Concept: These on-line quiz questions are not specifically linked to AIMs, but are instead based on recent sample questions. The difficulty level is a notch, or two notches, easier than bionicturtle.com's typical AIM-by-AIM question such that the intended difficulty level is nearer to an actual exam question. As these represent "easier than our usual" practice questions, they are well-suited to online simulation.

Questions:

415.1. A bond with a 1.5 year maturity has a coupon rate of 12.0% and pays the coupon semi-annually. The spot rate curve is very steep: 1.0% at 0.5 years, 2.0% at 1.0 years and 3.0% at 1.5 years. Because the spot rates are per annum with continuous compounding, the bond's price is $6.00*exp(-0.01*0.5) + $6.00*exp(-0.02*1.0) + $106*exp(-0.04*1.5) = $113.19. Under a scenario assumption of realized forwards--i.e., "[realized forwards] is to assume that forward rates equal expectations of future rates and that, as time passes, these forward rates are realized" says Tuckman--which is nearest to the bond price in six months?

a. $99.97

b. $107.75

c. $112.25

d. $118.00

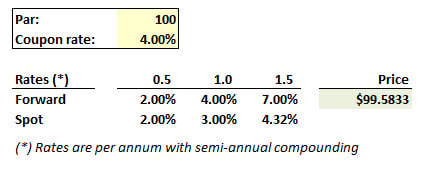

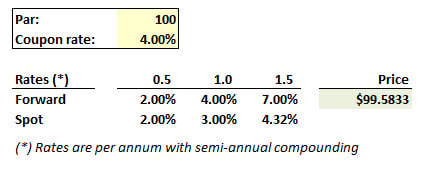

415.2. A bond with a 1.5 year maturity has a coupon rate of 4.0% and the coupon pays semi-annually. The forward rate curve is very steep and high: 2.0% at six months, 4.0% at 1.0 years and 7.0% at 1.5 years, all rates per annum with semi-annual compounding. The bond price is therefore $99.5833 with a yield (yield-to-maturity) of 4.290%. Under a scenario assumption of an unchanged term structure (in contrast to "realized forwards"), which is nearest to the expected yield (YTM) of the bond six months in the future?

a. 2.99%

b. 4.00%

c. 4.29%

d. 7.00%

415.3. Consider a bond with a maturity of (T) years when the spot rate curve is upward-sloping. In six months, when the bond's maturity is (T-0.5 years) which of the following is necessarily TRUE about the bond's price?

a. Its expected price (in six months) will be lower than the current price

b. Its expected price (in six months) will be higher than the current price

c. Its expected price will be lower under an unchanged term structure scenario than under a realized forward scenario

d. Its expected price will be lower under a realized forward scenario than under an unchanged term structure scenario

Answers here:

Questions:

415.1. A bond with a 1.5 year maturity has a coupon rate of 12.0% and pays the coupon semi-annually. The spot rate curve is very steep: 1.0% at 0.5 years, 2.0% at 1.0 years and 3.0% at 1.5 years. Because the spot rates are per annum with continuous compounding, the bond's price is $6.00*exp(-0.01*0.5) + $6.00*exp(-0.02*1.0) + $106*exp(-0.04*1.5) = $113.19. Under a scenario assumption of realized forwards--i.e., "[realized forwards] is to assume that forward rates equal expectations of future rates and that, as time passes, these forward rates are realized" says Tuckman--which is nearest to the bond price in six months?

a. $99.97

b. $107.75

c. $112.25

d. $118.00

415.2. A bond with a 1.5 year maturity has a coupon rate of 4.0% and the coupon pays semi-annually. The forward rate curve is very steep and high: 2.0% at six months, 4.0% at 1.0 years and 7.0% at 1.5 years, all rates per annum with semi-annual compounding. The bond price is therefore $99.5833 with a yield (yield-to-maturity) of 4.290%. Under a scenario assumption of an unchanged term structure (in contrast to "realized forwards"), which is nearest to the expected yield (YTM) of the bond six months in the future?

a. 2.99%

b. 4.00%

c. 4.29%

d. 7.00%

415.3. Consider a bond with a maturity of (T) years when the spot rate curve is upward-sloping. In six months, when the bond's maturity is (T-0.5 years) which of the following is necessarily TRUE about the bond's price?

a. Its expected price (in six months) will be lower than the current price

b. Its expected price (in six months) will be higher than the current price

c. Its expected price will be lower under an unchanged term structure scenario than under a realized forward scenario

d. Its expected price will be lower under a realized forward scenario than under an unchanged term structure scenario

Answers here:

Last edited by a moderator:

I have revised the answer to include "The one-year spot rate will equal 4.0%, which is the current f(0.5, 1.5)"; i.e.,

I have revised the answer to include "The one-year spot rate will equal 4.0%, which is the current f(0.5, 1.5)"; i.e.,