afterworkguinness

Active Member

Hi David,

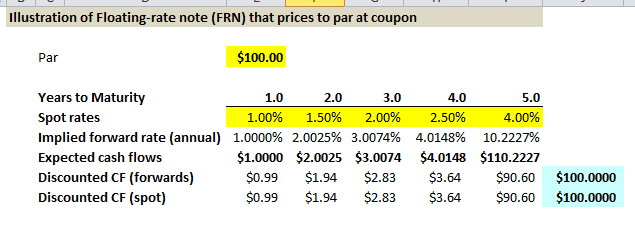

I don't fully understand how to value a plain vanilla swap as a fix rate and floating rate bond. In your Youtube video, for the floating rate bond you price it as PV (1st coupon + notional). Why don't you take into account the other floating rate coupons that take place during the life of the swap ?

Thanks in advance.

ps: Your Youtube videos are awesome.

I don't fully understand how to value a plain vanilla swap as a fix rate and floating rate bond. In your Youtube video, for the floating rate bond you price it as PV (1st coupon + notional). Why don't you take into account the other floating rate coupons that take place during the life of the swap ?

Thanks in advance.

ps: Your Youtube videos are awesome.