hellohi

Active Member

dear @David Harper CFA FRM

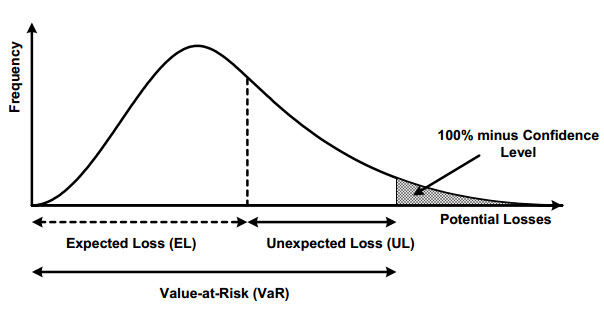

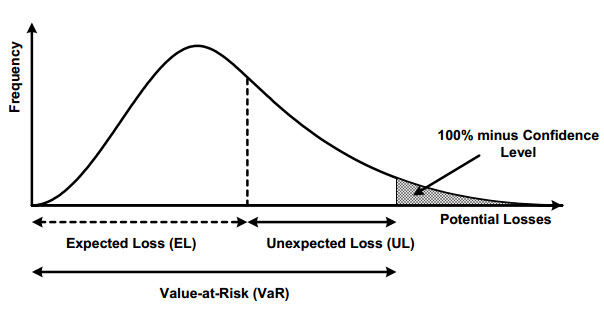

just want to ask if VAR includes expected loss? in the following chart, it seems that the VAR = EL + UL, not just unexpected loos....so this made me confused because as I knew that the expected loss is not risk, so how it be part of VAR?

best regards

Nabil

just want to ask if VAR includes expected loss? in the following chart, it seems that the VAR = EL + UL, not just unexpected loos....so this made me confused because as I knew that the expected loss is not risk, so how it be part of VAR?

best regards

Nabil

Last edited: