Nicole, I remember a while back someone shared language from GARP that candidates can use to indicate they passed the test and are just waiting on work experience verification...basically that it is only a matter of time but they can’t officially use the designation just yet. I tried to find it again but was unable to. Might be helpful to sticky somewhere...and if it is already stickied, my sincere apologies@yao94 You cannot use the FRM designation until GARP has approved your work experience. Once approved, you will receive a notification from GARP stating that you have your FRM certification.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Exam Feedback May 2021 Part 2 Exam Feedback

- Thread starter Nicole Seaman

- Start date

-

- Tags

- exam-feedback

- Status

- Not open for further replies.

So i passed both exams AND have over 2 years work experience but still have to wait month until GARP will approce my work experience?@yao94 You cannot use the FRM designation until GARP has approved your work experience. Once approved, you will receive a notification from GARP stating that you have your FRM certification.

@yao94 Yes, that is GARP's policy. Work experience must be approved before you can use the designation. You can state that you've passed both exams, but you cannot use the FRM designation until GARP has finished their work experience verification.So i passed both exams AND have over 2 years work experience but still have to wait month until GARP will approce my work experience?

Unknown as of yet (nor is the score required to pass----aka, minimum passing score, MPS--even remotely knowable ex ante, as has been much discussed, and this MPS can only be approximately inferred ex post).Pass rate ?

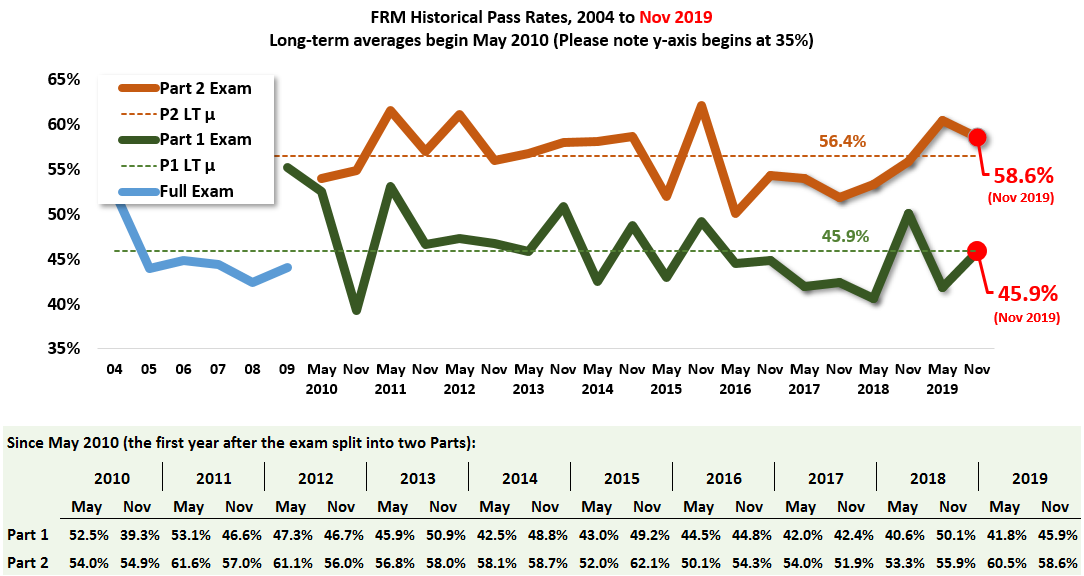

Historical averages are ~46% for P1 and ~56% for P2; will update chart when GARP releases the information https://forum.bionicturtle.com/threads/what-is-the-pass-rate-for-the-frm.10093/post-80406 ie.,

Below is the updated pass rate chart (cc @Nicole Seaman ). Really brief observations:

- This is now a 10-year sample (20 exams; starting with May 2010 when the FRM split into two parts)!

- The Part 1 pass rate of 45.9% happens to be coincident with its long-term average

- The Part 2 pass rate of 58.6% dropped from May's local peak of 60.5%. Last May's gap of 18.7% (i.e., 60.5% - 41.8% = 18.7%) was the largest gap in the exam's history. This November's gap was only 12.7% (i.e., 58.6% - 45.9% = 12.7%) and is nearer to the long-run gap of 10.6%. Historically, we've said that the P2 pass rate is about 10% higher than the P1 pass rate, so we're getting back to that.

Last edited:

Can the MPS be inferred at all? We really don’t know what GARP does with the questions after the fact.Unknown as of yet (nor is the score required to pass----aka, minimum passing score, MPS--even remotely knowable ex ante, as has been much discussed, and this MPS can only be approximately inferred ex post).

Historical averages are ~46% for P1 and ~56% for P2; will update chart when GARP releases the information https://forum.bionicturtle.com/threads/what-is-the-pass-rate-for-the-frm.10093/post-80406 ie.,

Lu Shu Kai FRM

Well-Known Member

Hi @LucreziaB ,

I think its pretty hard to infer the MPS, as it really depends on the distribution of scores that year. Assuming central limit theorem (due to a large number of test takers and a normally distributed set of scores), you'd have to find the mean and move by 4.0% as the long-run mean passing rate for part1 is about 46% as mentioned.

Ideally, I would work with a sample of scores and a certain confidence level, working till a confidence level that I can reject (from a hypothesis test) to deduce the MPS. Of course, this comes with a range of error... I'd most probably work with a t-distribution and n = 30 (minimum) scores.

I think its pretty hard to infer the MPS, as it really depends on the distribution of scores that year. Assuming central limit theorem (due to a large number of test takers and a normally distributed set of scores), you'd have to find the mean and move by 4.0% as the long-run mean passing rate for part1 is about 46% as mentioned.

Ideally, I would work with a sample of scores and a certain confidence level, working till a confidence level that I can reject (from a hypothesis test) to deduce the MPS. Of course, this comes with a range of error... I'd most probably work with a t-distribution and n = 30 (minimum) scores.

ProfZero

New Member

Dear @David Harper CFA FRM, @Nicole Seaman,

Just to share with you how great was having you, and the entire BT community at my side for the past 12 months.

Been clearing FRM Level 1 in November 2020 and Level 2 in May 2021, both on first try; I would like everyone to know that without your high-quality materials; challenging exercise packages; and incredibly relevant mock exams I'm confident I won't have made it.

I would like to thank you for providing such amazing support, and professional advice to all candidates; it would be my honor to assist now new candidates approaching the FRM designation for the first time, and see if my experience preparing for the exams could be helpful to the entire community.

Thank you all so much again!

My best,

Nic

Just to share with you how great was having you, and the entire BT community at my side for the past 12 months.

Been clearing FRM Level 1 in November 2020 and Level 2 in May 2021, both on first try; I would like everyone to know that without your high-quality materials; challenging exercise packages; and incredibly relevant mock exams I'm confident I won't have made it.

I would like to thank you for providing such amazing support, and professional advice to all candidates; it would be my honor to assist now new candidates approaching the FRM designation for the first time, and see if my experience preparing for the exams could be helpful to the entire community.

Thank you all so much again!

My best,

Nic

I work as a model developer in an S&P500 bank and we technically do challenge our models during development - weekly group calls with managers/sometimes SMEs. we challenge also among us developers. it would not be smart to submit something we know has a high chance of being rejected by the MVG. then we document and submit for validation. so go figuresame here, worked in 1 & 2 LoD. In a serious organization 1LoD will never challenge their models, that’s a nonsense. How is the model development team gonna bring up weaknesses on their own models? They will try to cover up if so.

that’s 2LoD job, challenge; it’s even on a the Guide to Internal Models from the European Banking Authority and the Capital Requirements Regulation.

Last edited:

I never said 1st line was the only or primary challenger. This is exactly why it was a poor question even if there was still a clear best answer...The question asked what would be appropriate for a CRO to ask groups to do, not implying any of these actions were exclusive of other actions. Page 141 of the ops risk text book describes user challenges to models (and their limitations, which you also name). Even if their challenge is limited, they still have a valid perspective - and it would be concerning if they didn’t do any testing/challenge of a model they would have to use regularly for business purposes - and the CRO should have them participate in the model testing process.

this is exactly true. the only thing I would challenge in this context is that the CRO would not realistically go into the nitty-gritty of the challenge process, at least where I work, he's too many levels above us developers to get into that level of detail.

superturtle

New Member

first one, I remember the question was asking "time-weighted discrete default rate", which I calculated using geometric average and get the answer D.

The second one, is the question saying someone observed the market volatility is increasing, and asking the direction (increase/decrease) of senior debt, mezzanine debt and equity's value?

Hi @David Harper CFA FRM, I would appreciate if you could share the formula for "time-weighted discrete default rate". I've searched the forum, notes and google but still isn't sure. Thanks in advance!

Last edited:

Hi @superturtle "time-weighted discrete default rate" has never been a term in the FRM. It sounds like a lazy mashup of De Laurentis's default rate (itself already redundantly discrete; i.e., what would continuous imply in this context? But that author has errors we've already submitted) and Bodie's time-weighted. I am writing GARP now, but I wish you would, too.

