Hello,

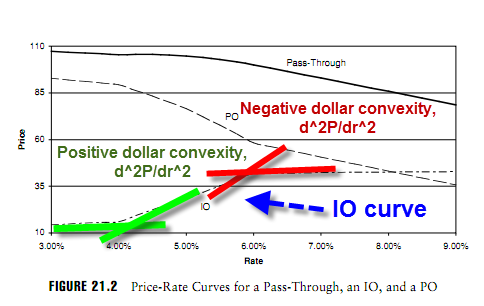

Do IOs ever have positive convexity? I have seen the P/Y graph for POs, but really cannot find one for IOs. POs have pos convexity at higher yields and neg convex at low yields but I am not sure at all what the P/Y graph for an IO looks like.

Also, this may be a very dumb question, but what are the mechanics behind an IO increasing in value as rates increase? The basic idea is that there will be no premayments and this will exten the period in which you are getting paid interest, but wont this also make the payments less valuable because they will be discounted at a higher rate?

Now that I think about it, why would POs have negative convexity? The faster the pre-payments come in (as rates fall), the faster the investors will be repaid, so wouldn't this result in positive convexity?

Thanks!

Shannon

Do IOs ever have positive convexity? I have seen the P/Y graph for POs, but really cannot find one for IOs. POs have pos convexity at higher yields and neg convex at low yields but I am not sure at all what the P/Y graph for an IO looks like.

Also, this may be a very dumb question, but what are the mechanics behind an IO increasing in value as rates increase? The basic idea is that there will be no premayments and this will exten the period in which you are getting paid interest, but wont this also make the payments less valuable because they will be discounted at a higher rate?

Now that I think about it, why would POs have negative convexity? The faster the pre-payments come in (as rates fall), the faster the investors will be repaid, so wouldn't this result in positive convexity?

Thanks!

Shannon