aditydev1997

New Member

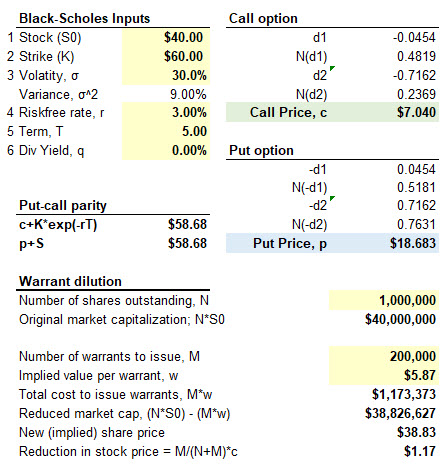

Since the company is the writer of the call option on stocks, the company gets paid (the warrant buyer will pay the price of warrant = w as premium) and hence I expected the market cap to increase by Mw (M = number of warrants). But instead, the chapter says the market cap is reduced by Mw. Is there something I am missing?