ankitagarwal

New Member

Thank you for the reply David.

I had one more question. How should I study 'Foundation of risk management'.

I started this now after completing 2,3,4 books, but this involves lot of theory which is quite difficult to remember.

What type of questions are expected out of this book 1.

Thab

Thanks

I had one more question. How should I study 'Foundation of risk management'.

I started this now after completing 2,3,4 books, but this involves lot of theory which is quite difficult to remember.

What type of questions are expected out of this book 1.

Thab

Thanks

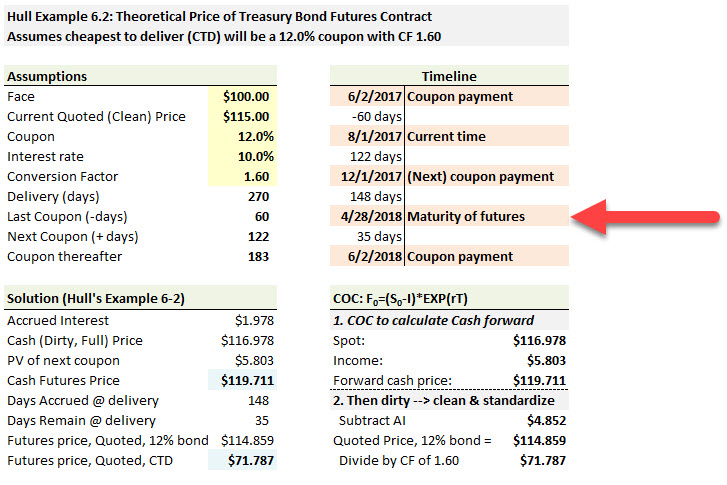

If you search for theoretical price of treasury bond, it will bring up quite a few threads that discuss this. If you have further questions after going through the original posts and comments, you can post your question directly in those threads so the concepts are being discussed in one place and not in multiple threads. These are just a few threads that come up in search:

If you search for theoretical price of treasury bond, it will bring up quite a few threads that discuss this. If you have further questions after going through the original posts and comments, you can post your question directly in those threads so the concepts are being discussed in one place and not in multiple threads. These are just a few threads that come up in search: