Hi David,

I did the FRM part 2 exam in November 2016 but unfortunately I falsed. I remembered one questios about Credit Var, which I was not able to get the solution. Please could you help me?

question:

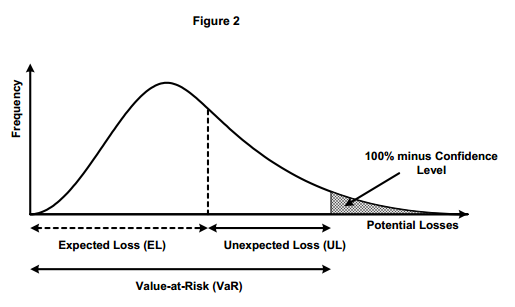

Bank has a basket of 500 short CDS. Each CDS for $1.000.000 bond, which has a 4% probability of default. RR equals 0%. There is a 5% probability that at least 25 bonds go to default. Calculate credit VaR.

Thanks in advance,

I did the FRM part 2 exam in November 2016 but unfortunately I falsed. I remembered one questios about Credit Var, which I was not able to get the solution. Please could you help me?

question:

Bank has a basket of 500 short CDS. Each CDS for $1.000.000 bond, which has a 4% probability of default. RR equals 0%. There is a 5% probability that at least 25 bonds go to default. Calculate credit VaR.

Thanks in advance,

But I hope you are still enjoying the journey! Thanks,

But I hope you are still enjoying the journey! Thanks,