Learning objectives: Assess the impact of maturity on the price of a bond and the returns generated by bonds. Define the flattening and steepening of rate curves and describe a trade to reflect expectations that a curve will flatten or steepen.

Questions:

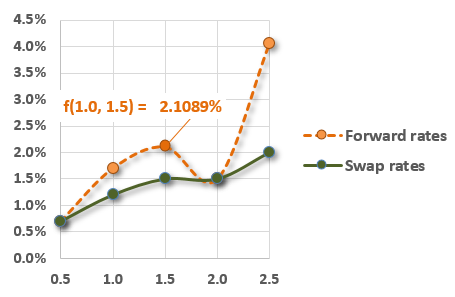

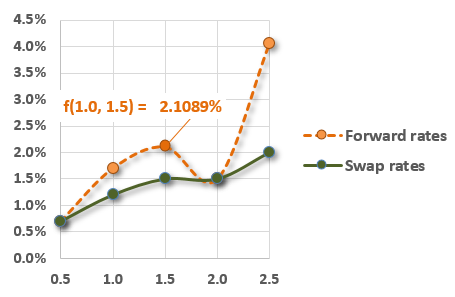

904.1. Below is a graph of swap rates (represented by the solid green line) and the corresponding, implied six-month forward rates (represented by the dotted orange line). Specifically, the six-month, 1.0-year, 1.5-year, 2.0-year and 2.5-year swap rates are, respectively, 0.70%, 1.20%, 1.50%, 1.50% and 2.0%. The six-month forward rates implied by this swap rate curve are: f(0, 0.5) = s(0.5) = 0.7000%; f(0.5, 1.0) = 1.7043%; f(1.0, 1.5) = 2.1089%; f(1.5, 2.0) = 1.5000%; f(2.0, 2.5) = 4.0674%.

Consider the fixed side of a 2.5-year swap which pays the swap rate of 2.0%. Because 2.0% is the 2.5-year par rate, the present value of 100 face amount of the fixed side of the 2.5-year swap is 100. Consider the price of the swap over the following year, in two six-month steps:

a. The price decreases during both six-month periods

b. The price increases during both six-month periods

c. The price increases (during first six months), then decreases (during next six months)

d. The price decreases (during first six months), then increases (during next six months)

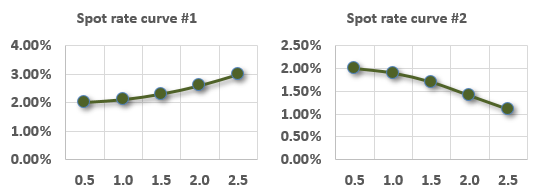

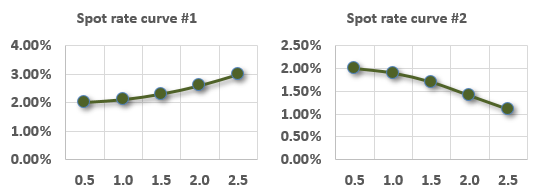

904.2. Consider the two spot rate curves below. Both start at S(0.5) = 2.0%, but curve #1 is upward-sloping such that its 2.5-year spot rate equals 3.0%, while curve #2 is downward-sloping such that its 2.5-year spot rate equals 1.10%.

Assume a $100.00 face value bond that pays a semi-annual coupon with a coupon rate of 4.0% and maturity of 2.5 years. If curve #1 prevails, this bond's price is $102.45 and its yield is about 2.97%. If curve #2 prevails, this bond's price is $107.08 and its yield is about 1.12%. Each of the following is true EXCEPT which is false?

