gargi.adhikari

Active Member

In reference to R8.P1.T1.Amenc_Ch4_RISK_MGMT_Topic:INFORMATION_RATIO_RESIDUAL vs_ACTIVE:

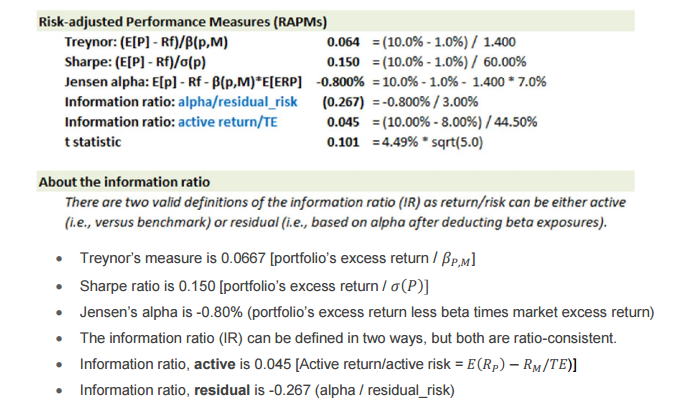

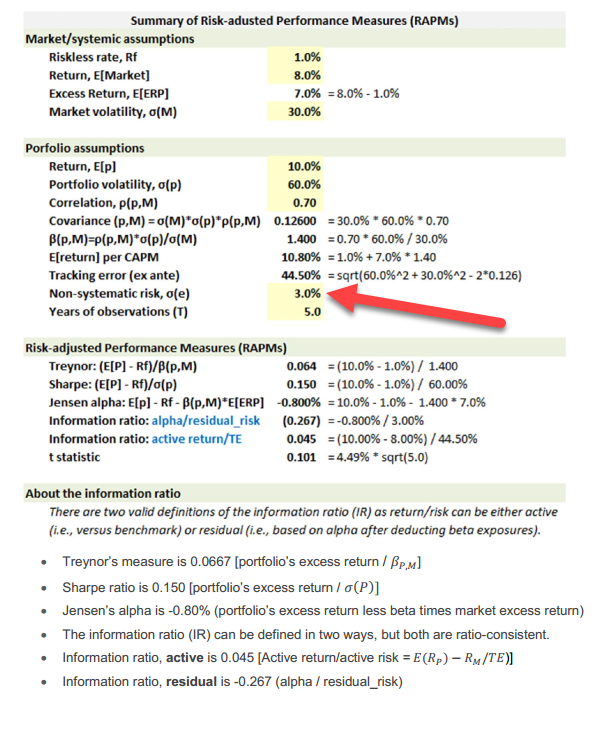

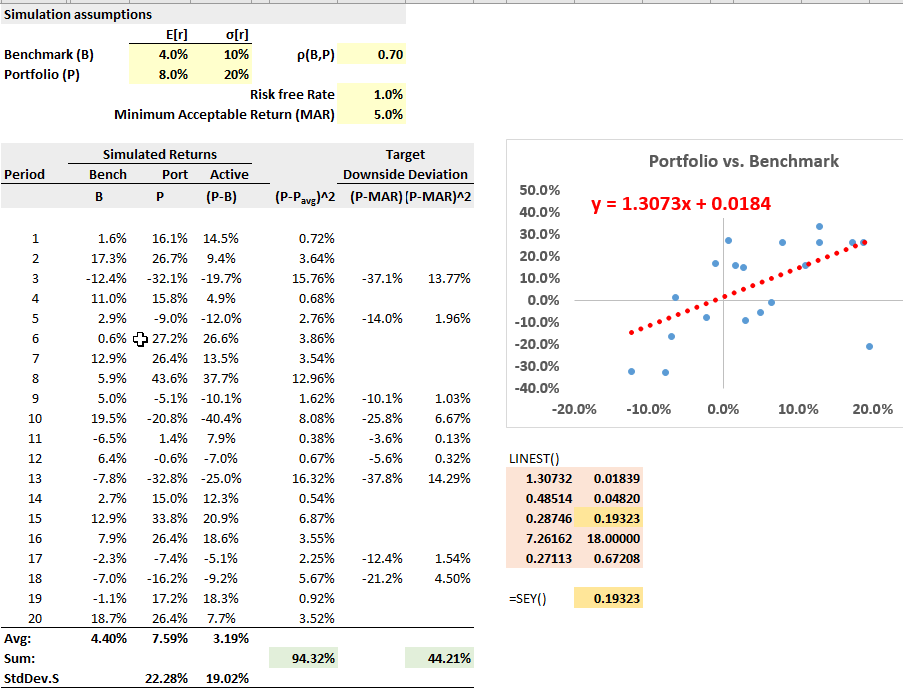

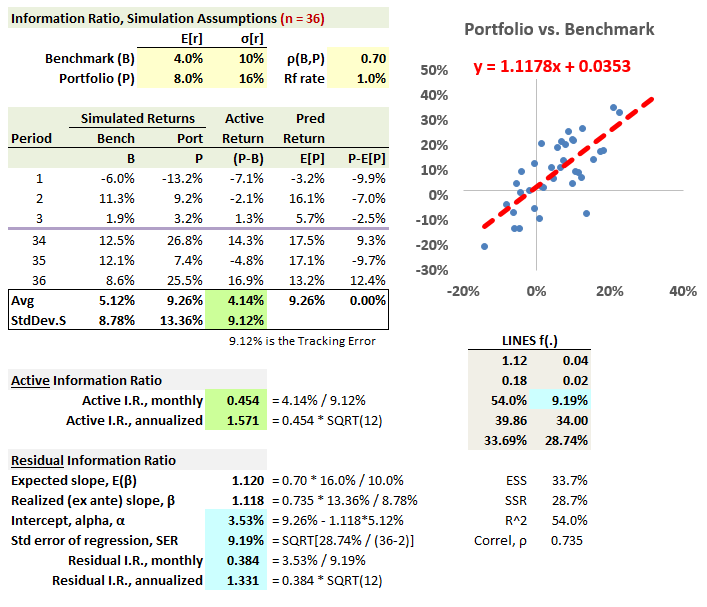

The Residual Risk is the idiosyncratic Risk = any risk which is not the Systemic Risk

and that Total Risk = Systemic Risk + Residual Risk.

Having said that though, I am trying to get the standardized formula to use for calculating Info-Ratio when we use:-

The study materials indicate just one formula for the Info-Ratio IR = E(Rp) - E(Rb) / Std-Dev( Rp - Rb)

Want to understand is whether the above stated formula is a) Residual Return/ Residual Risk or b) Active Return/ Active Risk... :-( ...?

Thanks much for all the help and insight on this topic ..

The Residual Risk is the idiosyncratic Risk = any risk which is not the Systemic Risk

and that Total Risk = Systemic Risk + Residual Risk.

Having said that though, I am trying to get the standardized formula to use for calculating Info-Ratio when we use:-

a) Residual Return/ Residual Risk vs.

b) Active Return/ Active Risk

b) Active Return/ Active Risk

The study materials indicate just one formula for the Info-Ratio IR = E(Rp) - E(Rb) / Std-Dev( Rp - Rb)

Want to understand is whether the above stated formula is a) Residual Return/ Residual Risk or b) Active Return/ Active Risk... :-( ...?

Thanks much for all the help and insight on this topic ..

Last edited: