Suzanne Evans

Well-Known Member

AIMs: Describe the process of and construct a tree for a short-term rate under the Ho-Lee Model with time dependent drift. Describe uses and benefits of the arbitrage-free models and assess the issue of fitting models to market prices.

Questions:

304.1. The current short-term rate, r(0) is 4.00%. Under a Ho-Lee Model with time-dependent drift, the time step is monthly and the annualized drifts are as follows: +100 basis points in the first month and +80 basis points in the second month. The annual basis point volatility (sigma) is 200 bps.

What is the value of the missing node [2,0] in this Ho-Lee interest rate tree?

a. 2.447%

b. 2.677%

c. 2.995%

d. 3.256%

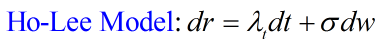

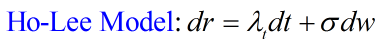

304.2. Analyst Susan wants to employ the Ho-Lee short-term interest rate model, which contains a time-dependent drift and is described by the following process:

(Bruce Tuckman, Fixed Income Securities, 3rd Edition (Hoboken, NJ: John Wiley & Sons, 2011))

Her model assumes the following:

a. 3.930%

b. 4.425%

c. 5.006%

d. 5.327%

304.3. Tuckman's short-term interest rate models classify into two categories: equilibrium models and arbitrage-free models. Consider the following statements about no-arbitrage interest rate models: (Source: Bruce Tuckman, Fixed Income Securities, 3rd Edition (Hoboken, NJ: John Wiley & Sons, 2011))

a. None

b. I. and II. only

c. II., III. and IV.

d. All are true

Answers:

Questions:

304.1. The current short-term rate, r(0) is 4.00%. Under a Ho-Lee Model with time-dependent drift, the time step is monthly and the annualized drifts are as follows: +100 basis points in the first month and +80 basis points in the second month. The annual basis point volatility (sigma) is 200 bps.

What is the value of the missing node [2,0] in this Ho-Lee interest rate tree?

a. 2.447%

b. 2.677%

c. 2.995%

d. 3.256%

304.2. Analyst Susan wants to employ the Ho-Lee short-term interest rate model, which contains a time-dependent drift and is described by the following process:

(Bruce Tuckman, Fixed Income Securities, 3rd Edition (Hoboken, NJ: John Wiley & Sons, 2011))

Her model assumes the following:

- The time step is monthly; i.e., dt = 1/12

- the current rate, r(0) = 4.000%

- The annual basis point volatility = 300 basis points

- Annualized drift in the first month, lamba(1) = 110 basis points

- Annualized drift in the second month, lambda(2) = 70 basis points

a. 3.930%

b. 4.425%

c. 5.006%

d. 5.327%

304.3. Tuckman's short-term interest rate models classify into two categories: equilibrium models and arbitrage-free models. Consider the following statements about no-arbitrage interest rate models: (Source: Bruce Tuckman, Fixed Income Securities, 3rd Edition (Hoboken, NJ: John Wiley & Sons, 2011))

I. Model 1 (Normally distributed rates and no drift) and Model 2 (Constant drift and risk premium) are classified as arbitrage-free models

II. The Ho-Lee Model, due to time-dependent drift, maybe be used to match the observed prices of securities and therefore may be classified as a arbitrage-free model

III. Important uses of arbitrage-free models include quoting non-actively traded securities (based on prices of liquid securities) and to value derivatives for purposes of market-making or proprietary trading

IV. Because an arbitrage-free model matches market prices does not necessarily imply that it provides fair values and accurate hedges: the model itself could be bad; and/or market prices may not be "fair" in the context of the model.

Which of the above statements are TRUE according to Tuckman?a. None

b. I. and II. only

c. II., III. and IV.

d. All are true

Answers: