afterworkguinness

Active Member

Hello,

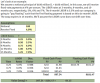

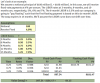

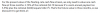

In the example on valuing swap as fixed and floating rate bonds in the notes on Hull chapter 7, the future value of the floating leg is computed as: (6 month LIBOR /2)*Notional. The notes say the floating rate is halved because "it is a semi annual payment on 5.5%"

I understand that if a bond has a 4% per annum coupon paid semi annually it is $2 per coupon, I don't get why it's being done in this case though since the swap leg is 6 months and we have a 6 month LIBOR.

I have attached a screen shot of the question for reference.

Thanks in advance.

In the example on valuing swap as fixed and floating rate bonds in the notes on Hull chapter 7, the future value of the floating leg is computed as: (6 month LIBOR /2)*Notional. The notes say the floating rate is halved because "it is a semi annual payment on 5.5%"

I understand that if a bond has a 4% per annum coupon paid semi annually it is $2 per coupon, I don't get why it's being done in this case though since the swap leg is 6 months and we have a 6 month LIBOR.

I have attached a screen shot of the question for reference.

Thanks in advance.