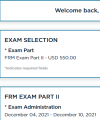

We hope that everyone did well on the FRM Part 1 exams over the past two weeks!  We would love to hear any feedback that you have about the exam, especially any helpful information that you can provide about the new CBT format. How did the exam go? Did you encounter unexpected questions? How was the experience with the COVID guidelines? Thank you in advance for any feedback you can provide! (Note: The above posts were shared before I created this thread)

We would love to hear any feedback that you have about the exam, especially any helpful information that you can provide about the new CBT format. How did the exam go? Did you encounter unexpected questions? How was the experience with the COVID guidelines? Thank you in advance for any feedback you can provide! (Note: The above posts were shared before I created this thread)

We would love to hear any feedback that you have about the exam, especially any helpful information that you can provide about the new CBT format. How did the exam go? Did you encounter unexpected questions? How was the experience with the COVID guidelines? Thank you in advance for any feedback you can provide! (Note: The above posts were shared before I created this thread)

We would love to hear any feedback that you have about the exam, especially any helpful information that you can provide about the new CBT format. How did the exam go? Did you encounter unexpected questions? How was the experience with the COVID guidelines? Thank you in advance for any feedback you can provide! (Note: The above posts were shared before I created this thread)

Last edited:

) and waiting for mid-September.

) and waiting for mid-September.