You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Malz Chapter 8:Portfolio Credit Risk

- Thread starter kik92

- Start date

Hii @kik92 I copied the underlying XLS to this sheet https://www.dropbox.com/s/1orxnlmqob00sap/0604-malz-ch8-cvar.xlsx?dl=0

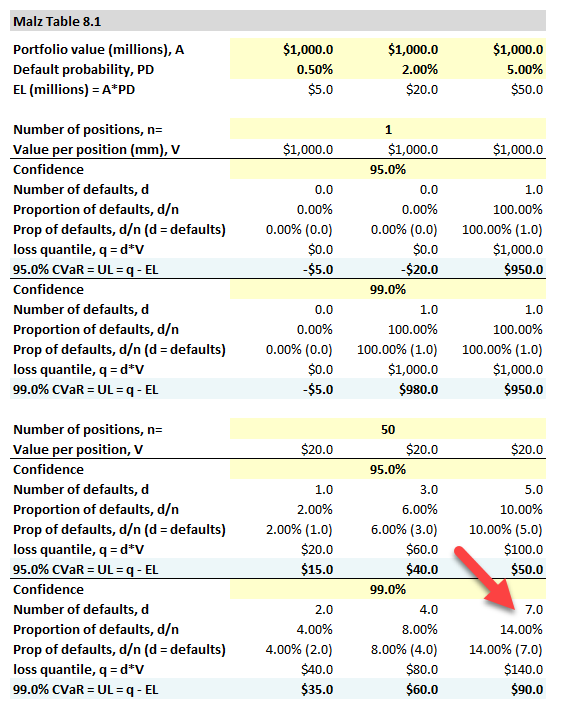

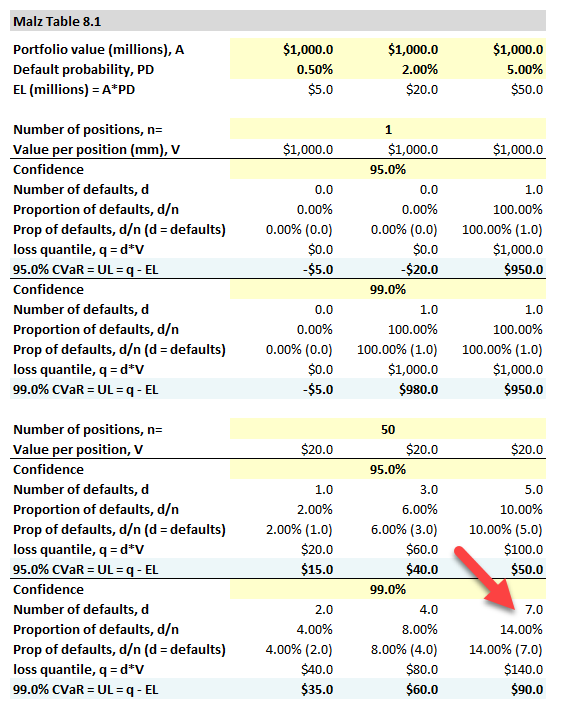

Screenshot below. For example, at the bottom-right under the assumptions of 99.0% confidence when n = 50 positions and PD = 5.0%, we can see the number of defaults returned is 7.0, which is produced with BINOM.INV(50, 0.05, 0.990) = 7.0. So that is an inverse cumulative binomial distribution. It returns 7.0 because notice the following results of the cumulative binomial:

Screenshot below. For example, at the bottom-right under the assumptions of 99.0% confidence when n = 50 positions and PD = 5.0%, we can see the number of defaults returned is 7.0, which is produced with BINOM.INV(50, 0.05, 0.990) = 7.0. So that is an inverse cumulative binomial distribution. It returns 7.0 because notice the following results of the cumulative binomial:

- =BINOM.DIST(6, 50, 5%,TRUE) = 98.821%

- =BINOM.DIST(7, 50, 5%,TRUE) = 99.681%; i.e., the 99.0% quantile falls at 7 defaults

- =BINOM.DIST(8,50, 5%,TRUE) = 99.924%. I hope that helps!

Hi @kik92 Yes, you are almost certainly correct: the exam cannot realistically ask you for most of the calculations above. I remind you that, above, we re-created Malz Table 8.1 for those who want a concrete understanding (which I realize takes extra time). However, let me just quickly gin up a conceptually similar question that could be asked:

- A portfolio contains five bonds each with i.i.d. default probability of 5.0%. Each bond has a value equal to its $100 par (i.e., coupon rate equals par yield, or coupons pay same as flat yield curve) and, if defaulted, assume zero recovery. What is the 95% CVaR?

@BaserMad i don't really understand your question, can you be more specific? did you open the XLS?

@BaserMad While the CVaR (i.e., XLS) illustrate an application of the inverse binomial distribution, per =BINOM.INV(.), the probabilities that I illustrated above in response to the question "a portfolio contains five bonds each with i.i.d. default probability of 5.0%. Each bond has a value equal to its $100 par (i.e., coupon rate equals par yield, or coupons pay same as flat yield curve) and, if defaulted, assume zero recovery," are straightaway applications of the binomial distribution (please see https://en.wikipedia.org/wiki/Binomial_distribution). In this example, we have 100 bonds (N = 100) each with default probability of 5.0% such that:

- The general form of the binomial is given by Pr(X = k) = C(n,k)*p^k*(1-p)^(n-k), where C(n,k) = n!/[k!(n-k)!]

- The probability of exactly zero defaults is given by Pr(X = 0) = C(5,0)*5%^0*95%^5 = 77.38%

- The probability of exactly one defaults is given by Pr(X = 1) = C(5,1)*5%^1*95%^4 = 20.36%. So the Prob[0 or 1 default] = 77.38% + 20.36%. I hope that helps!

trivzca

New Member

Hi David,

I'm not able to get this number of 28 calculated below in Malz study notes credit VaR section . Pl help

For a default probability of 2%, we illustrate how credit Var varies for each value of n: For a single credit portfolio(n=1), the extreme loss given default is equal to $1,000,000,000 as we assume recovery to be zero. Since the expected loss is subtracted from the extreme loss to get VaR, if default probability is π = 2%, the credit VaR is −$20,000,000. For n= 50, each position has a future value, if it doesn’t default, of $20,000,000. The expected loss is π×1,000,000,000 which is the same as for the single-credit portfolio. If π = 2 %, the 95th percentile of the number of defaults is 3 and the credit loss is $60,000,000. Subtracting the expected loss of $20,000,000, we get a credit VaR of $40,000,000.

For the same default probability (π = 2 %), if n =1,000 the 95th percentile of defaults is 28, and the credit loss is $28,000,000, so the credit VaR is $8,000,000.

I'm not able to get this number of 28 calculated below in Malz study notes credit VaR section . Pl help

For a default probability of 2%, we illustrate how credit Var varies for each value of n: For a single credit portfolio(n=1), the extreme loss given default is equal to $1,000,000,000 as we assume recovery to be zero. Since the expected loss is subtracted from the extreme loss to get VaR, if default probability is π = 2%, the credit VaR is −$20,000,000. For n= 50, each position has a future value, if it doesn’t default, of $20,000,000. The expected loss is π×1,000,000,000 which is the same as for the single-credit portfolio. If π = 2 %, the 95th percentile of the number of defaults is 3 and the credit loss is $60,000,000. Subtracting the expected loss of $20,000,000, we get a credit VaR of $40,000,000.

For the same default probability (π = 2 %), if n =1,000 the 95th percentile of defaults is 28, and the credit loss is $28,000,000, so the credit VaR is $8,000,000.

