emilioalzamora1

Well-Known Member

Hi All,

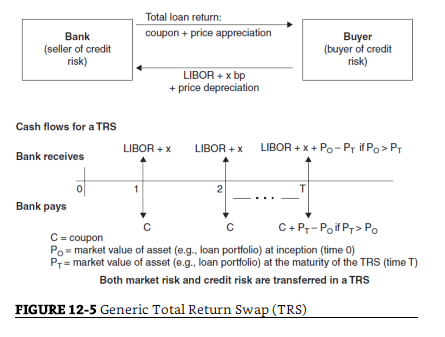

in Crouhy's book it says the following about a Total Return Swap:

the purchaser of the TRS makes periodic floating payments, often tied to LIBOR. The party selling the risk makes periodic payments to the purchaser, and these are tied to the total return of some underlying asset.

In Crouhy the Bank obviously acts as the protection SELLER and the investor acts as the protection BUYER.

This cannot work in my opinion! Why should the bank act as protection seller?

In David's example (125.3) it is the opposite. David says

'where the protection seller pays LIBOR + spread'

However, according to Crouhy's figure 12-7 it should be: the bank acting as protection seller, receives LIBOR.

Can someone please clarify this?

Thank you!

in Crouhy's book it says the following about a Total Return Swap:

the purchaser of the TRS makes periodic floating payments, often tied to LIBOR. The party selling the risk makes periodic payments to the purchaser, and these are tied to the total return of some underlying asset.

In Crouhy the Bank obviously acts as the protection SELLER and the investor acts as the protection BUYER.

This cannot work in my opinion! Why should the bank act as protection seller?

In David's example (125.3) it is the opposite. David says

'where the protection seller pays LIBOR + spread'

However, according to Crouhy's figure 12-7 it should be: the bank acting as protection seller, receives LIBOR.

Can someone please clarify this?

Thank you!