Learning objectives: Explain the process of calculating the effective duration and convexity of a portfolio of fixed income securities. Explain the impact of negative convexity on the hedging of fixed income securities. Construct a barbell portfolio to match the cost and duration of a given bullet investment, and explain the advantages and disadvantages of bullet versus barbell portfolios.

Questions:

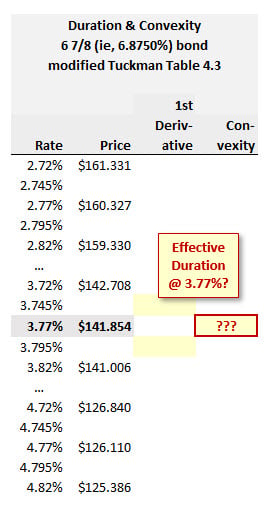

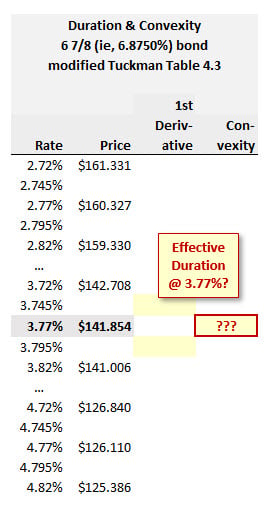

910.1. The table below (which is a modified version of Tuckman's Table 4.3) displays the price of a 6 7/8 bond at various yield ("rate") levels: (Bruce Tuckman, Fixed Income Securities, 3rd Edition (Hoboken, NJ: John Wiley & Sons, 2011))

At a rate level of 3.77%, which of the following are nearest, respectively, to the bond's effective duration and convexity?

a. 7.7 years and ~89 years-squared

b. 9.5 years and ~113 years-squared

c. 12.0 years and ~169 years-squared

d. 15.3 years and ~250 years-squared

910.2. In the course of business on May 28, 2019, a market maker sells $200.0 million face amount of the option, TYU0C 120, when its DV01 is $0.03505. The market maker immediately seeks to put on a DV01 hedge (aka, to neutralize its DV01 exposure) with a long position in future contracts, TYU0, when its DV01 is 0.07442. Consequently, the market maker purchases about $94.2 million face amount of the futures contract: $200.0 * 0.03505/0.07442 = $94.2 million. In regard to the market maker's net position, which of the following statements is TRUE?

a. After a 50 basis point increase in rates, the market maker experiences a material loss

b. After a 50 basis point decrease in rates, the market maker experiences a material gain

c. If rates are highly volatile, the long futures position will outperform the option position

d. After a three basis point change in rates in either direction, the market maker experiences a material gain

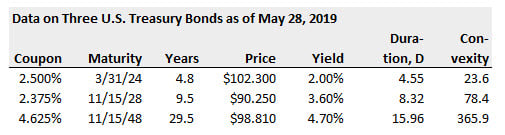

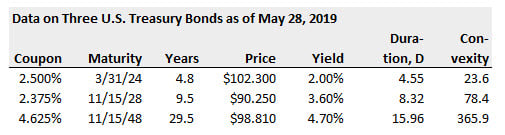

910.3. On May 28, 2019, Robin the Portfolio Manager considers the purchase of $100.0 million face amount of the U.S. Treasury 2 3/8s (2.375%) due November 15, 2028, at a cost of $90,250,000. She refers to this as her "bullet" investment. After an analysis of the interest rate environment, she is comfortable with the pricing of the bond at a yield of 3.60% and with its duration of 8.32 years

However, upon further inspection, Robin considers an alternative to the above-mentioned bullet investment in the 10-year 2 3/8s. Specifically, the alternative is a "barbell" investment in the shorter maturity 5-year 2 1/2s and the longer maturity 30-year 4 5/8s. The barbell would be constructed to have the same COST and DURATION as the bullet investment. Which of the following is nearest to the convexity of the alternative barbell portfolio?

a. 50.4 years^2

b. 78.4 years^2

c. 136.7 years^2

d. 305.9 years^2

Answers here:

Questions:

910.1. The table below (which is a modified version of Tuckman's Table 4.3) displays the price of a 6 7/8 bond at various yield ("rate") levels: (Bruce Tuckman, Fixed Income Securities, 3rd Edition (Hoboken, NJ: John Wiley & Sons, 2011))

At a rate level of 3.77%, which of the following are nearest, respectively, to the bond's effective duration and convexity?

a. 7.7 years and ~89 years-squared

b. 9.5 years and ~113 years-squared

c. 12.0 years and ~169 years-squared

d. 15.3 years and ~250 years-squared

910.2. In the course of business on May 28, 2019, a market maker sells $200.0 million face amount of the option, TYU0C 120, when its DV01 is $0.03505. The market maker immediately seeks to put on a DV01 hedge (aka, to neutralize its DV01 exposure) with a long position in future contracts, TYU0, when its DV01 is 0.07442. Consequently, the market maker purchases about $94.2 million face amount of the futures contract: $200.0 * 0.03505/0.07442 = $94.2 million. In regard to the market maker's net position, which of the following statements is TRUE?

a. After a 50 basis point increase in rates, the market maker experiences a material loss

b. After a 50 basis point decrease in rates, the market maker experiences a material gain

c. If rates are highly volatile, the long futures position will outperform the option position

d. After a three basis point change in rates in either direction, the market maker experiences a material gain

910.3. On May 28, 2019, Robin the Portfolio Manager considers the purchase of $100.0 million face amount of the U.S. Treasury 2 3/8s (2.375%) due November 15, 2028, at a cost of $90,250,000. She refers to this as her "bullet" investment. After an analysis of the interest rate environment, she is comfortable with the pricing of the bond at a yield of 3.60% and with its duration of 8.32 years

However, upon further inspection, Robin considers an alternative to the above-mentioned bullet investment in the 10-year 2 3/8s. Specifically, the alternative is a "barbell" investment in the shorter maturity 5-year 2 1/2s and the longer maturity 30-year 4 5/8s. The barbell would be constructed to have the same COST and DURATION as the bullet investment. Which of the following is nearest to the convexity of the alternative barbell portfolio?

a. 50.4 years^2

b. 78.4 years^2

c. 136.7 years^2

d. 305.9 years^2

Answers here: