Hi @bpdulog Yes, the CLN buyer (aka, CLN investor, protection seller) is analogous to the CDS seller: without a default, this investor/buyer receives agreed-upon coupons and return of the principal at maturity. (this is the key difference between CDS protection seller, who has not funded the CDS and therefore only collects "coupon" premiums versus the CLN buyer who has funded the securities and so receives coupons but also expects to get their principal/par back at maturity). But, as you say, they have sold credit protection, so if there is a default, they have their coupons (interest) and principal at risk. However, just like the CDS protection seller, if a credit event happnes, pays only (if cash settlement) notional minus recovery, the CLN buyer is entitled to the recovered principal (or, analogously, if the CDS is physically settled, the protection seller pays the entire notional but they receive any recovered bond). In both cases, the actual loss is net of recovery and the protection seller is not protecting the entire principal (in the case of the CLN) or the entire notional (in the case of the CDS) but rather the actually lost portion (i.e., net of recovery). I hope that clarifies!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Understanding Credit-Linked Notes

- Thread starter Hend Abuenein

- Start date

FrmL2_Aspirant

Member

Hi @bpdulog Yes, the CLN buyer (aka, CLN investor, protection seller) is analogous to the CDS seller: without a default, this investor/buyer receives agreed-upon coupons and return of the principal at maturity. (this is the key difference between CDS protection seller, who has not funded the CDS and therefore only collects "coupon" premiums versus the CLN buyer who has funded the securities and so receives coupons but also expects to get their principal/par back at maturity). But, as you say, they have sold credit protection, so if there is a default, they have their coupons (interest) and principal at risk. However, just like the CDS protection seller, if a credit event happnes, pays only (if cash settlement) notional minus recovery, the CLN buyer is entitled to the recovered principal (or, analogously, if the CDS is physically settled, the protection seller pays the entire notional but they receive any recovered bond). In both cases, the actual loss is net of recovery and the protection seller is not protecting the entire principal (in the case of the CLN) or the entire notional (in the case of the CDS) but rather the actually lost portion (i.e., net of recovery). I hope that clarifies!

Hi @David Harper CFA FRM , so, in case CLN buyer had invested 15 mio out of the total 105 mio, then

1. If 90 mio is recovered, CLN buyer gets nothing

2. If 100 mio is recovered, he will get 10 mio as recovery

Also, in case of no default, he will earn high yield on the total 105 mio, did I get it right?

Hi Hend,

Sorry I'm late to this thread. I think Leli's summary is excellent.

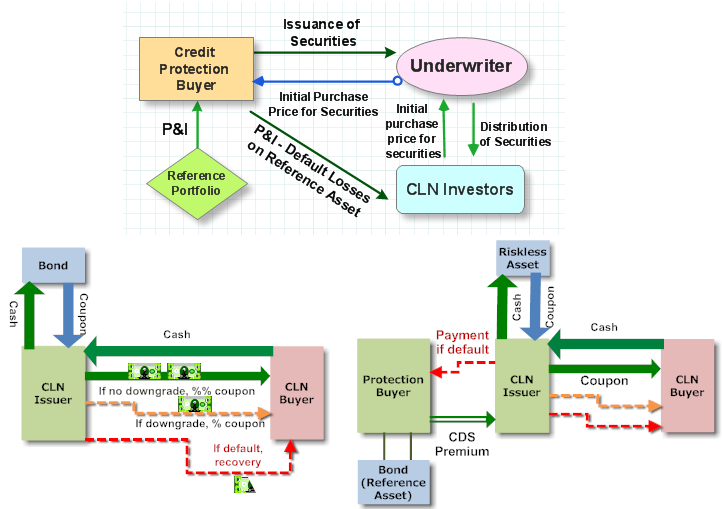

In case it helps, below is diagram from our notes/video, which is just stolen from assigned Culp (although I attached, below the Culp image, the CLN diagrams we used prior to Culp, based on Meissner). Key points:

- CLN ~= funded CDS; i.e., in both cases, "investors" sell credit protection on a reference. But CDS is unfunded (earning yield purely for default/deterioration risk), whereas CLN is funded with investor principal (earning yield for default/deterioration risk + financing/use of funds).

- CLN "is economically equivalent from the issuer's perspective to issuing a normal note plus buying credit protection from the bond investor through a CDS" (Culp)

- CLN issuer (aka, protection buyer) = short bond + long CDS; and

CLN investor (aka, CLN buyer) = long bond + short CDS.- Risk transfer (key difference): unfunded CDS buyer is exposed to counterparty risk and associated wrong-way risk (adverse correlation between reference and counterparty).

However, the CLN is FUNDED so the issuer/protection buyer has virtually no counterparty risk. Instead, the CLN buyer has the counterparty risk! (i.e., like any bond buyer, issuer can default on P&I).

So, FUNDING is the big difference: the counterparty risk switches from protection buyer to protection seller (CLN investor/CLN buyer) who ought to be compensated with additional premium (versus otherwise equivalent CDS) due to fact that funded principal at risk.- Terminology-wise, you can see it looks to be: protection buyer/CLN issuer versus CLN buyer/CLN investor.

As i *think* the CLN would be a security, as opposed to CDS derivative, it makes sense to me that CLN investor is a "buyer" not merely a "protection seller" because the CLN investor is purchasing issued securities. (I *think* we have a security/derivative distinction due to the funding, but not 100% sure about that).

So another question I have is this - the motivation of the CLN issuer is to offload risk because they fear the reference asset will default, yes? So , in these transactions are they (CLN issuers) actually losing money because they are paying the higher spread in exchange for protection from a credit event?

@FrmL2_Aspirant Yes, I agree with both of your scenarios. This sounds like Crouhy's scenario (e.g., https://forum.bionicturtle.com/threads/credit-linked-note.365/#post-49312) and you are correct. The investors pay (fund) $15 mm in exchange for leveraged yield (after all, their $15 mm is invested in Treasury notes at 6.5%, so their risk-free alternative here is to simply collect the unleveraged 6.5% on their $15 mm). Instead of unleverage 6.5%, they collect leveraged 17% by virtue of residual claim on the interest-bearing assets. They are in an equity or first-to-default position: they absorb all of the losses until they are wiped out. So if 90 million is recovered, they get nothing; if 100 million is recovered, they absorb all of the $5 million losses but keep the remaining $10.0.

@bpdulog Yes, the CLN issuers motivation is credit risk transfer (i.e., credit deterioration and default) and, at the price (just as insurance premiums are costly or purchasing a CDS is costly), the CLN issuer is "giving up" some yield. Although in Crouhy's 15/105 scenario, the CLN funds only a portion of the notional, such that the bank is using the trust to collect the excess yield on the super-ordinated ("upper") 90 but transferring the credit risk on the subordinated ("junior" or "equity") $15. Because the bank absorbs losses above 15. So it's not offloading all of the risk, just the first-loss position. In a vanilla CLN, maybe the issuer owns the bond, and issues a CLN on the entire notional. Then, it's like you say, they are basically giving up the excess yield and transferring the credit risk and "taking a negative view" on the bond akin to a hedge (although they can end up doing better if the bond deteriorates but does not default). I hope that's helpful!

@bpdulog Yes, the CLN issuers motivation is credit risk transfer (i.e., credit deterioration and default) and, at the price (just as insurance premiums are costly or purchasing a CDS is costly), the CLN issuer is "giving up" some yield. Although in Crouhy's 15/105 scenario, the CLN funds only a portion of the notional, such that the bank is using the trust to collect the excess yield on the super-ordinated ("upper") 90 but transferring the credit risk on the subordinated ("junior" or "equity") $15. Because the bank absorbs losses above 15. So it's not offloading all of the risk, just the first-loss position. In a vanilla CLN, maybe the issuer owns the bond, and issues a CLN on the entire notional. Then, it's like you say, they are basically giving up the excess yield and transferring the credit risk and "taking a negative view" on the bond akin to a hedge (although they can end up doing better if the bond deteriorates but does not default). I hope that's helpful!

FrmL2_Aspirant

Member

Clear... as always, thanks David.@FrmL2_Aspirant Yes, I agree with both of your scenarios. This sounds like Crouhy's scenario (e.g., https://forum.bionicturtle.com/threads/credit-linked-note.365/#post-49312) and you are correct. The investors pay (fund) $15 mm in exchange for leveraged yield (after all, their $15 mm is invested in Treasury notes at 6.5%, so their risk-free alternative here is to simply collect the unleveraged 6.5% on their $15 mm). Instead of unleverage 6.5%, they collect leveraged 17% by virtue of residual claim on the interest-bearing assets. They are in an equity or first-to-default position: they absorb all of the losses until they are wiped out. So if 90 million is recovered, they get nothing; if 100 million is recovered, they absorb all of the $5 million losses but keep the remaining $10.0.

@bpdulog Yes, the CLN issuers motivation is credit risk transfer (i.e., credit deterioration and default) and, at the price of (just as insurance premiums are costly or purchasing a CDS is costly) "giving up" or forgoing some yield. Although in Crouhy's 15/105 scenario, the CLN funds only a portion of the notional, such that the bank is using the trust to collect the excess yield on the super-ordinated ("upper") 90 but transferring the credit risk on the subordinated ("junior" or "equity") $15. Because the bank absorbs losses above 15. So it's not offloading all of the risk, just the first-loss position. In a vanilla CLN, maybe the issuer owns the bond, and issues a CLN on the entire notional. Then, it's like you say, they are basically giving up the excess yield and transferring the credit risk and "taking a negative view" on the bond akin to a hedge (although they can end up doing better if the bond deteriorates but does not default). I hope that's helpful!

Last edited by a moderator:

Mohammed.qureshi

New Member

Hi David - how would you value a CLN on a MTM basis. Credit risk (CDS - spread) to the protection buyer and then to the reference portfolio?

Hi David,

I understand the structure of CDS and CLN but this thing about still bearing credit risk is confusing me. Could you explain me this?

