AIMs: Calculate risk-neutral default rates from spreads. Describe advantages of using the CDS market to estimate hazard rates. Explain how a CDS spread can be used to derive a hazard rate curve. Construct a hazard rate curve from a CDS spread curve. Construct a default distribution curve from a hazard rate curve. Explain how the default distribution is affected by the sloping of the spread curve. Define spread risk and its measurement using the mark-to-market and spread volatility.

Questions:

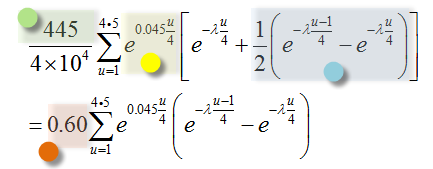

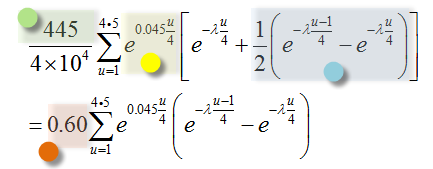

308.1. In the reading, Malz solves the following equation to obtain a single hazard rate (λ) estimate given a single credit default swap (CDS) spread:

(Source: Allan Malz, Financial Risk Management: Models, History, and Institutions (Hoboken, NJ: John Wiley & Sons, 2011))

In regard to this equation, each of the following is true except which is false?

a. The 445 highlighted in GREEN reflects a five-year credit default spread of 445 basis points which the protection buyer pays to the protection seller

b. The exp(0.045*u/4) highlighted in YELLOW models the price of a risk-free zero-coupon bond maturing at time (t) where 4.5% is a continuously compounded, flat swap rate curve

c. The term highlighted in BLUE, that is 1/2*(exp[-λ*(u-1)/4] - exp[-λ*u/4]) adjust the swap rates into spot rates

d. The 0.60 highlight in ORANGE reflects the loss given default (LGD) assumption because the recovery rate assumption 40%.

308.2. According to Malz, the advantages of using the CDS market, instead of the cash bond market, to estimate hazard rates include each of the following EXCEPT which is not an advantage?

a. Standardization: CDS trading occurs regularly in standardized maturities of 1, 3, 5, 7, and 10 years

b. Coverage: CDS spread curves exist for many corporate issuers

c. Liquidity: CDS often trade heavily with tighter bid-spread than bond issues

d. Fundamental: CDS are priced on according to pure (fundamental) credit default risk, not on market (aka, technical) factors, which will limit spread volatility

(Source: Allan Malz, Financial Risk Management: Models, History, and Institutions (Hoboken, NJ: John Wiley & Sons, 2011))

308.3. According to Malz, each of the following is true about the CDS spread curve and spread risk EXCEPT which is not?

a. If the market believes that a firm has a stable, low default probability that is unlikely to change for the foreseeable future, the firm’s spread curve will be flat, or more likely downward sloping to reflect diminishing marginal default probabilities

b. Downward-sloping spread curves are unusual, a sign that the market views a credit as distressed, but they did become prevalent during the subprime crisis.

c. If the CDS spread increases, the premium paid by the fixed-leg counterparty increases. This causes a gain to existing fixed-leg payers, who in retrospect got into their positions cheap

d. A common measure of spread risk is spread volatility (“spread vol”): the historical or expected standard deviation of changes in spread, often measured in basis points per day

(Source: Allan Malz, Financial Risk Management: Models, History, and Institutions (Hoboken, NJ: John Wiley & Sons, 2011))

Answers:

Questions:

308.1. In the reading, Malz solves the following equation to obtain a single hazard rate (λ) estimate given a single credit default swap (CDS) spread:

(Source: Allan Malz, Financial Risk Management: Models, History, and Institutions (Hoboken, NJ: John Wiley & Sons, 2011))

In regard to this equation, each of the following is true except which is false?

a. The 445 highlighted in GREEN reflects a five-year credit default spread of 445 basis points which the protection buyer pays to the protection seller

b. The exp(0.045*u/4) highlighted in YELLOW models the price of a risk-free zero-coupon bond maturing at time (t) where 4.5% is a continuously compounded, flat swap rate curve

c. The term highlighted in BLUE, that is 1/2*(exp[-λ*(u-1)/4] - exp[-λ*u/4]) adjust the swap rates into spot rates

d. The 0.60 highlight in ORANGE reflects the loss given default (LGD) assumption because the recovery rate assumption 40%.

308.2. According to Malz, the advantages of using the CDS market, instead of the cash bond market, to estimate hazard rates include each of the following EXCEPT which is not an advantage?

a. Standardization: CDS trading occurs regularly in standardized maturities of 1, 3, 5, 7, and 10 years

b. Coverage: CDS spread curves exist for many corporate issuers

c. Liquidity: CDS often trade heavily with tighter bid-spread than bond issues

d. Fundamental: CDS are priced on according to pure (fundamental) credit default risk, not on market (aka, technical) factors, which will limit spread volatility

(Source: Allan Malz, Financial Risk Management: Models, History, and Institutions (Hoboken, NJ: John Wiley & Sons, 2011))

308.3. According to Malz, each of the following is true about the CDS spread curve and spread risk EXCEPT which is not?

a. If the market believes that a firm has a stable, low default probability that is unlikely to change for the foreseeable future, the firm’s spread curve will be flat, or more likely downward sloping to reflect diminishing marginal default probabilities

b. Downward-sloping spread curves are unusual, a sign that the market views a credit as distressed, but they did become prevalent during the subprime crisis.

c. If the CDS spread increases, the premium paid by the fixed-leg counterparty increases. This causes a gain to existing fixed-leg payers, who in retrospect got into their positions cheap

d. A common measure of spread risk is spread volatility (“spread vol”): the historical or expected standard deviation of changes in spread, often measured in basis points per day

(Source: Allan Malz, Financial Risk Management: Models, History, and Institutions (Hoboken, NJ: John Wiley & Sons, 2011))

Answers:

I struggled but I'm happy with the visual

I struggled but I'm happy with the visual