We hope that everyone did well on the FRM Part 2 exam! We would love to hear any feedback that you have about the exam. How did the exam go? Did you encounter unexpected questions? Thank you in advance for any feedback you can provide!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Exam Feedback May 2023 Part 2 Exam Feedback

- Thread starter Nicole Seaman

- Start date

-

- Tags

- exam-feedback

- Status

- Not open for further replies.

enjofaes

Active Member

Exam went well! Had more than enough time. Had around 1 hour left. Some questions were a bit tricky, like for 2 or so I had no clue at all, around 10 or so it was a guess between 2 and all the rest gave me a bit of confidence. But it can always go the other way…

Below some questions that I tried to collect with colleagues. I’m not sure though if I can share them that thoroughly though?

Market risk

Credit risk

ORR

Investment Management

Liquidity risk

Current issues

Below some questions that I tried to collect with colleagues. I’m not sure though if I can share them that thoroughly though?

Market risk

| LN VaR vs VaR |

| "Failure rate" of 2%, 99% 1-day VaR calculation??? |

| ES97.5% using historical simulation, given were the 25th worst, average ES of simulation, … ?? |

| LN VaR vs VaR |

| FX swap basis |

| Undiversified VaR and diversified VaR and sum of CVaR |

| LDs |

| CS calculation (-1/N Ln(D/F)) |

| LDA |

| CIR tree |

| Vol Smile about the Eur Put and Call same maturity = same smile |

| VaR |

| Ho-Lee tree |

| Specific risk vs general risk |

| Reason FX volatility |

| FRTB |

Credit risk

| CPR: 30 months SMM |

| CDS curve fluctuations |

| Risk Neutral pricing |

| BCVA calculation |

| Initial margin purpose |

| Merton zero coupon that could not be bought, what is the equivalent portfolio?? |

| Copula |

| Z-score altman (easy one at least I think. Sumproduct) |

| Value TIPS based on regression hedge |

| Stress testing |

| CDS curve |

| Easy binomial tree |

| Trade compression |

| BCVA calculations but difficult one given only EPE and PD & LGD of institution and counterparty (tried it with BCVA = -CVA counterparty but didn't come out correctly) |

| Economic capital |

| PD calculation given names, and defaults per year. However question was 4y "discreet" PD. So I took the average of the 4 marginal PDs |

ORR

| TPRM |

| Six sigma method |

| 2LOD responsibilities (eg. Offer training I think) |

| Model inventory responsibilities |

| Model error frictions |

| ML/FT |

| MLC |

| MRM |

| After VaR RAROC |

| Business continuity planning |

| ORX |

Investment Management

| Hedge funds |

| IRR |

| CE & PE formula hurdle |

| Low risk anomaly |

| VaR for Hedge funds, why not? |

| Hedge funds other question |

| Stratification, screening, quadratic programming and linear programming |

| t-stat alpha |

| CVaR |

| SMB, Mom always high HML |

| Correlation questions see #1 |

| 99% CVaR |

| Efficient frontier how to end up on it? sigma, MVaR, E® |

| 99.9% CVaR #2 |

| Regression vs benchmark & regression vs peers. Some weird explanations of why they matter. Skill vs peers, I don't think so normally skill is measured agains the benchmarks… so tricky! |

Liquidity risk

| LD (Liquidity duration): tedious, didn't recall formula: 4800 shares but 4000 average volatility 12% with options 12, 15, 10 and 18?? |

| Illiquidity |

| Overdraft. But don’t recall it exactly |

| LRC |

| Repo liquidit risk and party |

| Maturity gap |

| LVaR |

| Inflation expectations and markets |

Current issues

| Climate risk and the effect on credit risk / market risk (eg. decline in property values will have an influence on the institution's market risk, other option which I took was the effect of the taxes on carbon dioxide production by companies which could have an effect on credit risk I thought) |

| Ridge vs Lasso regression descriptions |

| CBDC (eg. retail CBDC solved double spending) |

| Climate risk question |

| Decentralized exchanges |

I think that the sets are different for different time slots and few questions could surely be different ,as I saw few of these questions not appearing on my time slot .

But I felt theoretical questions to be so close options which made it quite a challenge to be confident on answer you are marking .

Quant questions were also not that straight forward .@enjofaes,

Need to see ,if we can pass by scoring 40/80(50%) on the test ,do we have any idea on this based on last trends .

But I felt theoretical questions to be so close options which made it quite a challenge to be confident on answer you are marking .

Quant questions were also not that straight forward .@enjofaes,

Need to see ,if we can pass by scoring 40/80(50%) on the test ,do we have any idea on this based on last trends .

enjofaes

Active Member

enjofaes

Active Member

@David Harper CFA FRM any ideas? Many people were angry about the marketing mail yesterday to complete frm2 in 2023!

I'm not an expert on GARP's marketing, but from what I've seen, they tend to send out emails like this to their entire email list to remind everyone about registration deadlines. Not saying it is right, but I don't think they sent this to imply that anyone passed or failed.@David Harper CFA FRM any ideas? Many people were angry about the marketing mail yesterday to complete frm2 in 2023!

enjofaes

Active Member

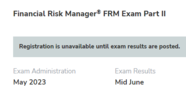

Indeed was my thought too, but indicating mid-June and afterwards switching to mid-July (see below) it’s a bit of a shameI'm not an expert on GARP's marketing, but from what I've seen, they tend to send out emails like this to their entire email list to remind everyone about registration deadlines. Not saying it is right, but I don't think they sent this to imply that anyone passed or failed.

enjofaes

Active Member

@David Harper CFA FRM @Nicole Seaman , is there a possibility from your side to contact GARP for this? They say mid June. For me mid June is tomorrow at the latest. All the mails that have been sent just contradict themselves..

You can also perhaps include the post with the 2 e-mails embedded above.

I mean adjusting the mid June to a certain week in the future shouldn’t be hard if this were the case?

enjofaes

Active Member

In the end let's just all be patient.

Lu Shu Kai FRM

Well-Known Member

Passed with 1,2,2,1,1,3 on the first try! I want to thank @David Harper CFA FRM and @Nicole Seaman for their help all these years. Definitely would recommend BT to others!

enjofaes

Active Member

I passed!! 111131 thanks a lot @David Harper CFA FRM & @Nicole Seaman !!!

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 294

- Replies

- 2

- Views

- 1K

- Replies

- 0

- Views

- 263

- Replies

- 10

- Views

- 2K

- Replies

- 9

- Views

- 3K