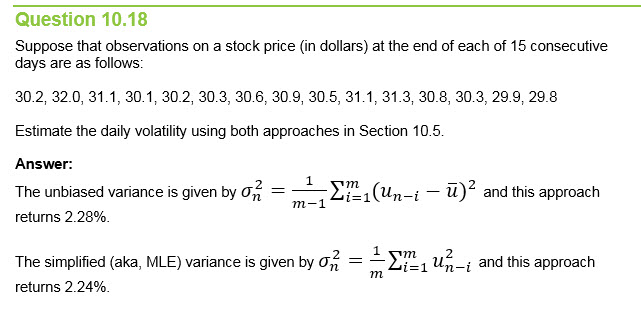

Hi @ziminli1228 I replaced the references to equations 10.2 and 10.4 with the actual formulas, see below (I also did this for Hull's EOC Question 10.5 which refers to equation 10.4). Equation 10.2 is the (first) "unbiased variance" that, when squaring the returns uses the difference between the return and the mean return, and also divides by (m-1). His equation 10.4 is the "simplified variance" because it (i) just squares the returns and therefore implicitly assumes the mean return is zero and (ii) divides by (m) rather than (m-1). The MLE indicates this simplified variance is a different estimator and therefore not not inferior (but also not unbiased). Thank you!

(cc @Nicole Seaman: saved .docx to non-urgent vR16-P1-T2-Hull-v7-31.docx)

(cc @Nicole Seaman: saved .docx to non-urgent vR16-P1-T2-Hull-v7-31.docx)

HI @yadav.anil 0.05 is the mean, so the 0.05 is correct. Instead, there should not be a 0.95 in the 4th moment per the correction in the source at https://forum.bionicturtle.com/threads/p1-t2-307-skew-and-kurtosis-miller.6825/

i.e., correct is:

cc @Nicole Seaman the pdf isn't updated to match the corrections in the thread, fyi

i.e., correct is:

307.1. C. S = 4.1, K = 18.1

Let X = 0 with prob 95.0% and X = 1 with prob 5.0%, such that mean (X) = 0.050:

3rd central moment = (1-0.05)^3*5% + (0-0.05)^3*95% = 0.04275, such that skew = 0.04275/(5%*95%)^(3/2) = 4.1295 (or -4.1295)

4th central moment = (1-0.05)^4*5% + (0-0.05)^4*95% = 0.04073, such that kurtosis = 0.04073/(5%*95%)^2= 18.053

i.e., excess kurtosis = 18.053 - 3.0 = 15.053

cc @Nicole Seaman the pdf isn't updated to match the corrections in the thread, fyi

@David Harper CFA FRMHI @yadav.anil 0.05 is the mean, so the 0.05 is correct. Instead, there should not be a 0.95 in the 4th moment per the correction in the source at https://forum.bionicturtle.com/threads/p1-t2-307-skew-and-kurtosis-miller.6825/

i.e., correct is:

cc @Nicole Seaman the pdf isn't updated to match the corrections in the thread, fyi

Thank you. I have a list of updates that I need to fix in the Miller notes. I will also check the PQ pdf to make sure that is corrected. I will get those updated and republished as soon as possible.

Hello @truongngoR16.P1.T2 (page 36): the first sentence in the section "Explain tail dependence" is unreadable due to formatting error.

I just downloaded the R16 Hull reading from the study planner, and there are no formatting errors on the document. Generally, when a member is having issues with formatting it is due to the PDF software that they are using to view the document. We recommend using the free Foxit PDF reader to view documents, which can be downloaded here: https://www.foxitsoftware.com/pdf-reader/.

Thank you,

Nicole

Thank you for the response. I guess it's the problem with Adobe Acrobat Reader as I saw quite a few errors like that. I will try as you advised.Hello @truongngo

I just downloaded the R16 Hull reading from the study planner, and there are no formatting errors on the document. Generally, when a member is having issues with formatting it is due to the PDF software that they are using to view the document. We recommend using the free Foxit PDF reader to view documents, which can be downloaded here: https://www.foxitsoftware.com/pdf-reader/.

Thank you,

Nicole

gprisby

Active Member

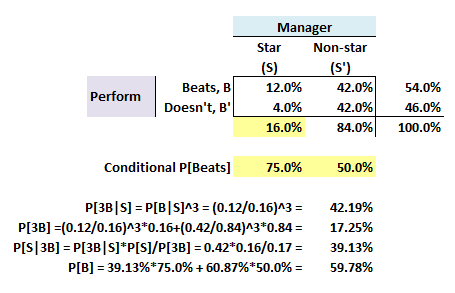

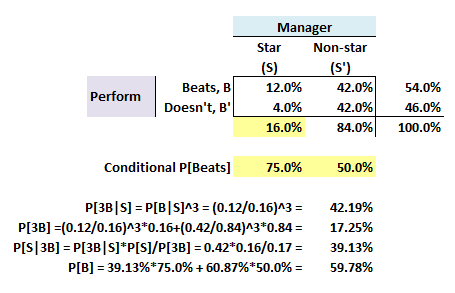

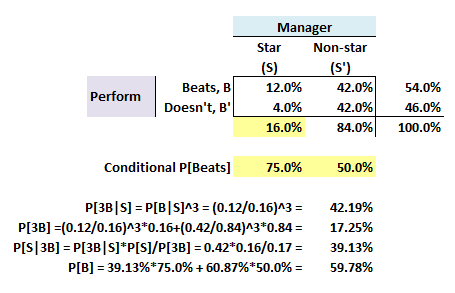

Hi @FlorenceCC As part of my youtube series, it happens to be that I recorded a video reviewing this problem (Miller Chapter 6 Sample #2), see below.

