Dear community,

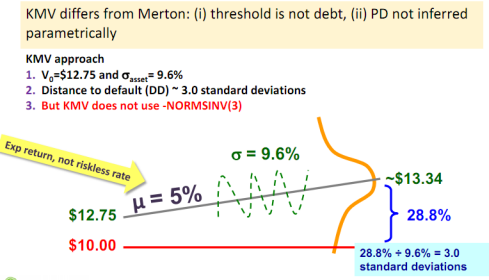

I've got a question about what drift to use when calculating the expected future value of a firm assets under the assumption that its assets follow a GBM.

In this paper it is quite clear that it is Mu + Sigma^2*0,5 the number that should be used (see last page):

http://www.columbia.edu/~ks20/FE-Notes/4700-07-Notes-GBM.pdf

But David uses Mu - Sigma^2*0,5 in Servigny study notes.

¿Why is this happening?

Thanks in advance.

I've got a question about what drift to use when calculating the expected future value of a firm assets under the assumption that its assets follow a GBM.

In this paper it is quite clear that it is Mu + Sigma^2*0,5 the number that should be used (see last page):

http://www.columbia.edu/~ks20/FE-Notes/4700-07-Notes-GBM.pdf

But David uses Mu - Sigma^2*0,5 in Servigny study notes.

¿Why is this happening?

Thanks in advance.