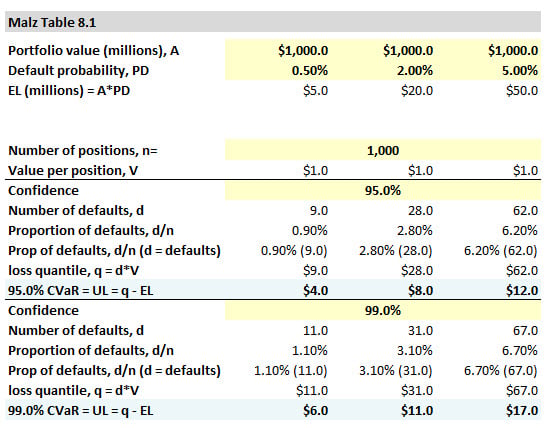

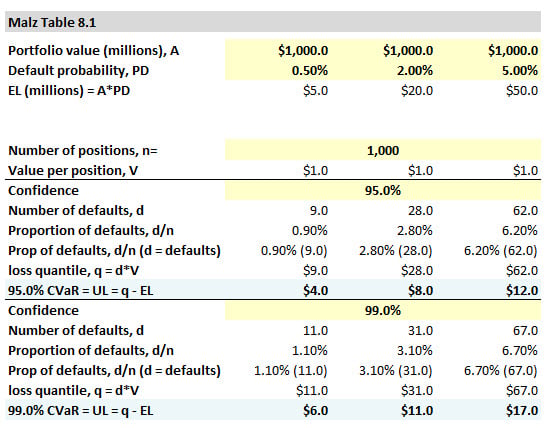

Hi @trivzca I moved your question to this thread. Below is a screenshot of Malz Table 8.1 (here is the XLS https://www.dropbox.com/s/dikemuzlk0tdcp2/0511-malz-cvar.xlsx?dl=0) Similar to the above discussion, I retrieved 28 defaults with =BINOM.INV(1000, 0.02, 0.950) = 28.0, which is an inverse cumulative binomial distribution; i.e., under a binomial distribution with n = 1,000 and p = 2.0%, the 95.0% cumulative probability "falls on" the quantile at 28 defaults.

Specifically, working the other direction (which is more intuitive to me), here are the two adjacent CDFs:

Specifically, working the other direction (which is more intuitive to me), here are the two adjacent CDFs:

- =BINOM.DIST(27, 1000, 2%, TRUE) = 94.9%

- =BINOM.DIST(28, 1000, 2%, TRUE) =96.7%

shaoni0803

New Member

Hello David,

This question is on Credit VaR.

"For n= 50, each position has a future value, if it doesn’t default, of $20,000,000. The expected loss is π×1,000,000,000 which is the same as for the single-credit portfolio. If π = 2 %, the 95th percentile of the number of defaults is 3 (from table 8.1) and the credit loss is $60,000,000. Subtracting the expected loss of $20,000,000, we get a credit VaR of $40,000,000."

Could you please explain, how we are getting the number of default of 3 here. Thanks.

This question is on Credit VaR.

"For n= 50, each position has a future value, if it doesn’t default, of $20,000,000. The expected loss is π×1,000,000,000 which is the same as for the single-credit portfolio. If π = 2 %, the 95th percentile of the number of defaults is 3 (from table 8.1) and the credit loss is $60,000,000. Subtracting the expected loss of $20,000,000, we get a credit VaR of $40,000,000."

Could you please explain, how we are getting the number of default of 3 here. Thanks.

@shaoni0803Hello David,

This question is on Credit VaR.

"For n= 50, each position has a future value, if it doesn’t default, of $20,000,000. The expected loss is π×1,000,000,000 which is the same as for the single-credit portfolio. If π = 2 %, the 95th percentile of the number of defaults is 3 (from table 8.1) and the credit loss is $60,000,000. Subtracting the expected loss of $20,000,000, we get a credit VaR of $40,000,000."

Could you please explain, how we are getting the number of default of 3 here. Thanks.

I moved your question to this thread where David has discussed this question directly above. His response may not answer your question specifically, but we want to keep the discussion about the same questions together so they are not all over the forum. I found this thread by using the search function here in the forum. Many times you will find that your question has already been answered if you search before posting. If David's explanation above does not answer your question, I'm sure he or someone else can elaborate further

Thank you,

Nicole

Thank you @Nicole Seaman Good move! Please note @shaoni0803 that it has been explained (how we get 3 defaults) above, I hope it is helpful!

Similar threads

- Replies

- 0

- Views

- 291

- Replies

- 2

- Views

- 355

- Replies

- 0

- Views

- 303

- Replies

- 0

- Views

- 300