This sample question is perhaps not "exam-level" quality due to the slightly loose wording. I would not say it's wrong (is just my opinion) because I think it's right to infer that the second question is asking for the posterior (conditional) probability given the "evidence" of three years of beating the market:

... but, at the same time, to qualify as exam-level a good question should be precise and explicit. As somebody who write questions constantly, I agree with the spirit of your point: I would definitely want to edit that second question, because a good question does not hang people up in semantic interpretation like this question very well could. I hope you like my video about this question, thanks!

I actually came to see if this was in the errors.. I usually follow along with the videos and the notes since they are coordinated. I got hung up on 2 things due to typos/errors.

In the notes, I think the equation needs to be P[3B|S] = P[B|S]^3 = (0.12/0.16)^3

It has the probability of non-star doesn't beat (0.4) in the red bold term above. We are trying to show 75%^3.... not 3^3

Also, I think the edit from Florence might be throwing off the whole question / solution. The question has no mention of "3 years", so I was getting so confused as to why we were taking everything to the 3rd power in the solution. It made sense when I saw the question including the sentence about the manager being there 3 years ago. I just thought I would come make a post about it. It kind of helps me learn to type this stuff out while thinking about it!

If I am totally off/wrong, let me know too lol.

If I am totally off/wrong, let me know too lol.Hi @gprisby (cc: @Nicole Seaman ) Yes, absolutely; we need to edit/reissue this study note. The solution should look as below; ie., the same mistake came up a couple of days ago here at https://forum.bionicturtle.com/thre...ting-covariance-correlation.14026/#post-61698 i.e.,

Table on page 101 should be as follows; i.e., (0.12/0.16)^3 = 42.19%

Hi @vaisman (cc @Nicole Seaman ) Apologies, but the upper matrix on page 101 is a mistake and should not be there (you are correct, it's a mistaken copy from the previous sample problem). For sample problem #2, we should be showing only the following matrix (notice that I have colored in YELLOW the three assumptions given: these are all we need to populate the entire matrix!):

And then I notice a second problem, I don't know how this happened but the problem statement omits the following emphasized sentence: "Stars are rare. Of a given pool of managers, only 16% turn out to be stars. A new manager was added to your portfolio three years ago. Since then, the new manager has beaten the market every year." Hence the cubed probability: the probability that a star manager beats the market on any given year is 75%, such that the probability she/he will do that for three consecutive years is 75%^3. In this way, the Bayes theorem applied is P(S | 3B) = P(3B | S)*P(S) / P(3B). Sorry for the confusions, thanks!

Table on page 101 should be as follows; i.e., (0.12/0.16)^3 = 42.19%

gprisby

Active Member

Nice, I might be catching on!

Very minor...but thought I should point out for posterity

Part 1: Quant Analysis: Reading 1: Miller, Mathematics and Statistics, Chapters 2, 3, 4, 6 & 7

Study Notes:

(1) p.130 missing absolute value bar before "X" in Chebyshev's Inequality:

(2) p. 132 redundant summation for calculating Binomial probability for K = 4. Technically it is not incorrect since there is no dependence on "k", but it seemed a vestige from the next calculation.

Part 1: Quant Analysis: Reading 1: Miller, Mathematics and Statistics, Chapters 2, 3, 4, 6 & 7

Study Notes:

(1) p.130 missing absolute value bar before "X" in Chebyshev's Inequality:

(2) p. 132 redundant summation for calculating Binomial probability for K = 4. Technically it is not incorrect since there is no dependence on "k", but it seemed a vestige from the next calculation.

Additional minor points on next reading:

Part 1: Quant Analysis

Stock, Introduction to Econometrics, Chapters 4, 5, 6 and 7

Study Notes

1) Page 12, Interchange “Slope” and “intercept”

2) Page 19, second bullet point should read B_0 hat and B_1 hat

3) p. 43, bullet 2, the denominator should have SE of beta hat j, not 1

Same page, 3rd bullet point, I believe it should be |t^act|

Part 1: Quant Analysis

Stock, Introduction to Econometrics, Chapters 4, 5, 6 and 7

Study Notes

1) Page 12, Interchange “Slope” and “intercept”

2) Page 19, second bullet point should read B_0 hat and B_1 hat

3) p. 43, bullet 2, the denominator should have SE of beta hat j, not 1

Same page, 3rd bullet point, I believe it should be |t^act|

Branislav

Member

Dear @David Harper CFA FRM , am I missing something in this example or it looks like we are missing current volatility estimate 0.0227 in question?

Thanks in advance

Thanks in advance

Last edited by a moderator:

Hi David

I was very confused about the following statement in the Bionic Turtle FRM Study Notes on Miller (page 40) that "kurtosis measures the degree of "peakedness" of the distribution".

It seems that this a (common) incorrect notion of kurtosis and the only unambiguous interpretation is in terms of tail extremity. A measure for outliers. See the following research paper giving more details www.ncbi.nlm.nih.gov/pmc/articles/PMC4321753/

With best regards,

Maarten

I was very confused about the following statement in the Bionic Turtle FRM Study Notes on Miller (page 40) that "kurtosis measures the degree of "peakedness" of the distribution".

It seems that this a (common) incorrect notion of kurtosis and the only unambiguous interpretation is in terms of tail extremity. A measure for outliers. See the following research paper giving more details www.ncbi.nlm.nih.gov/pmc/articles/PMC4321753/

With best regards,

Maarten

- Status

- Not open for further replies.

Similar threads

- Sticky

- Replies

- 0

- Views

- 1K

- Sticky

- Replies

- 0

- Views

- 699

- Sticky

- Replies

- 0

- Views

- 2K

- Sticky

- Replies

- 1

- Views

- 131

- Sticky

- Replies

- 0

- Views

- 128