Abhishek Verma

New Member

Hi David,

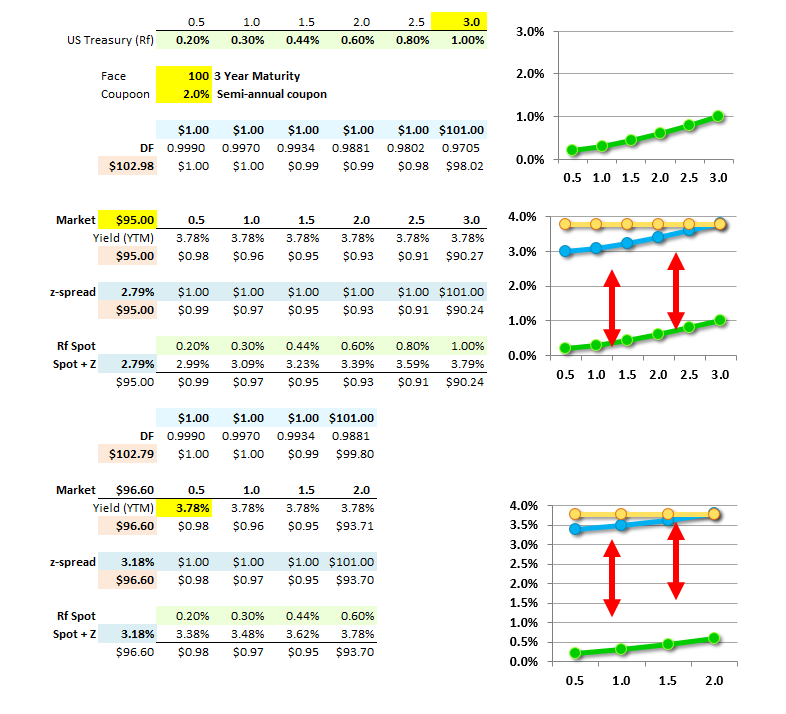

Does Z spread for a same bond, when calculated at different time periods changes ?

For example lets say we are valuing a bond on January 2000 that will mature in January 2010 bond. Lets say z spread for the bond is 100 bps at Jan 2000. Will Z spread be the same when we will value the same bond on January 2005?

Provided interest rate doesn't changes.

Does Z spread for a same bond, when calculated at different time periods changes ?

For example lets say we are valuing a bond on January 2000 that will mature in January 2010 bond. Lets say z spread for the bond is 100 bps at Jan 2000. Will Z spread be the same when we will value the same bond on January 2005?

Provided interest rate doesn't changes.

Last edited: