You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chapter 5 MPT,CAPM

- Thread starter DenisAmbrosov

- Start date

Lu Shu Kai FRM

Well-Known Member

Hi @DenisAmbrosov ,

From my understanding, this statement seems to be made in the framework of the Markowitz efficient frontier. I would guess that this cost is taking about the cost of lowered return. This is because when you reduce risk exposures by investing in a less risky asset (lower beta), you would be exposed to less return (risk-return tradeoff). However, when you diversify through assets, you are eliminating idiosyncratic risk while retaining systematic risk that allows you to gain higher return.

The second sentence is actually quite interesting. My understanding of it would be that there is no reward (in terms of return), from taking on additional idiosyncratic risk. Perhaps David may be able to give a much better insight than me.

From my understanding, this statement seems to be made in the framework of the Markowitz efficient frontier. I would guess that this cost is taking about the cost of lowered return. This is because when you reduce risk exposures by investing in a less risky asset (lower beta), you would be exposed to less return (risk-return tradeoff). However, when you diversify through assets, you are eliminating idiosyncratic risk while retaining systematic risk that allows you to gain higher return.

The second sentence is actually quite interesting. My understanding of it would be that there is no reward (in terms of return), from taking on additional idiosyncratic risk. Perhaps David may be able to give a much better insight than me.

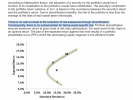

Totally agree @lushukai , thank you! @DenisAmbrosov The first sentence rephrases the bolded sentence (in context below). If you consider the plot you copied and imagine a straight line between the PPC's endpoints (which would represent perfect correlation between the two assets: diversification is imperfect correlation and the lower the correlation the more curvature is introduced into the PPC), the sentence reflects that fact that, at any given level of return, diversification enables us to occupy an (efficient) point on the curved line to the left (ie., with less risk) for the same level of return.

Put simply, it costs us nothing (we sacrifice no return) to reduce risk via diversification. Put visually, the first sentence is visualized by any horizontal segment connecting the PPC to the undiversified straight line (not shown) because such a line(s) illustrates (in moving to the left) the free lunch ("no cost") of risk reduction at a given level of expected return.

The second sentence can follows from the entire MPT/CAPM (as far as I'm concerned): CAPM says the expected return does not increase if we add idiosyncratic risk; we only increase expected return by adding systematic (beta) risk. Thanks,

Put simply, it costs us nothing (we sacrifice no return) to reduce risk via diversification. Put visually, the first sentence is visualized by any horizontal segment connecting the PPC to the undiversified straight line (not shown) because such a line(s) illustrates (in moving to the left) the free lunch ("no cost") of risk reduction at a given level of expected return.

The second sentence can follows from the entire MPT/CAPM (as far as I'm concerned): CAPM says the expected return does not increase if we add idiosyncratic risk; we only increase expected return by adding systematic (beta) risk. Thanks,

"According to Markowitz, the level of investment in a particular financial asset should be based upon that asset’s contribution to the distribution of the portfolio’s overall portfolio return (as measured by the mean and variance). An asset’s performance is not judged in isolation, but rather in relationship to the performance of the other portfolio assets. In other words, what matters is the covariability of the asset’s return with respect to the return of the overall portfolio. Portfolio diversification enables (at least in theory) the zero-cost reduction of risk exposures to individual assets.

Logically, a reduction in risk should result in lower expected returns. If the asset weights are appropriately selected, however, the resulting diversification can enable the optimization (i.e., maximization) of returns for any given level of risk. Plotting the optimal returns for each level of risk results in the efficient frontier, which is represented by the solid curve in Figure 5.1. Each point on this curve represents the portfolio of assets that is expected to offer the highest return for the given level of risk. -- Education, Pearson. Foundations of Risk Management. Pearson Learning Solutions, 2020. VitalBook file. Chapter 5."

Similar threads

- Sticky

- Replies

- 0

- Views

- 124

- Replies

- 0

- Views

- 325

- Replies

- 0

- Views

- 173

- Sticky

- Replies

- 0

- Views

- 119