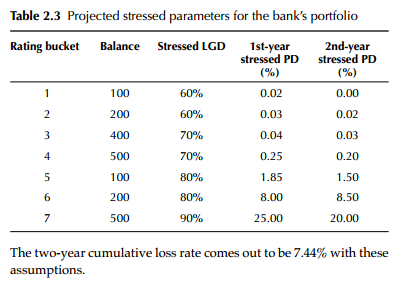

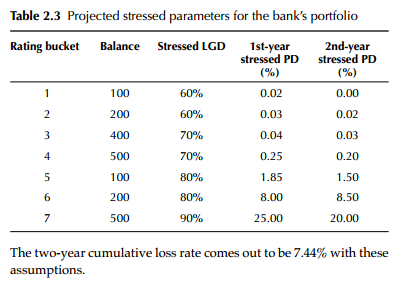

Hi David, in your note (chapter 2) for (Siddique and Hasan stress testing pg 13), the value for two year cumulative rate is 7.44%. However, the GARP official text (pg 303) gave a value of 10.61%. How do we get the value for two year cumulative loss rate and which is the correct value?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stress testing and other risk management tools

- Thread starter lowhueyyi

- Start date

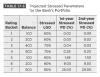

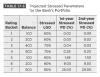

Hi @lowhueyyi We did not run the calculations on that exhibit but rather just used (copied) the source text, as below:

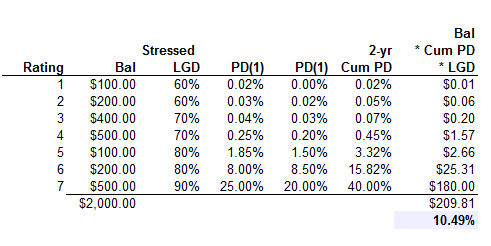

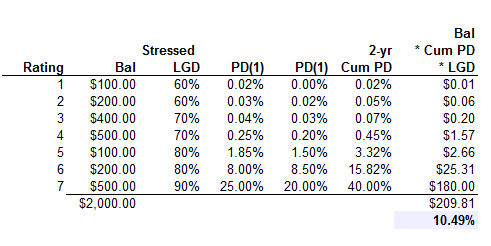

... but the text edition must have been updated (it would not be like GARP to run calculations, not even ) because quickly I can see that 10.x% does appears to be correct. See below. All i did was calculate the 2-year cum pd = 1 - (1-PD1)*(1-PD2), then final column is the stressed loss = Bal * 2-yr cum PD * LGD. Then 209.81/2000 = 10.49%; I did this in ~3 min so i could have a typo .,..

Can I trouble you for a screen shot? I think the source must have been updated etc

cc: @Nicole Seaman

Thanks,

... but the text edition must have been updated (it would not be like GARP to run calculations, not even ) because quickly I can see that 10.x% does appears to be correct. See below. All i did was calculate the 2-year cum pd = 1 - (1-PD1)*(1-PD2), then final column is the stressed loss = Bal * 2-yr cum PD * LGD. Then 209.81/2000 = 10.49%; I did this in ~3 min so i could have a typo .,..

Can I trouble you for a screen shot? I think the source must have been updated etc

cc: @Nicole Seaman

Thanks,

Hi @David Harper CFA FRM , below are the images from the 2019 edition GARP text.

Btw do we have to know how to calculate cumulative loss rate in part 1? I am not sure where this formula is covered in part 1.

Btw do we have to know how to calculate cumulative loss rate in part 1? I am not sure where this formula is covered in part 1.

Last edited:

Hi @lowhueyyi Thank you, I did not realize it had been thusly updated. Re: "do we have to know how to calculate cumulative loss rate in part 1? I am not sure where this formula is covered in part 1" ... this is typical of the FRM. This exact formula is not exactly covered in Part 1; it is certainly not assigned in this reading which has no quantitative action verbs (calculate, compute). However, it's almost fair game in my opinion in the total context of Part 1. Omitting the "stressed," notice how the calculation for each balance is:

Now that you identified this, I think we (our note) is wrong to omit the calculation, is to suggest I think a P1 should know this, even if it's strictly borderline, because that's how GARP runs the FRM, their borders on the questions are fuzzy ... I hope that's helpful

THANK YOU for alerting me to this discrepancy!

- Loan * cumulative 2-year PD * LGD

- which is then summed over the buckets; i.e., as a portfolio

Now that you identified this, I think we (our note) is wrong to omit the calculation, is to suggest I think a P1 should know this, even if it's strictly borderline, because that's how GARP runs the FRM, their borders on the questions are fuzzy ... I hope that's helpful

THANK YOU for alerting me to this discrepancy!

Similar threads

- Replies

- 0

- Views

- 205

- Replies

- 0

- Views

- 209

- Replies

- 0

- Views

- 158

- Replies

- 0

- Views

- 54