I think there is a mistake in the answer to GARP question 10.20 in book 4.

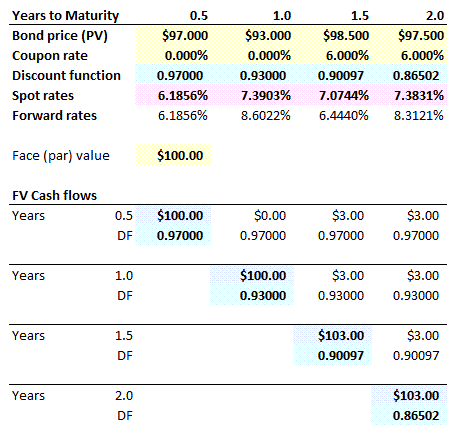

10.20 The cash prices of 6-month and one-year Treasury bills are 97.0 and 93.0. A 1.5-year and two-year Treasury bond with coupons at the rate of 6% per year sell for 98.5 and 97.5. Calculate the six-month, 12-month, 18-month, and 24-month spot rates with semi-annual compounding.

These are my answers:

6m: 6.186%

12m: 7.390%

18m: 7.074%

24m: 7.383%

GARP answers:

6m: 6.186%

12m: 7.390%

***18m: 7.612% (maybe wrong?)***

24m: 7.383%

Are you able to verify a possible mistake in the 18 month rate provided by GARP? I match off with their discount factor, but not the rate implied by it.

Many thanks.

10.20 The cash prices of 6-month and one-year Treasury bills are 97.0 and 93.0. A 1.5-year and two-year Treasury bond with coupons at the rate of 6% per year sell for 98.5 and 97.5. Calculate the six-month, 12-month, 18-month, and 24-month spot rates with semi-annual compounding.

These are my answers:

6m: 6.186%

12m: 7.390%

18m: 7.074%

24m: 7.383%

GARP answers:

6m: 6.186%

12m: 7.390%

***18m: 7.612% (maybe wrong?)***

24m: 7.383%

Are you able to verify a possible mistake in the 18 month rate provided by GARP? I match off with their discount factor, but not the rate implied by it.

Many thanks.