GARP says, it is the protection buyer (issuer of the CLN) who is retaining the risk of default of the asset portfolio above and beyond the collateral posted by the investor in the CLN, in this case, I understand this, but, what is the point in buying credit protection if you still bear the risk of default on the asset portfolio? (maybe it is benefitial to cover just the first part of the loss in case of default?)

But also, you said “the CLN is FUNDED so the issuer/protection buyer has virtually no counterparty risk”, isn’t this contradictory to what GARP says? Am I missing something? What do you mean it is “funded” (you mean it the part covered by the collateral is funded)?

Also, in the same way, why do you say “unfunded CDS buyer is exposed to counterparty risk”? so why do we buy protection/CDS if we still bear counterparty risk?

Thanks in advance!

I understand the structure of CDS and CLN but this thing about still bearing credit risk is confusing me. Could you explain me this?

GARP says, it is the protection buyer (issuer of the CLN) who is retaining the risk of default of the asset portfolio above and beyond the collateral posted by the investor in the CLN, in this case, I understand this, but, what is the point in buying credit protection if you still bear the risk of default on the asset portfolio? (maybe it is benefitial to cover just the first part of the loss in case of default?)

But also, you said “the CLN is FUNDED so the issuer/protection buyer has virtually no counterparty risk”, isn’t this contradictory to what GARP says? Am I missing something? What do you mean it is “funded” (you mean it the part covered by the collateral is funded)?

Also, in the same way, why do you say “unfunded CDS buyer is exposed to counterparty risk”? so why do we buy protection/CDS if we still bear counterparty risk?

Thanks in advance!

Hi @patriciarodriguez I haven't reviewed the thread above (moving quickly) but your notes appear coherent to me because, super stylistically (GARP's example of course is Crouhy's non-trivial example; e.g,. https://forum.bionicturtle.com/threads/credit-linked-note.365/post-49312):

- In either the CDS/CLN there is a reference entity (company/portfolio/etc). This is the default risk that is traded, the derivative payoff is triggered by a credit event at the reference.

- In either the CDS/CLN, one counterparty buys protection from another counterparty. Notice that is three (3) entities: two counterparties who have traded the default risk of a third entity

- The CDS is unfunded because the protection seller is merely contractually promising to make the payoff to the protection buyer if the reference defaults. The CLN is funded because the protection seller posted the funds in advance (via securities); in the CLN, the protection buyer does not need to "worry" about the counterparty risk of being paid if the reference defaults. In this way, in either case, default risk is transferred, but the CDS implies counterparty risk to the protection buyer that the CLN does not. I hope that reconciles. I am being very symbolic here with the three entities. Like the Crouhy example (GARP T6.Ch 18) there are many varieties some complex. Thanks,

Many Thanks David!!Hi @patriciarodriguez I haven't reviewed the thread above (moving quickly) but your notes appear coherent to me because, super stylistically (GARP's example of course is Crouhy's non-trivial example; e.g,. https://forum.bionicturtle.com/threads/credit-linked-note.365/post-49312):

- In either the CDS/CLN there is a reference entity (company/portfolio/etc). This is the default risk that is traded, the derivative payoff is triggered by a credit event at the reference.

- In either the CDS/CLN, one counterparty buys protection from another counterparty. Notice that is three (3) entities: two counterparties who have traded the default risk of a third entity

- The CDS is unfunded because the protection seller is merely contractually promising to make the payoff to the protection buyer if the reference defaults. The CLN is funded because the protection seller posted the funds in advance (via securities); in the CLN, the protection buyer does not need to "worry" about the counterparty risk of being paid if the reference defaults. In this way, in either case, default risk is transferred, but the CDS implies counterparty risk to the protection buyer that the CLN does not. I hope that reconciles. I am being very symbolic here with the three entities. Like the Crouhy example (GARP T6.Ch 18) there are many varieties some complex. Thanks,

All clear now

In this example, can someone help me understand how the extra 9% return to the investor is sourced from? Ideally, investor should receive return in proportion to her investment 150bps*(15/105) = 0.214%, but is receiving .214% * 7 (105/15) = 1.5% due to the benefit of leverage making the total return to 8%. Shouldn't this be the case? If the return is 150 bps*7, the extra 9% must have been sourced from some where. I think 9% return from the 100 bps (retained by the bank) due re-investment is unrealistic.

Attachments

Understand this now! Apologies for the trouble!In this example, can someone help me understand how the extra 9% return to the investor is sourced from? Ideally, investor should receive return in proportion to her investment 150bps*(15/105) = 0.214%, but is receiving .214% * 7 (105/15) = 1.5% due to the benefit of leverage making the total return to 8%. Shouldn't this be the case? If the return is 150 bps*7, the extra 9% must have been sourced from some where. I think 9% return from the 100 bps (retained by the bank) due re-investment is unrealistic.

Similar threads

- Replies

- 32

- Views

- 9K

- Replies

- 0

- Views

- 3K

- Replies

- 0

- Views

- 3K