Kavita.bhangdia

Active Member

HI David,

we have definitiions of various actives..

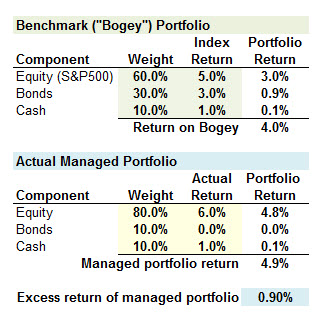

1. Active return : Portfolio return - benchmark return

2. Active risk : Standard deviation of Active risk??

3. Active weight.. No idea

Please can you help..

Thanks,

Kavita

we have definitiions of various actives..

1. Active return : Portfolio return - benchmark return

2. Active risk : Standard deviation of Active risk??

3. Active weight.. No idea

Please can you help..

Thanks,

Kavita