mhkpayel20

New Member

Hi,

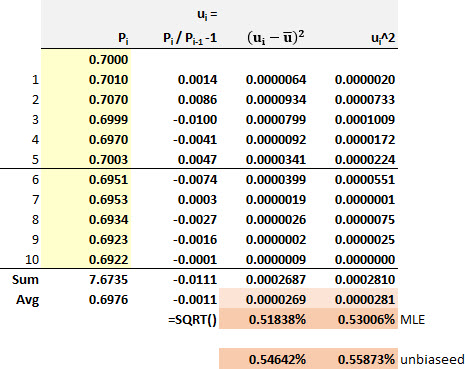

Suppose that observations on an exchange rate at the end of the past 11 days have been 0.7000, 0.7010, 0.7070, 0.6999, 0.6970, 0.7003, 0.6951, 0.6953, 0.6934, 0.6923, and 0.6922. Estimate the daily volatility using both approaches in Section 10.5

1. what is the standard formula of SD here? is it sqrt{[Xi-avg(Xi)]^2/n}

2. Can anyone please explain this one elaborately?

Suppose that observations on an exchange rate at the end of the past 11 days have been 0.7000, 0.7010, 0.7070, 0.6999, 0.6970, 0.7003, 0.6951, 0.6953, 0.6934, 0.6923, and 0.6922. Estimate the daily volatility using both approaches in Section 10.5

1. what is the standard formula of SD here? is it sqrt{[Xi-avg(Xi)]^2/n}

2. Can anyone please explain this one elaborately?