You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

R19.P1.T3.FIN_PRODS_HULL_Ch26_ExoticOptions_Topic:Asian-Options

- Thread starter gargi.adhikari

- Start date

Hi,

It should be average stock price only,here the Average strike is calculated based on the average stock price which is the variable that is under observation. Its Average Strike option where the Average denotes the average stock price and the Strike means that the Strike price is calculated based on the average stock price .

thanks

It should be average stock price only,here the Average strike is calculated based on the average stock price which is the variable that is under observation. Its Average Strike option where the Average denotes the average stock price and the Strike means that the Strike price is calculated based on the average stock price .

thanks

gargi.adhikari

Active Member

Thanks so much @ShaktiRathore for correcting my thought process on this ...I see what you're saying...Avg of Strike Prices kinda does not make sense any way cause it is supposed to be a predetermined threshold level/value...So as a follow up question on this...for Avg Strike Asian Options, do we use the Avg -Stock Price or the

Avg-Excercise Price at each point of time.Asking cause if we use the Avg Stock Price, wouldn't that be the same as the Avg-Stock-Asian Option..? except that we'll just be using the Avg Stock price in place of the Strike Price in the payoff formula.... ?

except that we'll just be using the Avg Stock price in place of the Strike Price in the payoff formula.... ?

Avg-Excercise Price at each point of time.Asking cause if we use the Avg Stock Price, wouldn't that be the same as the Avg-Stock-Asian Option..?

except that we'll just be using the Avg Stock price in place of the Strike Price in the payoff formula.... ?

except that we'll just be using the Avg Stock price in place of the Strike Price in the payoff formula.... ?

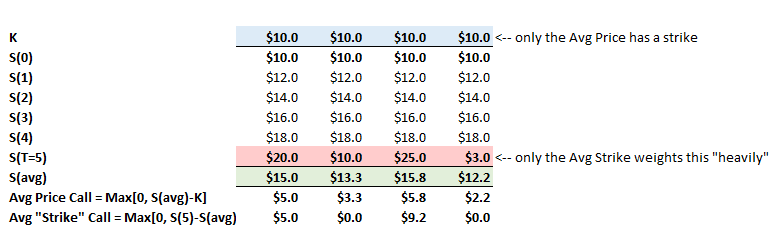

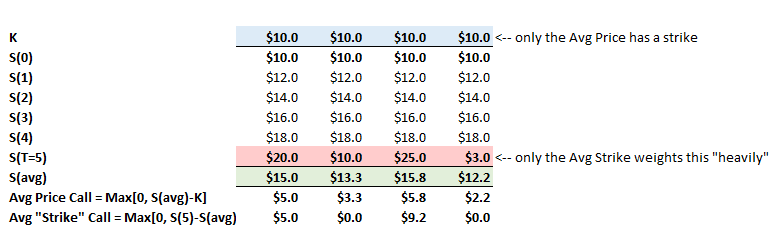

Hi @gargi.adhikari It's a good point, they seem so similar. For myself, I like to experiment. I just did this (https://www.dropbox.com/s/higs007v1qbawta/0308-asian.xlsx?dl=0 ), see screenshot below. It just illustrates a five step stock price, from S(0) to S(T = 5) at maturity (in red) when the exercise occurs. Also, at the beginning (in blue) is a strike price (which i just set equal to the same initial stock price of $10.00), and second-from-bottom-row is the average of the stock price series (in green). Then I just rapidly generated four scenarios which are identical except for the final price. So obviously there can be many more creative scenarios, mine are pretty dull. But the point is to recognize that while both of the asian options use the average price, only the "average price" asian uses an actual fixed strike price (the average strike asian does not accept a fixed strike price at all, it "generates" its own path-dependent strike price), and only the "average strike" asian directly uses the final price (the average price uses the final price indirectly to inform the average obviously). I am sure other conclusions can be found with different scenarios but notice, for one thing, how the "average strike" is (of course) highly sensitive to the final price. While the "average price" retains some payoff even under the catastrophic final scenario of a drop to $3.0 at the end. I just wanted to show you there is a difference, although this is an extremely narrow (un-creative) set with which to do so. I hope that's helpful!

Similar threads

- Replies

- 0

- Views

- 280

- Replies

- 0

- Views

- 228

- Sticky

- Replies

- 3

- Views

- 1K

- Replies

- 0

- Views

- 188