Kavita.bhangdia

Active Member

Hi David,

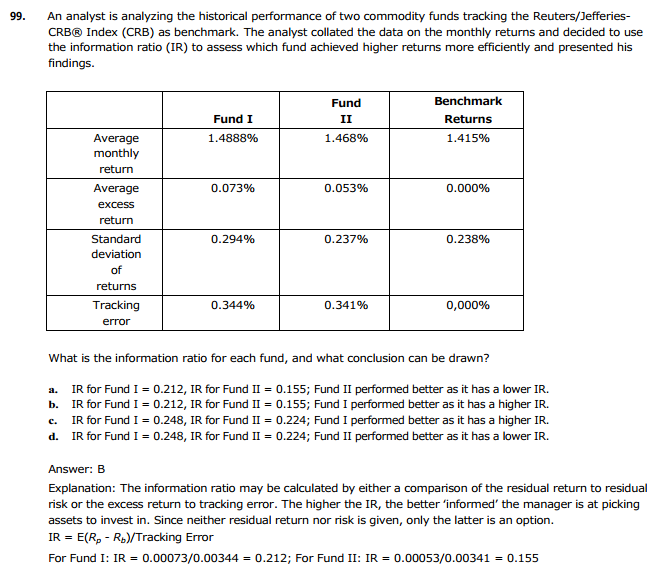

Information ratio = Alpha / volatility of tracking error.

Jorion defines tracking error as active return -benchmark return

But that is not how bodie defines it.

Am I right??

Kavita

Information ratio = Alpha / volatility of tracking error.

Jorion defines tracking error as active return -benchmark return

But that is not how bodie defines it.

Am I right??

Kavita