sleepybird

Active Member

Hi David,

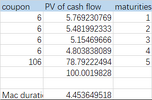

In your T5.c video there was an example on mapping a two-bond portfolio where you mapped the duration to 2.73 yrs. Can you clarify that the 2.73 yrs is the Macaulay duration (i.e., the column should be labeled Macaulay Duration)?

I am still very confused with which (Mac or Mod) duration is defined as the weighted average maturity of the bond? I think it is the Mac duration, that's why I suggest the 2.73 yrs is the Mac duration?

Thanks.

In your T5.c video there was an example on mapping a two-bond portfolio where you mapped the duration to 2.73 yrs. Can you clarify that the 2.73 yrs is the Macaulay duration (i.e., the column should be labeled Macaulay Duration)?

I am still very confused with which (Mac or Mod) duration is defined as the weighted average maturity of the bond? I think it is the Mac duration, that's why I suggest the 2.73 yrs is the Mac duration?

Thanks.