Kavita.bhangdia

Active Member

Hello everyone,

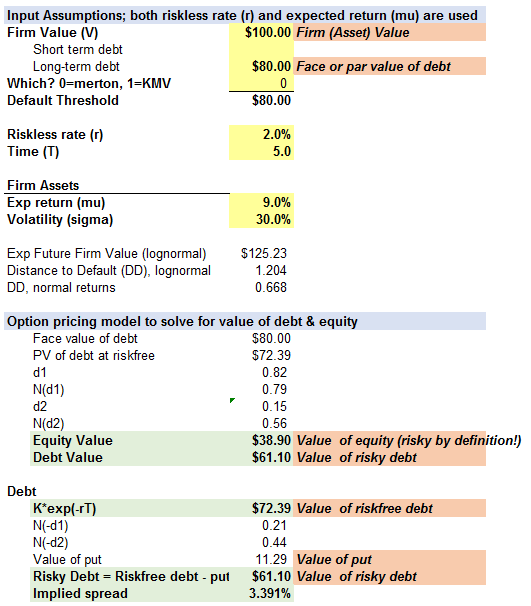

I had thought that I had sorted it out, but today I was reading the Merton model again but am completely lost with the difference between risky debt and risk free debt. Please can someone redefine it

Risky debt = riskfree debt-put option..

Please explain risky and risk free debt.

Thanks

Kavita

I had thought that I had sorted it out, but today I was reading the Merton model again but am completely lost with the difference between risky debt and risk free debt. Please can someone redefine it

Risky debt = riskfree debt-put option..

Please explain risky and risk free debt.

Thanks

Kavita