Fran

Administrator

AIMs: Define discount factor and use a discount function to compute present and future values. Define the “law of one price,” explain it using an arbitrage argument, and describe how it can be applied to bond pricing.

Questions:

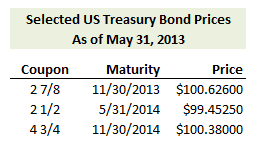

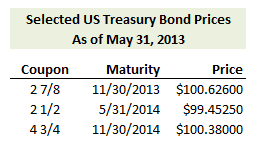

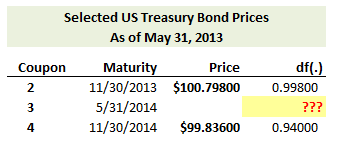

309.1. The table below gives coupon rates and mid-market prices for three U.S. Treasury bonds for settlement on (as of) May 31, 2013:

Which of the following is nearest to the implied discount function (set of discount factors) assuming semi-annual compounding?

a. d(0.5) = 0.9370, d(1.0) = 0.8667, d(1.5) = 0.9210

b. d(0.5) = 0.9920, d(1.0) = 0.9700, d(1.5) = 0.9350

c. d(0.5) = 0.9999, d(1.0) = 0.7455, d(1.5) = 0.8018

d. d(0.5) = 1.0350, d(1.0) = 1.1175, d(1.5) = 0.6487

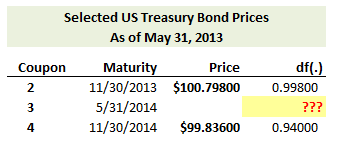

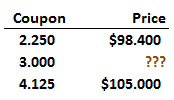

309.2. The table below gives coupon rates and mid-market prices for two U.S. Treasury bonds, one that settles in six months and one that settles in 1.5 years. We are, however, given neither a price nor a discount factor for the 3.0% coupon bond that settles in one year:

We do know that the six month discount factor, d(0.5) = 0.9980, and the 1.5 year discount factor, d(1.5) = 0.9400. According to the "law of one price," what must be the one-year discount factor, d(1.0), if we assume semi-annual compounding?:

a. 0.9157

b. 0.9631

c. 0.9800

d. 0.9947

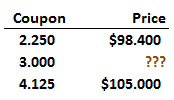

309.3. The table below gives the prices of two out of three US Treasury notes for settlement on July 31, 2013. All three notes will mature exactly one year later on July 31, 2013. Assume annual coupon payments and that all three bonds have the same coupon payment date.

Which is nearest to the price of the 3.0% Treasury note (based on GARP's 2010 Practice Exam P1.18)?

a. $96.55

b. $99.37

c. $101.04

d. $103.28

Answers:

Questions:

309.1. The table below gives coupon rates and mid-market prices for three U.S. Treasury bonds for settlement on (as of) May 31, 2013:

Which of the following is nearest to the implied discount function (set of discount factors) assuming semi-annual compounding?

a. d(0.5) = 0.9370, d(1.0) = 0.8667, d(1.5) = 0.9210

b. d(0.5) = 0.9920, d(1.0) = 0.9700, d(1.5) = 0.9350

c. d(0.5) = 0.9999, d(1.0) = 0.7455, d(1.5) = 0.8018

d. d(0.5) = 1.0350, d(1.0) = 1.1175, d(1.5) = 0.6487

309.2. The table below gives coupon rates and mid-market prices for two U.S. Treasury bonds, one that settles in six months and one that settles in 1.5 years. We are, however, given neither a price nor a discount factor for the 3.0% coupon bond that settles in one year:

We do know that the six month discount factor, d(0.5) = 0.9980, and the 1.5 year discount factor, d(1.5) = 0.9400. According to the "law of one price," what must be the one-year discount factor, d(1.0), if we assume semi-annual compounding?:

a. 0.9157

b. 0.9631

c. 0.9800

d. 0.9947

309.3. The table below gives the prices of two out of three US Treasury notes for settlement on July 31, 2013. All three notes will mature exactly one year later on July 31, 2013. Assume annual coupon payments and that all three bonds have the same coupon payment date.

Which is nearest to the price of the 3.0% Treasury note (based on GARP's 2010 Practice Exam P1.18)?

a. $96.55

b. $99.37

c. $101.04

d. $103.28

Answers:

). I think we all agreed that it is an

). I think we all agreed that it is an