a. If curve #1 steepens, this bond's price will decrease below $102.45

b. If curve #1 steepens, this bond's yield will increase above 2.97%

c. If curve #2 flattens, this bond's price will increase above $107.08

d. If curve #2 flattens, this bond's yield will increase above 1.12%

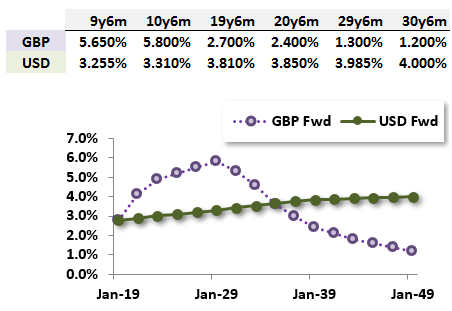

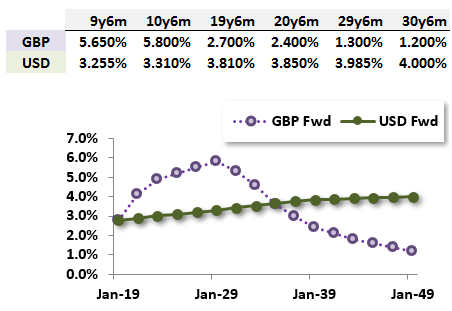

904.3. Susan is a trader who observes the two six-month forward curves graphed below. In GBP for example, the six-month rate 10-years forward (aka, 10y6m) is 5.800%; the USD six-month rate 20-years forward (aka, 20y6m) is 3.850%.

Susan has a view and executes the following two trades, she will: receive fixed in the GBP 10y6m, and she will pay fixed in the GBP 30y6m. Over the subsequent year, both forward term structures are unchanged.

a. Over the subsequent year, her trade experiences a roll-down gain

b. Over the subsequent year, her trade experiences a roll-down loss

c. Susan's trade reflected a belief that the GBP 10s-30s forward curve will flatten

d. Susan's trade reflected a belief that the USD 10s-30s forward curve will steepen

Answers here:

Questions:

904.1. Below is a graph of swap rates (represented by the solid green line) and the corresponding, implied six-month forward rates (represented by the dotted orange line). Specifically, the six-month, 1.0-year, 1.5-year, 2.0-year and 2.5-year swap rates are, respectively, 0.70%, 1.20%, 1.50%, 1.50% and 2.0%. The six-month forward rates implied by this swap rate curve are: f(0, 0.5) = s(0.5) = 0.7000%; f(0.5, 1.0) = 1.7043%; f(1.0, 1.5) = 2.1089%; f(1.5, 2.0) = 1.5000%; f(2.0, 2.5) = 4.0674%.

Consider the fixed side of a 2.5-year swap which pays the swap rate of 2.0%. Because 2.0% is the 2.5-year par rate, the present value of 100 face amount of the fixed side of the 2.5-year swap is 100. Consider the price of the swap over the following year, in two six-month steps:

- After six months, as the swap ages (toward maturity) from 2.5-year to a 2.0-year swap (but with the same fixed rate, of course)

- After another six months, as the swap ages from a 2.0-year swap to a 1.5-year swap

a. The price decreases during both six-month periods

b. The price increases during both six-month periods

c. The price increases (during first six months), then decreases (during next six months)

d. The price decreases (during first six months), then increases (during next six months)

904.2. Consider the two spot rate curves below. Both start at S(0.5) = 2.0%, but curve #1 is upward-sloping such that its 2.5-year spot rate equals 3.0%, while curve #2 is downward-sloping such that its 2.5-year spot rate equals 1.10%.

Assume a $100.00 face value bond that pays a semi-annual coupon with a coupon rate of 4.0% and maturity of 2.5 years. If curve #1 prevails, this bond's price is $102.45 and its yield is about 2.97%. If curve #2 prevails, this bond's price is $107.08 and its yield is about 1.12%. Each of the following is true EXCEPT which is false?

a. If curve #1 steepens, this bond's price will decrease below $102.45

b. If curve #1 steepens, this bond's yield will increase above 2.97%

c. If curve #2 flattens, this bond's price will increase above $107.08

d. If curve #2 flattens, this bond's yield will increase above 1.12%

904.3. Susan is a trader who observes the two six-month forward curves graphed below. In GBP for example, the six-month rate 10-years forward (aka, 10y6m) is 5.800%; the USD six-month rate 20-years forward (aka, 20y6m) is 3.850%.

Susan has a view and executes the following two trades, she will: receive fixed in the GBP 10y6m, and she will pay fixed in the GBP 30y6m. Over the subsequent year, both forward term structures are unchanged.

a. Over the subsequent year, her trade experiences a roll-down gain

b. Over the subsequent year, her trade experiences a roll-down loss

c. Susan's trade reflected a belief that the GBP 10s-30s forward curve will flatten

d. Susan's trade reflected a belief that the USD 10s-30s forward curve will steepen

Answers here: