You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Perfect Negative Correlation

- Thread starter y2alk

- Start date

That is correct - perfect negative correlation would correspond to 2 line segments!

Thanks Brian!

Hi,

•Standard deviation of two asset A and B portfolio,

σp=√wA²*σA²+wB²*σB²+2*Cov(A,B)*wA*wB=√wA²*σA²+wB²*σB²+2*ρ(A,B)*wA*wB*σA*σB

for perfect negative correlation,ρ(A,B)=-1

σp=√wA²*σA²+wB²*σB²+2*(-1)*wA*wB*σA*σB

σp=√wA²*σA²+wB²*σB²-2*wA*wB*σA*σB

σp=√(wA*σA-wB*σB)²

σp=wA*σA-wB*σB( case1) or σp= wB*σB-wA*σA (case 2)

we first take the case σp=wA*σA-wB*σB

case 1) σp+wB*σB=wA*σA-wB*σB+wB*σB

σp+wB*σB=wA*σA

σp+(1-wA)*σB=wA*σA (wA+wB=1 =>wB=1-wA)

σp+σB-wA*σB=wA*σA

σp+σB-wA*σB+wA*σB=wA*σA+wA*σB

σp+σB= wA*σA+wA*σB=wA(σA+σB)

(σp+σB)/(σA+σB)=wA(σA+σB)/(σA+σB)

(σp+σB)/(σA+σB)=wA

wA=(σp+σB)/(σA+σB) ...1)

•Expected return of two asset portfolio A and B

E(Rp)=wA*E(RA)+wB*E(RB) ...2)

E(Rp)-wB*E(RB)=wA*E(RA)+wB*E(RB)-wB*E(RB)

E(Rp)-wB*E(RB)=wA*E(RA)

E(Rp)-(1-wA)*E(RB)=wA*E(RA)

E(Rp)-E(RB)+wA*E(RB)=wA*E(RA)

E(Rp)-E(RB)+wA*E(RB)-wA*E(RB)=wA*E(RA)-wA*E(RB)

E(Rp)-E(RB)=wA*E(RA)-wA*E(RB)=wA(E(RA)-E(RB))

E(Rp)-E(RB)=wA(E(RA)-E(RB))

(E(Rp)-E(RB))/(E(RA)-E(RB))=wA(E(RA)-E(RB))/(E(RA)-E(RB))

(E(Rp)-E(RB))/(E(RA)-E(RB))=wA

wA=(E(Rp)-E(RB))/(E(RA)-E(RB)) ...2)

equating equations 1 and 2,

wA=(σp+σB)/(σA+σB)=(E(Rp)-E(RB))/(E(RA)-E(RB))

(E(Rp)-E(RB))=((E(RA)-E(RB)) /(σA+σB))*(σp+σB)

E(Rp)=E(RB)+[(E(RA)-E(RB)) /(σA+σB)]*(σp+σB) is the equation of the case 1 straight line

Let m=slope=[(E(RA)-E(RB)) /(σA+σB)]

Thus equation becomes,

E(Rp)=E(RB)+m*(σp+σB)=m*(σp+σB)+E(RB)

This line is upward sloping as is evident from the slope m=[(E(RA)-E(RB)) /(σA+σB)]>0 (we assume for both cases that E(RA)>E(RB))

case 2)

σp= wB*σB-wA*σA

σp+wA*σA= wB*σB-wA*σA+wA*σA

σp+wA*σA=wB*σB

σp+wA*σA-wB*σB=wB*σB-wB*σB

σp+wA*σA-wB*σB=0

σp+wA*σA-wB*σB-wA*σA=0-wA*σA

σp-wB*σB=-wA*σA

σp-(1-wA)*σB=-wA*σA (wA+wB=1 =>wB=1-wA)

σp-σB+wA*σB=-wA*σA

σp-σB+wA*σB-wA*σB=-wA*σA-wA*σB

σp-σB=-wA*σA-wA*σB

σp-σB=-wA(σA+σB)

(σp-σB)/(σA+σB)=-wA(σA+σB)/(σA+σB)

-(σp-σB)/(σA+σB)=wA

wA=-(σp-σB)/(σA+σB) ...1)

•Expected return of two asset portfolio A and B

Also we know from case 1 equation 2,

wA=(E(Rp)-E(RB))/(E(RA)-E(RB)) ...2)

equating equations 1 and 2,

wA=-(σp-σB)/(σA+σB)=(E(Rp)-E(RB))/(E(RA)-E(RB))

(E(Rp)-E(RB))=-((E(RA)-E(RB)) /(σA+σB))*(σp-σB)

E(Rp)=E(RB)-((E(RA)-E(RB)) /(σA+σB))*(σp-σB) is the equation of the case 2 straight line

Let m=slope=-[(E(RA)-E(RB)) /(σA+σB)]

Thus equation becomes,

E(Rp)=E(RB)+m*(σp-σB)=m*(σp-σB)+E(RB) ( we see from relation case 2 ,σp= wB*σB-wA*σA such that σp>=σB)

This line is downward sloping as is evident from the negative slope m=-[(E(RA)-E(RB)) /(σA+σB)]<0 (we assume for both cases that E(RA)>E(RB))

Thus there are two straight lines

1) E(Rp)=m*(σp+σB)+E(RB) where m=[(E(RA)-E(RB)) /(σA+σB)] =positive slope(upward sloping) and

2) E(Rp)=m*(σp-σB)+E(RB) where m=-[(E(RA)-E(RB)) /(σA+σB)]=negative slope (downward sloping)

If we had assumed that E(RA)<E(RB) in both cases then

we would have the following pair of straight lines ,

1) E(Rp)=m*(σp+σB)+E(RB) where m=[(E(RA)-E(RB)) /(σA+σB)]=negative slope (downward sloping) and

2) E(Rp)=m*(σp-σB)+E(RB) where m=-[(E(RA)-E(RB)) /(σA+σB)]=positive slope (upward sloping)

Thus its proved that for perfect negative correlation there are two pair of straight lines one with a negative slope (downward sloping) and other with a positive slope (upward sloping) (as can be seen from the graph also such that there are two straight lines one downward sloping and the other upward sloping)depending on the relation whether E(RA)>E(RB) or E(RA)<E(RB).

Thanks

•Standard deviation of two asset A and B portfolio,

σp=√wA²*σA²+wB²*σB²+2*Cov(A,B)*wA*wB=√wA²*σA²+wB²*σB²+2*ρ(A,B)*wA*wB*σA*σB

for perfect negative correlation,ρ(A,B)=-1

σp=√wA²*σA²+wB²*σB²+2*(-1)*wA*wB*σA*σB

σp=√wA²*σA²+wB²*σB²-2*wA*wB*σA*σB

σp=√(wA*σA-wB*σB)²

σp=wA*σA-wB*σB( case1) or σp= wB*σB-wA*σA (case 2)

we first take the case σp=wA*σA-wB*σB

case 1) σp+wB*σB=wA*σA-wB*σB+wB*σB

σp+wB*σB=wA*σA

σp+(1-wA)*σB=wA*σA (wA+wB=1 =>wB=1-wA)

σp+σB-wA*σB=wA*σA

σp+σB-wA*σB+wA*σB=wA*σA+wA*σB

σp+σB= wA*σA+wA*σB=wA(σA+σB)

(σp+σB)/(σA+σB)=wA(σA+σB)/(σA+σB)

(σp+σB)/(σA+σB)=wA

wA=(σp+σB)/(σA+σB) ...1)

•Expected return of two asset portfolio A and B

E(Rp)=wA*E(RA)+wB*E(RB) ...2)

E(Rp)-wB*E(RB)=wA*E(RA)+wB*E(RB)-wB*E(RB)

E(Rp)-wB*E(RB)=wA*E(RA)

E(Rp)-(1-wA)*E(RB)=wA*E(RA)

E(Rp)-E(RB)+wA*E(RB)=wA*E(RA)

E(Rp)-E(RB)+wA*E(RB)-wA*E(RB)=wA*E(RA)-wA*E(RB)

E(Rp)-E(RB)=wA*E(RA)-wA*E(RB)=wA(E(RA)-E(RB))

E(Rp)-E(RB)=wA(E(RA)-E(RB))

(E(Rp)-E(RB))/(E(RA)-E(RB))=wA(E(RA)-E(RB))/(E(RA)-E(RB))

(E(Rp)-E(RB))/(E(RA)-E(RB))=wA

wA=(E(Rp)-E(RB))/(E(RA)-E(RB)) ...2)

equating equations 1 and 2,

wA=(σp+σB)/(σA+σB)=(E(Rp)-E(RB))/(E(RA)-E(RB))

(E(Rp)-E(RB))=((E(RA)-E(RB)) /(σA+σB))*(σp+σB)

E(Rp)=E(RB)+[(E(RA)-E(RB)) /(σA+σB)]*(σp+σB) is the equation of the case 1 straight line

Let m=slope=[(E(RA)-E(RB)) /(σA+σB)]

Thus equation becomes,

E(Rp)=E(RB)+m*(σp+σB)=m*(σp+σB)+E(RB)

This line is upward sloping as is evident from the slope m=[(E(RA)-E(RB)) /(σA+σB)]>0 (we assume for both cases that E(RA)>E(RB))

case 2)

σp= wB*σB-wA*σA

σp+wA*σA= wB*σB-wA*σA+wA*σA

σp+wA*σA=wB*σB

σp+wA*σA-wB*σB=wB*σB-wB*σB

σp+wA*σA-wB*σB=0

σp+wA*σA-wB*σB-wA*σA=0-wA*σA

σp-wB*σB=-wA*σA

σp-(1-wA)*σB=-wA*σA (wA+wB=1 =>wB=1-wA)

σp-σB+wA*σB=-wA*σA

σp-σB+wA*σB-wA*σB=-wA*σA-wA*σB

σp-σB=-wA*σA-wA*σB

σp-σB=-wA(σA+σB)

(σp-σB)/(σA+σB)=-wA(σA+σB)/(σA+σB)

-(σp-σB)/(σA+σB)=wA

wA=-(σp-σB)/(σA+σB) ...1)

•Expected return of two asset portfolio A and B

Also we know from case 1 equation 2,

wA=(E(Rp)-E(RB))/(E(RA)-E(RB)) ...2)

equating equations 1 and 2,

wA=-(σp-σB)/(σA+σB)=(E(Rp)-E(RB))/(E(RA)-E(RB))

(E(Rp)-E(RB))=-((E(RA)-E(RB)) /(σA+σB))*(σp-σB)

E(Rp)=E(RB)-((E(RA)-E(RB)) /(σA+σB))*(σp-σB) is the equation of the case 2 straight line

Let m=slope=-[(E(RA)-E(RB)) /(σA+σB)]

Thus equation becomes,

E(Rp)=E(RB)+m*(σp-σB)=m*(σp-σB)+E(RB) ( we see from relation case 2 ,σp= wB*σB-wA*σA such that σp>=σB)

This line is downward sloping as is evident from the negative slope m=-[(E(RA)-E(RB)) /(σA+σB)]<0 (we assume for both cases that E(RA)>E(RB))

Thus there are two straight lines

1) E(Rp)=m*(σp+σB)+E(RB) where m=[(E(RA)-E(RB)) /(σA+σB)] =positive slope(upward sloping) and

2) E(Rp)=m*(σp-σB)+E(RB) where m=-[(E(RA)-E(RB)) /(σA+σB)]=negative slope (downward sloping)

If we had assumed that E(RA)<E(RB) in both cases then

we would have the following pair of straight lines ,

1) E(Rp)=m*(σp+σB)+E(RB) where m=[(E(RA)-E(RB)) /(σA+σB)]=negative slope (downward sloping) and

2) E(Rp)=m*(σp-σB)+E(RB) where m=-[(E(RA)-E(RB)) /(σA+σB)]=positive slope (upward sloping)

Thus its proved that for perfect negative correlation there are two pair of straight lines one with a negative slope (downward sloping) and other with a positive slope (upward sloping) (as can be seen from the graph also such that there are two straight lines one downward sloping and the other upward sloping)depending on the relation whether E(RA)>E(RB) or E(RA)<E(RB).

