Head on over to our Facebook page to enter our Trivia Contest! You will be entered to win a $15 gift card of your choice from Starbucks, Amazon or iTunes (iTunes is US only)!

If you do not have Facebook, you can enter right here in our forum. Just answer the following questions:

1. An airline hedges future planned purchases of jet fuel with long positions in heating oil futures contracts but incurs the risk implied by this cross-hedge. Which is the most acute risk?

a. Directional market risk

b. Basis risk (as a market risk)

c. Volatility (as market risk)

d. Operational risk

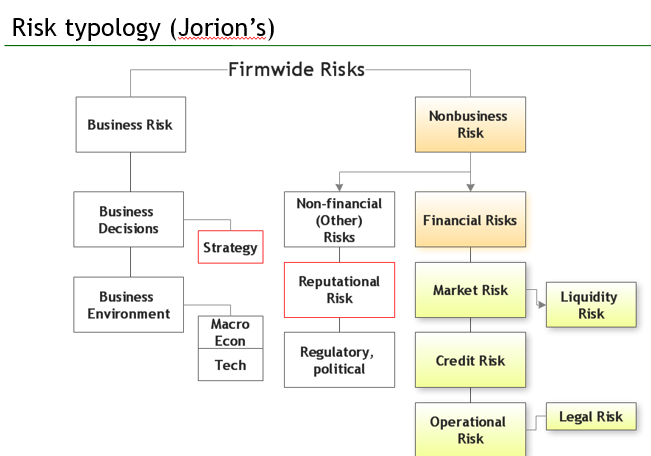

2. Before 1994, Banker's Trust was widely admired as a leader in risk management. But in 1994 the bank became embroiled in a high-profile lawsuit with Procter & Gamble that damaged the bank's reputation. The legal risk (lawsuit) is considered an operational risk. In a risk typology, where is located the reputational risk?

a. Non-financial business risk

b. Non-business financial risk

c. Non-business non-financial risk

d. Operational risk (along with legal risk)

3. A financial institution has a position in an over-the-counter (OTC) currency swap with a bank. Neither the institution nor the bank employs margin or collateral. The swap has a remaining maturity of only three months. Interest rates and exchanges rates are trending in the institution's favor, producing mark-to-market gains for the institution (and corresponding MtM losses for the bank). This trend of positive MtM gains for the institution is likely to continue until maturity of the currency swap. Which risk is probably most significant (i.e., the broad risk class which includes the specific type)?

a. Liquidity risk

b. Market risk

c. Credit risk

d. Operational risk

4. A bank takes a position in a exotic option based on its internal mark-to-model valuation estimate. Subsequently, major market makers reveal through trades that the bank over-valued the option. Which broad risk has been revealed (The broad class includes the specific risk type. The train is a toy model, do you get the cute metaphor?...)?

a. Market risk

b. Credit risk

c. Legal risk

d. Operational risk

5. At a major broker-dealer, a data entry error creates an artificial over-estimation of posted collateral which prevents a collateral call that should have occured. This is an operational risk, but which Basel operational event type (ET) is this?

a. Internal Fraud

b. Execution, Delivery, & Process Management

c. Clients, Products, & Business Practice

d. Business Disruption & Systems Failures

If you do not have Facebook, you can enter right here in our forum. Just answer the following questions:

1. An airline hedges future planned purchases of jet fuel with long positions in heating oil futures contracts but incurs the risk implied by this cross-hedge. Which is the most acute risk?

a. Directional market risk

b. Basis risk (as a market risk)

c. Volatility (as market risk)

d. Operational risk

2. Before 1994, Banker's Trust was widely admired as a leader in risk management. But in 1994 the bank became embroiled in a high-profile lawsuit with Procter & Gamble that damaged the bank's reputation. The legal risk (lawsuit) is considered an operational risk. In a risk typology, where is located the reputational risk?

a. Non-financial business risk

b. Non-business financial risk

c. Non-business non-financial risk

d. Operational risk (along with legal risk)

3. A financial institution has a position in an over-the-counter (OTC) currency swap with a bank. Neither the institution nor the bank employs margin or collateral. The swap has a remaining maturity of only three months. Interest rates and exchanges rates are trending in the institution's favor, producing mark-to-market gains for the institution (and corresponding MtM losses for the bank). This trend of positive MtM gains for the institution is likely to continue until maturity of the currency swap. Which risk is probably most significant (i.e., the broad risk class which includes the specific type)?

a. Liquidity risk

b. Market risk

c. Credit risk

d. Operational risk

4. A bank takes a position in a exotic option based on its internal mark-to-model valuation estimate. Subsequently, major market makers reveal through trades that the bank over-valued the option. Which broad risk has been revealed (The broad class includes the specific risk type. The train is a toy model, do you get the cute metaphor?...)?

a. Market risk

b. Credit risk

c. Legal risk

d. Operational risk

5. At a major broker-dealer, a data entry error creates an artificial over-estimation of posted collateral which prevents a collateral call that should have occured. This is an operational risk, but which Basel operational event type (ET) is this?

a. Internal Fraud

b. Execution, Delivery, & Process Management

c. Clients, Products, & Business Practice

d. Business Disruption & Systems Failures

and it is debatable as there is no single authoritative typology.

and it is debatable as there is no single authoritative typology.