hello David,

Im studying for the FRM exam part 1, and I would appreciate if you elaborate on the two topics below taken for foundation 1.a:

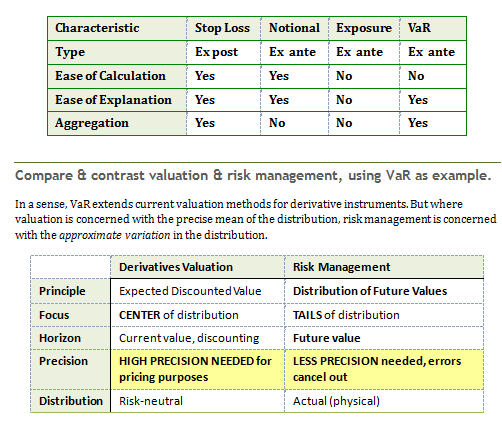

1. compare and contrast valuation and risk management using Var as an example

2. describe advantage and disadvantage of Var relative to atop-loss, notional and exposure limit

Thanks,

Orit Waisman

Im studying for the FRM exam part 1, and I would appreciate if you elaborate on the two topics below taken for foundation 1.a:

1. compare and contrast valuation and risk management using Var as an example

2. describe advantage and disadvantage of Var relative to atop-loss, notional and exposure limit

Thanks,

Orit Waisman