Thanks

Last edited:

Hi all,

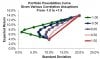

Had this doubt while going through the below graph,

View attachment 395

Why is there a bend in the case of perfect negative correlation?

When we substitute Ro = -1 in S.D formula we get two straight line equations so this bend shouldn't occur correct?

So the slight change in slope in the top line segment should not be there....

jairamjana

Member

Additing to @ShaktiRathore explanation..

The effect of diversification in a two asset portfolio or even three is that if the Correlation between assets decrease you can reduce the overall risk and also when the assets are negatively correlated it is actually possible to eliminate risk completely down to zero. If you notice that green bend stretches to the Y-axis indicating that at a 6 - 8% Expected Return the SD is nil... You can replicate a riskless asset.

Now the math part.. You know the SD formula for a portfolio I believe. Now if we have correlation as 1 .. The SD formula will look like (a+b)^2 = a^2 + b^2 + 2ab i.e SD(p) = w(A)*SD(A) + (1-w(A))*SD(B)

So under that formula SD cannot be negative but rather it is perfectly linear..

Now if we have a perfect negative correlation .. then SD Formula will look like (a-b)^2 = a^2+b^2-2ab SD(p) = w(A)*SD(A) - (1-w(A))*SD(B)

Now if we substitute SD(p) = 0 and test the equation

0 = w(A)*SD(A) - (1-w(A))*SD(B)

0 = w(A)*SD(A) - SD(B) + w(A)*SD(B)

SD(B) = w(A)*SD(A) + w(A)*SD(B)

SD(B)

w(A) = _________

SD(A) + SD(B)

At this weight of Asset A .. The Risk of portfolio is zero.

But remember this last equation can be achieved only if Correlation between two assets is perfectly negative.

The effect of diversification in a two asset portfolio or even three is that if the Correlation between assets decrease you can reduce the overall risk and also when the assets are negatively correlated it is actually possible to eliminate risk completely down to zero. If you notice that green bend stretches to the Y-axis indicating that at a 6 - 8% Expected Return the SD is nil... You can replicate a riskless asset.

Now the math part.. You know the SD formula for a portfolio I believe. Now if we have correlation as 1 .. The SD formula will look like (a+b)^2 = a^2 + b^2 + 2ab i.e SD(p) = w(A)*SD(A) + (1-w(A))*SD(B)

So under that formula SD cannot be negative but rather it is perfectly linear..

Now if we have a perfect negative correlation .. then SD Formula will look like (a-b)^2 = a^2+b^2-2ab SD(p) = w(A)*SD(A) - (1-w(A))*SD(B)

Now if we substitute SD(p) = 0 and test the equation

0 = w(A)*SD(A) - (1-w(A))*SD(B)

0 = w(A)*SD(A) - SD(B) + w(A)*SD(B)

SD(B) = w(A)*SD(A) + w(A)*SD(B)

SD(B)

w(A) = _________

SD(A) + SD(B)

At this weight of Asset A .. The Risk of portfolio is zero.

But remember this last equation can be achieved only if Correlation between two assets is perfectly negative.

Hi @nirmal019 That is really observant, nobody ever noticed this ... I realize that my chart has a flaw. It does plot the correct points; however, my XLS is only plotting 10% increments in asset weight (I also have selected "Smoothed line" which does not help because the perfect negative correlation is two straight lines; un-smoothing, however will still show a bump, incorrectly). So my plot above includes the following points, given assumptions for Asset A (exp return = 14% and StdDev = 20%) and Asset B (exp return = 4% and Std Dev = 10%), for the perfect negative correlation:

Thanks,

Thanks,

- Asset A 20% weight/80% Asset B: 6.0% exp return and 4.0% Std Dev

- Asset A 30% weight/70% Asset B: 7.0% exp return and 1.0% Std Dev

- Asset A 40% weight/60% Asset B: 8.0% exp return and 2.0% Std Dev

- Asset A 50% weight/50% Asset B: 9.0% exp return and 5.0% Std Dev

Thanks,

Thanks,Thanks David for clarifying.

Similar threads

- Replies

- 0

- Views

- 467

- Replies

- 0

- Views

- 2K