Last edited:

Yes, it seems like a direct application of the merton model, but I think that we should not refer to "market volatility", in fact in P2.T6.403 403.2 it is stated that "higher firm asset volatility" implies higher equity value and lower (senior/junior) debt value..What about the answer to this Q:

The second one, is the question saying someone observed the market volatility is increasing, and asking the direction (increase/decrease) of senior debt, mezzanine debt and equity's value?

Equity goes up and senior debt goes down I presume?

And also, by logic of the fundamental accounting relationship, (equity = asset - liabilities (i.e. debt)) if equity increases (by the effect of volatility, higher maturity, increase in risk-free interest rate as per BSM formula) debt decreases, more capital implies less debt.

Or another way to see it, imagine you finance $100 asset with $50 capital (your money) and $50 debt (a bank loan), now imagine you decide you will finance your $100 asset with $80 capital (you decide to put +$30 of your money) so you will "only" need $20 debt (a bank loan).... so equity increases and debt decreases.

Last edited:

I wish 1LoD at the bank where I do 2LoD work thought about doing that. Sometimes I think they are just submitting anything and hoping 2LoD will find any problems.I work as a model developer in an S&P500 bank and we technically do challenge our models during development - weekly group calls with managers/sometimes SMEs. we challenge also among us developers. it would not be smart to submit something we know has a high chance of being rejected by the MVG. then we document and submit for validation. so go figure

Suprised by the very qualitative nature of the exam. I knew there would be many text-based questions etc. but not to that degree and nature. Agree many questions were poorly written and contained vague answers at best, sometimes very difficult to choose the correct one - even on topics I knew very well - because answers were formulated in an ackward way and it was not clear which one ansswered the question best. Many times questions revolved around minor parts of the books rather than the core of the learning objectives I feel. Quite clustered on parts of the syllabus. Question style was not in line with that from GARPs mock - not talking about difficulty here, just tzpe of questions.

The few purely quantitative questions were OK. I mostly expected these kind of questions to be honest where the candidate needs to choose the correct tool or formula to answer the question, i.e. the question iteself does not point to the equation or reasoning to be used. These were fair in my opinion.

In terms of timing, it was fair. I took my time and had about 5min left at the end of the exam.

It seemed difficult and suprising to most people in my room - about 10 of us - so hoepfully scores will be scaled appropriately.

We hope that everyone did well on the FRM Part 2 exam on Saturday!We would love to hear any feedback that you have about the exam. How did it go? Did you encounter unexpected questions? How was the experience with all of the COVID guidelines? Thank you in advance for any feedback you can provide!

IMPORTANT NOTE: THIS IS ONLY FOR THE PART 2 EXAM THAT WAS HELD ON SATURDAY, MAY 15TH. THE PART 1 EXAMS ARE STILL ONGOING SO WE CANNOT ALLOW PART 1 FEEDBACK TO BE POSTED IN THE FORUM UNTIL THE EXAMS ARE OVER ON THE 21ST.

Yes, it seems like a direct application of the merton model, but I think that we should not refer to "market volatility", in fact in P2.T6.403 403.2 it is stated that "higher firm asset volatility" implies higher equity value and lower (senior/junior) debt value..

And also, by logic of the fundamental accounting relationship, (equity = asset - liabilities (i.e. debt)) if equity increases (by the effect of volatility, higher maturity, increase in risk-free interest rate as per BSM formula) debt decreases, more capital implies less debt.

Or another way to see it, imagine you finance $100 asset with $50 capital (your money) and $50 debt (a bank loan), now imagine you decide you will finance your $100 asset with $80 capital (you decide to put +$30 of your money) so you will "only" need $20 debt (a bank loan).... so equity increases and debt decreases.

I'm confused by all the feedback of candidates being surprised that Level !! is more qualitative. The exam descriptions clearly state that Level I is more quantitative and level II is more qualitative.I agree with all the above comments in that it was predominately qualitative....

There was one question that took up half the page and was lots of blah blah between investments in several different products. It then went on to say that the investor made two additional transactions, a correlation swap and something else I believe.

I spent so much time trying to understand the question that I left it till the end. Then time was short and I just read the answers and one correct one that stood out was that if the realised correlation was greater than the fixed the investor would gain. I ticked that one. TBH not sure if it was the right one but at least the payoff was correct.

what "exam descriptions" do you mean?I'm confused by all the feedback of candidates being surprised that Level !! is more qualitative. The exam descriptions clearly state that Level I is more quantitative and level II is more qualitative.

- Status

- Not open for further replies.

Similar threads

- Replies

- 2

- Views

- 1K

- Replies

- 9

- Views

- 2K

- Replies

- 2

- Views

- 1K

- Replies

- 9

- Views

- 3K

- Replies

- 5

- Views

- 2K